Disability Insurance 2024: Top 5 Reasons You Need It and How To Get It

If you are in search of disability insurance, you’ve to the right place! You’ll know the top 5 reasons why you need it and how to get it.

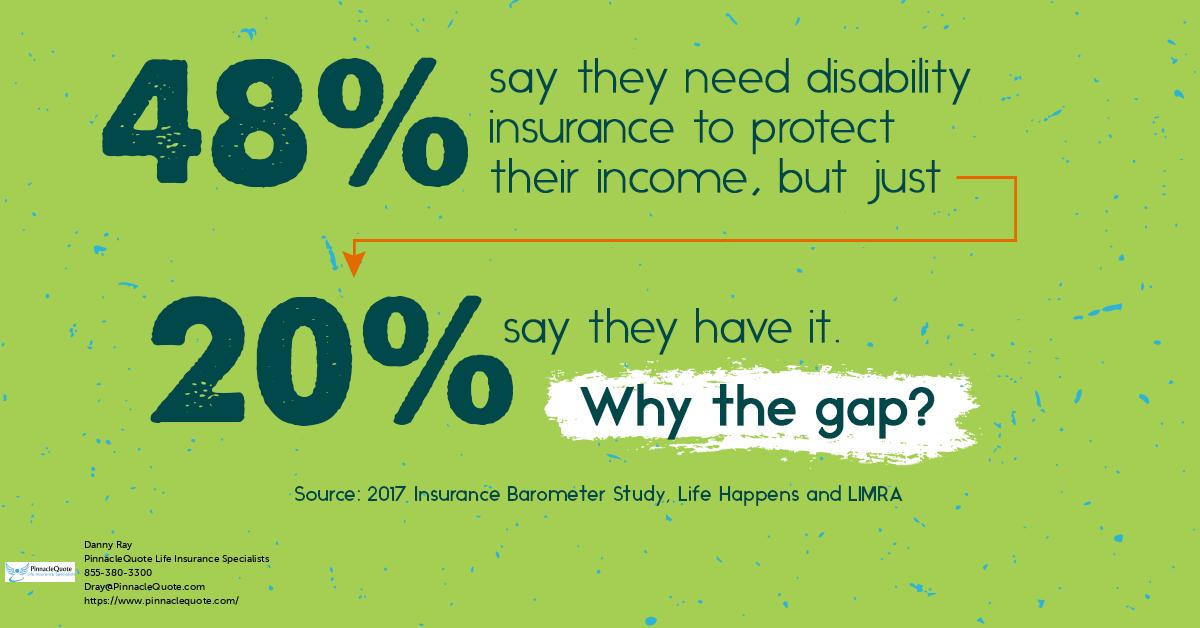

You’re not alone if you’ve never heard of disability insurance. In fact, as many as 40% of Americans don’t know about it and more than 60% of those who do are without coverage. Whether you work in a desk job or one that requires physical labor, the risk for injury is always present.

And these days, accidents happen all too frequently. The good news is that disability insurance can provide financial stability for anyone with an income-earning occupation. – Disability Insurance: Top 5 Reasons You Need It and How To Get It:

Article Navigation

Life Happens. No one is immune to illness or injury. Are you prepared? How important is disability insurance?

If you become disabled due to an illness or physical disability and cannot work, disability insurance is meant to replace a portion of your income. Keep in mind, it will only cover up to 60% of your earnings per month benefit.

But I am young, Do I need disability insurance? If you work, you need to apply for disability insurance benefits.

Statistics show, that around 20% of people in their 20’s will have some form of disability by the time that they retire. We are all aware of the importance of purchasing life insurance.

Do I Need Disability Insurance?

Consider this, between the ages of 25-55 your chances of being disabled are higher than your chances of dying. Buy long-term disability insurance needs to be considered.

How does Disability Insurance Work

Is disability insurance worth it? YES.

Disability insurance will pay you a pre-set amount of income that you are no longer able to earn an income due to an illness or injury. This is a monthly payment that provides you, (the policyholder) enough money for living expenses.

Business Disability Insurance

Having disability coverage in place is just as vital as a business life insurance plan. It will also fill the gaps that workers’ compensation falls short of.

Disability coverage is the type of insurance that will replace your income when you can’t work due to injury. This is a great employee benefit that a small business owner may offer.

If a business owner offers disability benefits it is a business overhead expense that can be part of a deferred compensation plan.

With that said, in most cases, it’s a business expense that is a tax deduction. Most key personnel have this.

What are the Types of Disability Insurance

There are 2 different types of disability insurance available.

Short Term Disability ~ The waiting period (elimination period) is 0-14 days. The benefit period is no longer than 2 years.

Long Term Disability ~ The waiting period (elimination period) for the long term can be several weeks to even several months. The Benefit period can be many years or for the rest of your life.

Disability Insurance Companies

The Top 4 best disability insurance companies are:

- Mutual of Omaha ~ benefit for ages 18-61. $5,000 max benefit. Guaranteed renewable up to age 67.

- Assurity ~ benefit for ages 18-59. Benefit $300-$3,000 max.

- Principal Financial Group ~ benefit for ages 18-60. $20,000 max per month.

- Ameritas ~ Max benefit period will be is to age 70.

Can I Buy Short Term Disability Insurance On My Own

What determines my eligibility for disability insurance? In short, your occupation is the determining factor. A few things to think about and what a carrier will ask:

- is your occupation high risk?

- do you travel for work?

- and how intense is the manual labor you perform?

The Top 5 Reasons You Should Purchase Disability Insurance

- Debt Obligations ~ Mortgage, car loan payment. Think about what would you do if you lost your income. Disability insurance for mortgage payments is meant to help keep you going financially, prevent foreclosure and help you survive.

- Your Family ~ If you are the primary money spouse and your family is depending on your paycheck monthly, What would you do if you suddenly were disabled and you could not work for a period of time? Bottom line if you have a family depending on your salary to put food on your table, you NEED to consider a disability policy.

- High-Risk Occupation ~ Like we discussed early, if you are working in a high-risk environment, such as work from dangerous heights, carrying a weapon, wearing heavy protective gear, scuba divers, commercial fisherman, etc.

- No Go-To Emergency Stash ~ If you do not have an emergency fund that would help you through your disability.

- Family History ~ Also considered high-risk medical history. If stroke, cardiovascular/circulatory disorders, diabetes, or cancers run in your family or if you become ill, and are unable to work for a period of time, you need disability insurance.

Am I too Young for Disability Insurance – Michael’s Story

At what age should you buy disability insurance? If you have a job and you have people who depend on you.

You NEED disability insurance. This is Michael Sizemore. Read his incredible story.

Dave Ramsey Long Term Disability Insurance

“EVERYONE needs disability insurance regardless of what job you have, whether you are a high-rise window washer or a car salesperson.” ~ DAVE RAMSEY

EveryDollar Guide to Budgeting

What is the free Every Dollar Guide? Well, first off Dave Ramsey recommends it! Nothing is guaranteed in life and anything can happen.

When we are faced with financial situations we have to be ready. Download the free EveryDollar budgeting app today.

Here is what you will get when you download the app:

- Creating a budget plan

- How to save for your future

- How to face your debt head on

- Tips to budgeting

- Your accountability in everyday budgeting

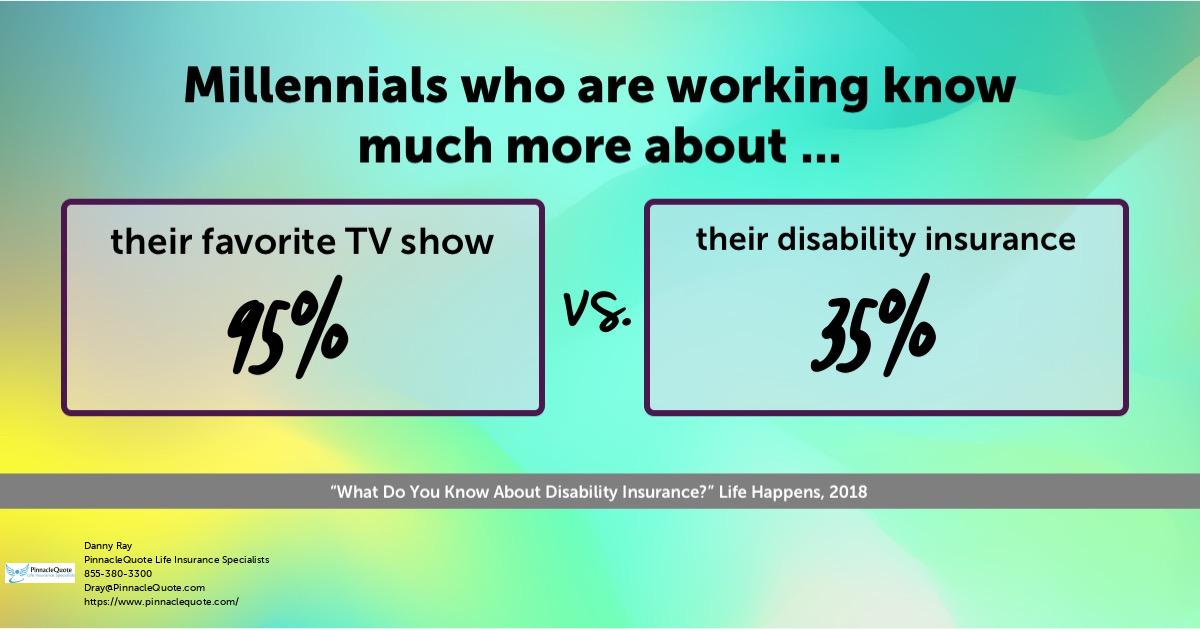

Millennial’s and Disability Insurance

Millennials and Disability Insurance

According to the Council for Disability, Awareness millennials are projected to make up approximately 75% of our workforce by 2025.

Statistics lean towards 50% of 35-year-olds to be out of work for 90 days or more by the age of 65. This will be 3 months or more of lost earnings.

Many young people today feel that they do not need disability insurance because they believe disability will not happen to them.

Ask Michael Sizemore about that. I bet he didn’t think he would be struck by a drunk driver, but he was and I know he is probably thankful he had disability insurance in place.

Now if you do not have disability insurance and no safety net, you can bet your bottom dollar in today’s world, you will be financially crippled. This will lead to foreclosure, evictions, or loan defaults.

Is My Work Disability Through My Employer Enough?

Many people believe that the disability insurance offered through your current employment is sufficient. But it depends on how your employer defines disability. There are two types to consider.

True Own Occupation ~ disability will replace some of your income if you cannot perform the duties of your current position. Will also offer the highest premium payments to you.

Any Occupation ~ disability will cover you if you can’t work any job.

You can lose that job tomorrow, then what will you do? Work insurance is great, but truthfully, not enough.

Best Disability Insurance For Physicians

Disability insurance for doctors is extremely important. You will want to make sure that it is a guaranteed renewable policy in addition to a non-cancelable provision.

Guaranteed renewable does not allow the carrier to change any terms, except for the premiums. However, the increase in rate has to be for similar occupations across the board.

A non-cancelable policy is very similar in features but the rate/premiums are guaranteed.

What is the average cost of disability insurance for physicians? For long-term individual (not group coverage) disability insurance, physicians should expect to pay close to 6% of their gross earnings.

This could be about $7000 a year.

Short Term Disability Insurance Maternity

Prior to maternity leave, you can qualify for short-term disability while you are pregnant. Part of your income will be covered while you are out of work.

In many cases, if you have accrued time leave and run out, you may qualify for your disability to take over until you return to work.

Disability Income Insurance Riders

What are some of my options for riders?

Inflation Protection – if you are young (’20-the ’40s) this is a good idea as your benefit increases with inflation.

Future Purchase Option – you will be permitted to purchase a larger benefit without the carrier asking you additional questions regarding health or lifestyle.

Catastrophic Disability – if unable to do 2 or more activities of daily living.

Retirement Benefit – if you become disabled, the insurance company will put some money into a retirement fund for you.

Residual Disability – covers partial disability and in addition a partial benefit as you recover.

Can You Deduct Disability Insurance Premiums as Taxable Income

What about income tax time? You pay the premiums with after-tax monies. You receive these benefits tax-free.

Keep in mind, unlike health insurance, you cannot deduct paid premiums for individual disability as a medical expense.

FAQs

The two main types are short-term disability (STD) insurance, covering disabilities for a short period (usually a few months to a year), and long-term disability (LTD) insurance, covering longer periods.

The choice depends on your occupation, financial situation, and existing coverage (like employer-provided benefits). STD is for brief absences from work, while LTD is for more serious, long-lasting disabilities.

It covers a portion of your income (usually 50-70%) during the period you are unable to work due to a qualifying disability.

Most policies have exclusions and limitations, such as not covering disabilities resulting from pre-existing conditions, self-inflicted injuries, or certain specific activities.

The cost varies based on factors like your age, health, occupation, income, and the extent of coverage. Generally, premiums range from 1-3% of your annual income.

Factors include the policyholder’s age, health status, occupation, income level, length of the benefit period, and the waiting period before benefits start.

It’s possible, but policies may have exclusions or higher premiums for pre-existing conditions. Some insurers may not offer coverage depending on the condition.

Employer-provided coverage can be a great benefit, but it may not be enough. Evaluating your individual needs and possibly supplementing with a private policy is advisable.

To file a claim, notify your insurance provider, provide medical evidence of your disability, and complete the required paperwork.

Workers’ compensation only covers work-related injuries and illnesses, while disability insurance covers non-work-related incidents as well.

If you pay the premiums with after-tax dollars, your benefits are typically tax-free. If your employer pays the premiums, the benefits are usually taxable.

Benefit periods can vary from a few months to several years, or even until retirement age, depending on the policy.

Yes, self-employed individuals can and should consider disability insurance to protect their income, as they might not have employer-provided coverage.

Related Articles

Conclusion

If you want to avoid the stress of feeling like your family would be out on the street if something happened to you, disability insurance is a must. You’ll need to make sure that there’s enough coverage in place for when things happen unexpectedly and it can help keep you from having too much debt. Don’t fret about how expensive this might seem- we’ll show you some top ways to get cheap rates! It may not feel glamorous but investing now will save a lot of worries later. Is getting disability insurance one of your New Year resolutions? Let us know what else is on your list.