2024 Guide To Life Insurance with Atrial Fibrillation

Getting life insurance with Atrial Fibrillation can seem challenging, but it’s not out of reach. If you’re living with AFib, you might be worried about how your condition affects your insurance options and premiums.

The good news is that there are life insurance policies tailored for AFib patients, offering the protection you need at rates that are manageable. Understanding your eligibility and the kind of coverage you can get is crucial.

Whether you’re looking into term life insurance or whole life options, there are affordable and beneficial plans designed to give you peace of mind.

This guide will walk you through the essentials of buying life insurance with Atrial Fibrillation, so you can make an informed decision that secures your family’s future without breaking the bank.

Article Navigation

- Can I Get Life Insurance With Atrial Fibrillation

- Life Insurance With AFIB

- Life Insurance Application With AFIB Heart Disease

- Best Time To Apply After AFIB Diagnosis

- Life Insurance After Ablation

- What Life Insurance Rate Class Will I Receive With AFIB

- How to Buy Affordable Life Insurance with AFIB

- FAQ

- Conclusion

Can I Get Life Insurance With Atrial Fibrillation

How Does Atrial Fibrillation Affect Life Insurance?

I was 37 years old when diagnosed with atrial fibrillation…

So, I can say firsthand how life insurance rates are affected by atrial fibrillation, I have had it since I was 37 years old.

I applied for life insurance just before my cardiac ablation. Within two months after, I was approved at a standard plus standard table 4. After 12 months after getting my policy, I did a reconsideration at my one year anniversary and got a 4 table credit to standard.

I am now just over seven years since my ablation and things are going good.

For some people, getting life insurance for an afib heart problem is a walk in the park. However, for those with pre-existing medical conditions, like an Afib condition, getting life insurance can be pretty complicated.

If you have atrial fibrillation, you may not think you’ll be able to get affordable life insurance. However, this isn’t necessarily the case. There are several things you can do to find an affordable policy even if you are considered high risk.

Life Insurance With AFIB

After a diagnosis of atrial fibrillation, you might think getting life insurance is a lost cause. I am here to tell you that is not the case.

For instance, Afib and life insurance, which is sometimes called AF life insurance are very obtainable. In fact, it will come down to treatment and how many episodes. But preferred rates are not out of the question.

Having an irregular heartbeat is not fun! Taking blood thinners are not fun. Having shortness of breath is not fun. However, it can be treated and some invasive surgeries can cure it for the time being.

You are at a high risk of a stroke as well when you are in AFIB!

Life Insurance Application With AFIB Heart Disease

Do you know how many A-Fib episodes you have?

Diagnosed patients with chronic AFIB or intermittent atrial fibrillation usually do not know the specific amount of episodes they have.

With this said, do life insurance carriers confirm how many episodes you are having, or can it be based on honesty?

When applying for life insurance, the insurance carrier is going to have some fundamental questions they ask you about your situation and how frequently you have episodes.

Normally, the only time a physician would know about an incident is if it took hospitalization or when it took therapy other than what your regular treatment is.

In that circumstance, they essentially depend on you to be fair and tell them how frequently your episodes happen.

Atrial Fibrillation Questionnaire

- Please list the date when first diagnosed

- Is the atrial fibrillation/flutter: Chronic (permanent) Paroxysmal (intermittent)

- Are there any symptoms with the irregular heartbeat? Blackout, Dizziness, (lightheadedness/faint feeling) Palpitations, Chest discomfort?

- Have any of the following tests been done? If so, please give date and results: ECG? Stress test?Echocardiogram? Holter monitor?

- Is your client on any medications? Yes (Please give details)? No?

- The cause of the atrial fibrillation/flutter is due to Coronary heart disease Alcohol Thyroid disease Unknown or other Mitral valve disease Cardiomyopathy

- Has your client smoked cigarettes in the last 12 months? Yes No

- Does your client have any other major health problems (ex: stroke, etc.)? Yes (Please give details)?No?

Best Time To Apply After AFIB Diagnosis

As I stated at the beginning of this article if you apply right after your diagnosis, insurance carriers will typically approve a sub-standard rate.

As time continues, however, if you’re handling your condition, keeping a healthful way of life, after your physician’s orders, then your rates will surely enhance over time.

On the reverse side of this, applicants that are diagnosed with atrial fibrillation and after that do not make lifestyle modifications only hurt themselves.

If you do not follow their physician’s advice and do not have regular echocardiograms, it will be tough getting approved for a better rate.

The major issue to remember while applying for life insurance whenever you have afib is to receive the illness handled, follow your physician’s orders, and keep a wholesome lifestyle.

These are the chief things insurance companies will be searching to find.

Life Insurance After Ablation

If you have had a cardiac ablation after an AFIB episode, the life insurance carrier will want you to have followups with your electrophysiologist. Again, speaking for myself, I had gotten approved 3 months after my ablation at a table 4 rate.

However, after my one year follow up, my AFIB did not come back. So my hearts electrical signal was in sinus rhythm. Then three months later I did a reconsideration and the carrier gave me a standard rate class.

Atrial Fibrillation and a Pacemaker

If you are older and have AFIB the doctor sometimes recommends a pacemaker. The reason why they do this is that they are treating the AFIB with medication.

In some cases, the medication may slow down the heart rate too much. So what the cardiologist might do is have a pacemaker implanted.

People with pacemakers may have other health conditions. For instance, you may have heart disease that damages the sinus nodes. This will result in an irregular heartbeat. Also, this will result in a slower heart rate.

What Term Life Insurance Carriers Want To Know About AFIB

Be Honest with your Agent!!!

One of the ways to get a better offer from a life insurance company is to answer their questions accurately. Above all, preparation is essential.

The more thorough and honest answers you give, the more likely they are to approve your application, and the more likely they are to offer you lower rates.

Here are a few questions that the insurance company will want to know about your atrial fibrillation:

- Is your condition chronic or intermittent?

- What’s the cause of your condition?

- Do you have any other health issues?

- Do you have other high-risk life insurance factors, such as high blood pressure or smoking?

- When were you diagnosed?

- Does your family have a medical history of heart disease?

- Are you on any medication, or are you receiving any treatment?

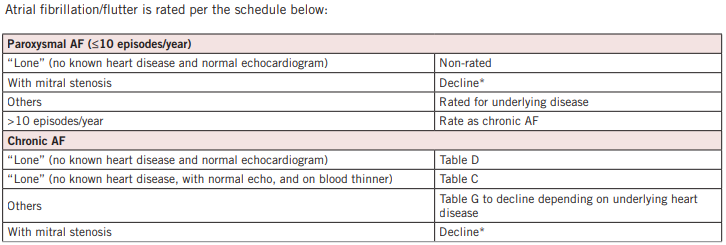

What Life Insurance Rate Class Will I Receive With AFIB

Is AFIB Fatal? Untreated? You will have The Risk for other medical issues…

Although atrial fibrillation isn’t a life-threatening condition alone, people who have it are at a higher risk of suffering a stroke or having other heart issues.

For this reason, a lot of insurance companies may be concerned about insuring people with atrial fibrillation. Of course, this is not the only factor that they will consider in your rating.

General health, occupation, and age are among some of the other factors.

The ratings go:

- Preferred Plus

- Preferred

- Standard

- Substandard (Table 2 – Table 8)

- Declines (Table 9 and above)

Most of the time, a standard rating is the best possible rating for people with atrial fibrillation. However, the most likely rating for someone with atrial fibrillation is substandard, which means rates will be higher.

Declines usually occur when applicants have other serious heart issues on top of their atrial fibrillation.

What Causes Atrial Fibrillation

Nobody knows the specific cause of Atrial Fibrillation. But understanding Afib heart disease more and more that it’s more prevalent in particular age groups. Typically over 40.

Atrial Fibrillation can be seen more in individuals who suffer from other heart-related ailments, for example:

- Congenital Heart Disease

- Blood Pressure (Hypertension)

- Cardiomyopathy

- Heart Valve Disease

- Pericarditis

Some pre-existing medical conditions can trigger AFIB:

- Overactive Thyroid

- Diabetes

- Asthma

- COPD

- Lung Cancer

These lifestyle habits have also been known to cause AFIB:

- Obesity

- Excessive amounts of caffeine

- Smoking tobacco products

- Alcohol Binge drinking

- Illegal drugs

Is AFIB Considered Heart Disease

Pay attention to the signs, A-Fib can lead to other health problems!!!

Atrial fibrillation (also called AFIB or AF) is a quivering or irregular heartbeat (arrhythmia) that can lead to blood clots, stroke, heart failure, and other heart-related complications.

At least 2.7 million Americans are living with AFIB.

Here’s how patients have described their experience:

My heart flip-flops, skips beats, and feels like it’s banging against my chest wall, especially if I’m carrying stuff up my stairs or bending down.

I was nauseated, light-headed, and weak. My heartbeat was fast and felt like I was gasping for air.

Symptoms of Atrial Fibrillation

Atrial fibrillation can be a very common type of irregular heartbeat which in most cases does not prove especially benign or dangerous. However, like most of the heart conditions in does must be accommodated and tracked carefully. Thus, what would be the top signs of AFib?

- Fatigue

- Irregular Heartbeat

- Rapid Heartbeat

- Sweating

- Feeling Dizzy

- Shortness of Breath

Types of Atrial Fibrillation

Below are the different stages of AFIB.

- Paroxysmal AFIB: This is when your heart goes in and out of normal rhythm for under a week. You might feel this happening for minutes or a couple of days. You might not feel the need to seek treatment for this particular type of AFib. However, you should visit a doctor. Also, it sometimes happens when you’re under extreme stress.

- Persistent AFIB: This means your AFib has lasted more than a week. It may stop on its own, but it’s likely you might require treatment or drugs to avoid it. Medicine and treatment like electric cardioversion might not stop the AFib. Doctors can use another type of treatment, such as ablation (which burns certain places of one’s heart’s electrical system) to displace your regular heart rhythm.

- Chronic AFIB: When you are “Chronic,” usually it means treatment won’t help. If you have this type, you and your physician will decide whether or not you might desire longterm medication to get a grip on your bouncing heart rate and lower your chance of stroke. Usually with arrhythmia drug with a blood thinner.

How to Buy Affordable Life Insurance with AFIB

Hire an Independent Agent ~ PinnacleQuote!!!

There are a lot of ways to strategically go about getting cheap life insurance. Our best piece of advice would be to compare multiple life insurance companies before choosing a policy.

By comparing quotes, you’ll be more likely to find a more affordable policy.

You may want to hire an independent insurance agent to assist you with this. In fact, an independent insurance agent is usually a significant investment. They’ll be able to connect you with the top life insurance companies.

Another thing to remember is that each insurance company has different medical underwriting.

Furthermore, This means that your perceived level of risk will vary between companies.

An independent insurance agent may know which companies tend to be more lenient towards those with atrial fibrillation, occasional atrial fibrillation or chronic paroxysmal atrial fibrillation thereby increasing your chances of getting an affordable life insurance policy.

Of course, finding the right company isn’t the only thing you can do to get lower prices on your life insurance. You can also take measures to improve your general health.

Much before taking your medical exam, you should exercise, eat healthier, and do anything else that will improve your health.

How Will Blood Thinners Affect Rates

People diagnosed with AFIB is most cases need to take blood thinners.

Do life insurance carriers look unfavorably on candidates that are on blood thinners?

If you are taking warfarin, insurance providers typically assign a table two rate class, which is essentially the sixth-highest rate class.

Though warfarin can assist in preventing the odds of having a stroke as it prevents blood clots, there is the issue of internal bleeding out of long-term usage.

Carriers take these issues into account but generally when you’ve got atrial fibrillation and are taking warfarin; you can expect a table 2 class at a minimum.

Other new alternatives to Warfarin blood-thinning treatment:

- Eliquis

- Xarelto

- Pradaxa

Do these kinds of blood thinners influence your prices?

When a new drug comes out, and it does not have the same health risk among the older. However, conventional blood thinners, such as warfarin, have the insurance carriers adjust their prices.

It is possible, later on, we can see folks getting approved at standard prices if they are taking a blood thinner. So far, these do not pose any challenges that conventional blood thinners do.

For now, however, I have not seen anyone return better than a standard rate when they are on a blood thinner, but that is not to say which will not alter later on.

Do insurance carriers take into consideration the length of time you are on a blood thinner? Someone may be on it briefly since they have only had an ablation.

By way of instance, once I had my ablation, I had been on Eliquis for only a month or two.

Treatments Available For Atrial Fibrillation

The goals of treatment for atrial fibrillation include strengthening a regular heart rhythm (sinus rhythm), controlling the heart rate, preventing blood clots and lowering the chance of stroke.

Many options are available to treat atrial fibrillation, such as lifestyle modifications, medications, catheter-based processes, and surgery. The recommended treatment relies on your heart rhythm and strain. This also will be apart of the strategy your doctor, and you come up with.

Originally, drugs were utilized to treat atrial fibrillation.

Medicines may include:

- Rhythm control medicines (antiarrhythmic drugs)

- Antiarrhythmic medications help return the heart to normal sinus rhythm or maintain regular sinus rhythm.

There are numerous forms of rhythm control medicines, including:

- procainamide (Pronestyl)

- disopyramide (Norpace)

- flecainide acetate (Tambocor)

- propafenone (Rythmol)

- sotalol (Betapace)

- dofetilide (Tikosyn)

- amiodarone (Cordarone)

You might need to remain in the hospital when you first start taking these drugs so that your heart rhythm and reaction to the medication is best if carefully tracked.

These medicines are effective 30 to 60 percent of the time but might lose their efficacy with time. Your physician may have to prescribe some different antiarrhythmic medications to ascertain the perfect one for you.

Some rhythm control medications might lead to more arrhythmias, so it is essential to talk to your physician about your symptoms and any changes in your problem.

Arrythmia Controlled Medications

Rate control medications, including:

- digoxin (Lanoxin),

- beta-blockers for atrial fibrillation [metoprolol (Toprol, Lopressor)].

- Calcium channel blockers like verapamil (Calan) or diltiazem (Cardizem),

These are utilized to slow down the heart rate during atrial fibrillation. These medicines don’t control the heart rhythm, but also to stop the ventricles from beating too quickly.

Blood Thinner/Anticoagulant Drugs

Anticoagulant or antiplatelet treatment drugs, like warfarin (Coumadin), warfarin options, or aspirin reduce the possibility of blood clots and stroke, but they don’t remove the risk.

Standard blood tests are required when taking Coumadin to evaluated the effectiveness. If you’re taking warfarin alternatives, routine blood tests are not required. Speak to your physician about the naturopathic drug that is right for you.

Surgical Procedures

When medications do not work to fix or restrain atrial fibrillation, or whenever medications don’t work, a process may be required to care for the abnormal heart rhythm. The atrial fibrillation procedures used most:

- electric cardioversion,

- pulmonary vein antrum isolation procedure,

- ablation of the AV node

These procedures can most commonly follow by a pacemaker placement, or surgical ablation (Maze procedure or minimally invasive surgical treatment).

Electric Cardioversion (Getting Shocked)

Cardioversion is a process where an electrical shock is delivered to the heart to convert an irregular or rapid heartbeat (called an arrhythmia) to regular heart rhythm.

During cardioversion, your physician uses a cardioverter machine to send electrical energy (or even a “jolt”) to the heart muscle to restore the normal heart rhythm

Pulmonary vein ablation (also known as pulmonary vein antrum isolation or PVAI), is a cure for atrial fibrillation.

Ablation of The AV Node

With AV Node ablation, doctors insert catheters through the veins (usually in the groin) and led into the heart. In fact, this prevents the electrical signs of the atrium by reaching the ventricle.

This result is irreversible, and so, the patient desires a permanent pacemaker to maintain an adequate heart rate. Though this process can decrease atrial fibrillation symptoms, it does not cure the condition.

Because the individual will last to get atrial fibrillation, anti-inflammatory medication is prescribed to reduce the risk of stroke.

Lifestyle Changes Helps Keep AFIB Under Control

Besides taking drugs and surgical procedures, there are some changes you may make to increase your overall health.

Atrial Fibrillation Prevention

- In case an irregular heart rhythm happens more frequently with particular actions, avoid these actions and inform your cardiologist. From time to time, your drugs might have to be corrected.

- STOP SMOKING

- Restrict your consumption of alcohol. Moderation is the secret. Consult your physician for individual alcohol recommendations.

- Some folks are allergic to caffeine and might detect more symptoms when utilizing caffeinated products (like tea, coffee, energy drinks, colas, and a few over-the-counter drugs).

- Beware of stimulants used in cold and cough medicines, since a few of those drugs contain ingredients which might raise the chance of irregular heart rhythms. Read drug labels and ask your physician or pharmacist which sort of cold medicine is ideal for you.

- If you’re overweight or obese, achieve the desired weight.

- Control glucose levels

- Be compliant with sleep apnea treatment

- Control of High Blood Pressure

Lifestyle Habits That Can Cause AFIB To Come Back

Quit Smoking!!!

Quitting all tobacco products before applying is maybe the number one way to cut your costs on life insurance.

Cigarette smokers pay 2 or 3 times more on their life insurance than nonsmokers. You don’t need any more reasons for insurance companies to label you a high-risk applicant when you already have atrial fibrillation.

And, as we touched on briefly above, preparing for any questions that the life insurance company will ask when applying for life insurance will help. Life insurance companies are hesitant to work with people that do not adequately or accurately answer the questions during the application process.

Atrial Fibrillation and exercise

Start Exercising!

People with Afib who have an exercise routine and increase their level of activity will have a better quality of life. Any level of physical activity will help, whether a regular exercise routine or some brisk walking will not only reduce stress but also help make you feel better overall. Their mind and body will be well balanced.

When it comes to atrial fibrillation afib, moderate exercise helps with any cardiac rehabilitation as well.

In fact, the benefits of exercise are priceless, however, if you feel chest pain or have any other medical impairments, always consult your doctor first!!!!

Atrial Fibrillation Diet

Your everyday health and eating healthy foods is important not just for you and living a long healthy life but it is also for your loved ones who care for you.

Introducing leafy greens and omega-3 fatty acids will help you live a long healthy life. Read food labels. Also keep away from the following: fat, dairy, binge drinking, high levels of saturated fats, fried foods.

Remember, always seek medical advice before starting any exercise routine or changing your diet. We do not suggest doing anything that will increase your risk of heart attacks, A-fib, etc…

Related Articles

FAQ

Can I get Life Insurance if I have Atrial Fibrillation?

Yes, you can get life insurance with Atrial Fibrillation. However, the terms and the premiums may vary depending on the severity of the condition, your overall health, and the underwriting guidelines of the insurance provider.

What information will insurers need if I have Atrial Fibrillation?

Insurers will likely require details about your diagnosis, treatment, medication, the frequency and severity of symptoms, any hospitalizations, and the recommendations of your healthcare provider.

Will Atrial Fibrillation affect my Life Insurance premiums?

Atrial Fibrillation can affect your life insurance premiums. Insurers may charge higher premiums if they determine that the condition presents an increased risk. Controlled and well-managed AFib may lead to more favorable premium rates.

Are there specific types of Life Insurance policies that are better for people with AFib?

The suitability of life insurance policies can vary. Term life insurance might be more accessible for some, while others may find that whole or universal life insurance offers the coverage they need. Working with an insurance expert can help determine the best option for your specific situation.

How can I improve my chances of getting approved for Life Insurance with Atrial Fibrillation?

Improving your overall health, following your treatment plan, keeping regular appointments with your healthcare provider, and maintaining a healthy lifestyle can improve your chances of approval.

What if I’m denied Life Insurance because of Atrial Fibrillation?

If you’re denied life insurance, you may explore guaranteed issue life insurance policies that do not require a medical exam, though these may come with higher premiums and lower benefit amounts.

Does the type of Atrial Fibrillation I have influence Life Insurance options?

Yes, the type of AFib can influence your life insurance options. Paroxysmal AFib may be viewed more favorably than persistent or permanent AFib, as it tends to be less severe.

Should I disclose my Atrial Fibrillation when applying for Life Insurance?

Absolutely. Full disclosure is necessary to avoid the risk of a policy being voided due to nondisclosure. Honesty in the application process is crucial for the validity of your policy.

Can I still get Life Insurance at a competitive rate with Atrial Fibrillation?

While having Atrial Fibrillation may increase your premiums, competitive rates may still be available, especially if the condition is well-managed. Comparing quotes from different insurers is advisable.

Conclusion

So, if you have a diagnosis of atrial fibrillation and are thinking about life insurance, don’t give up. It might be easier than you think to get the coverage that will help protect your family in case anything happens to you.

Get Quote is here for all of your life insurance needs so feel free to reach out with any questions or concerns! We can tailor a plan just for you and we want nothing more than for our clients to achieve peace of mind knowing their loved ones would be taken care of no matter what may happen.

There’s never been a better time than now to take action on this issue- call 855-380-3300 today!