Foresters Life Insurance Review For 2024 Complete Guide

If you are in search of Foresters Life Insurance, you came to the right place! Foresters life insurance is more than just a policy, it’s a promise for the future.

In our latest review, we delve into Foresters insurance policies, shedding light on their benefits, rates, and what actual policyholders think.

With a rich history in providing financial products, Foresters offers both term and whole life insurance options.

As you read on, you’ll gain insights into the advantages of Foresters life insurance, as well as feedback from customers to help you make an informed decision.

Who is Foresters Life Insurance Company

Above all, Foresters Financial and Foresters are trade names and trademarks of The Independent Order of Foresters Life Insurance. The Independent Order of Foresters is so much more than the average insurance and annuity products company.

In fact, they are an international financial services company that was established in 1874 stretching across Canada, the United States and the United Kingdom. Moreover, for their over one million members, they have been providing life insurance coverage, retirement, and investment needs for over 145 years!

Not only are they committed to their member’s unique situation and financial goals, but they are big at giving back to the community through volunteering that benefit local communities. Foresters life insurance rating is “A” (Excellent) with the independent rating agency A.M. Best for financial strength making Foresters Financial services one of our top 10 life insurance carriers in the US.

Foresters Financial Headquarters

As we mentioned before, Foresters Life Insurance Company has members in the United States, Canada, and the United Kingdom. However, they are headquartered in Toronto, Canada. Here are some of the ways you can contact Foresters Life Insurance Company Canada.

Foresters Life Insurance Address

The Independent Order of Foresters

789 Don Mills Road, Toronto, ON Canada M3C1T9

U.S. Mailing Address: PO Box 179, Buffalo, NY.

Courier/ Overnights:

Foresters FinancialC/O Frontier Distributing Attention: New Business660 Howard Street, Buffalo, NY 14206

Foresters Life Insurance Phone Number:

- Member Benefits: 1-800-444-3043

- General member inquires: 1-800-828-1540

Foresters Financial Life Insurance Reviews (Products)

Now that we know the history of Foresters Financial let’s get down to what makes this engine move! This will be a Foresters Insurance review by product.

As a broker/agent, it’s hard to beat the rates on some of the insurance products that Foresters offers. In fact, they have so many quality smart universal life insurance products geared for your specific situation and financial goals. Furthermore, It’s important to speak with your representative to discuss your specific situation.

Foresters Your Term

Foresters Your Term level term life insurance has a 10, 15, 20, 25 and 30-year guaranteed level term life insurance with issue ages from 18-80. When speaking with an agent always speak with your specific security and investment strategy at heart!

Above all, this is in most cases the best-priced term product for seniors over the age 70 especially if in good health compared to other life insurance companies.

Here are some of Foresters Life Insurance Quotes and how they stack up with the competitors.

Here are some of the highlights that Foresters Your Term offers

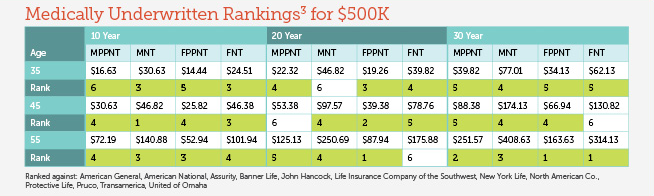

- Competitively Ranked – Consistently ranks in the top 5 against against the top 12 competitors.

- Insure More Clients – Medically Underwritten face amounts from $100k to $10mm.

- Easy To Apply – NonMedical life insurance rates up to $400k

- Future Flexibility – Renewable and convertible without proving insurability

- More Value at No Additional Premium – Accelerated Death Benefit, Common Carrier Accidental Death, and Family health Benefit

Strong Foundation Non-Med

Foresters Strong Foundation offers a non-medical (non-med) term life insurance plan that’s easy to understand and apply for.

This means you can get life insurance without going through medical exams or providing blood and urine samples. It’s a great choice if you’re not comfortable with medical tests or if you need insurance quickly.

What Does Non-Tobacco Mean?

If you use tobacco products like cigars, pipes, or vape pens, or even nicotine patches and marijuana, this insurance still considers you a non-tobacco user. This is important because being classified as a non-tobacco user can help you get better rates.

Rates for Female, Age 45, Vape Pen User, $100K

| Carrier | 15-year | 20-year | 30-year |

|---|---|---|---|

| American-Amicable Home Protector (tobacco rate) | $77.70 | $97.42 | $132.18 |

| Americo Home Mortgage Series 125 (tobacco rate) | $90.73 | $113.91 | $154.85 |

| Foresters Strong Foundation (non-tobacco rate)> | $36.93 | $41.39 | $61.43 |

| Mutual of Omaha Term Life Express (tobacco rate) | $87.58 | $99.68 | $127.00 |

Rates for Male, Age 45, Regular Cigar Smoker, $100K

| Carrier | 15-year | 20-year | 30-year |

|---|---|---|---|

| American-Amicable Home Protector (tobacco rate) | $77.70 | $97.42 | $132.18 |

| Americo Home Mortgage Series 125 (tobacco rate) | $90.73 | $113.91 | $154.85 |

| Foresters Strong Foundation (non-tobacco rate) | $39.20 | $44.89 | $69.04 |

| Mutual of Omaha Term Life Express (tobacco rate) | $90.60 | $106.27 | $144.27 |

Key Features of the Plan

- Term Lengths: You can choose how long you want your coverage for – 10, 15, 20, 25, or 30 years.

- Guaranteed Benefits: The amount of money your family receives (death benefit) and your payments (premiums) stay the same throughout the term you choose.

- Renewable and Convertible: You can renew your policy until you’re 95 years old, and you can change it to a permanent plan during certain times.

No Medical Exams Needed

One of the best parts? You don’t need to go through a medical exam to qualify. This speeds up the process and makes it less stressful.

Special Cases Covered

- Diabetes: If you have diabetes, you might still qualify. It depends on things like your age, how long you’ve had diabetes, your A1C levels, and your overall health.

- Mild COPD: If you’re a non-smoker with mild COPD and can climb stairs without much trouble, you could still be eligible.

Age and Coverage Limits

- If you’re between 18 and 55, you can get up to $500,000 in coverage.

- If you’re over 56, you can get up to $250,000 in coverage.

Extra Benefits at No Extra Cost

- Accelerated Death Benefit: Get some of your insurance money early if you become seriously ill.

- Common Carrier Accidental Death: Extra benefit if you die in an accident on a plane, train, or other public transport.

- Family Health Benefit: Helps cover costs if a natural disaster affects your family’s health.

Who Should Consider This Plan?

This plan is perfect for people who want life insurance without the hassle of medical exams. It’s also great if you need to cover specific debts like a mortgage, car loan, or credit card debt.

Foresters Strong Foundation non-med term life insurance is all about making life insurance simple, accessible, and hassle-free. Whether you’re new to life insurance or looking for a plan that fits your busy life, this could be the perfect fit for you.

Foresters Advantage Plus II

Foresters Advantage Plus participating whole life offers permanent life insurance policy with a guaranteed death benefit protection up to age 121. In addition, offers guaranteed cash value and guaranteed premiums, FOR LIFE!!

Here are some Key Highlights of the Advantage Plus Participating Whole Life Insurance

Underwriting Options

- Non-Medical issue upt o $400k from ages 16-55

- Face amounts from $100k-$10mm

- Preferred and Substandard underwriting available

Coverage and Cash Values

- Guaranteed death benefit and cash values

- 10/20 year term riders for additional low cost coverage

- Potential for dividends for accelerated cash value growth

- Paid-Up Additions rider provides additional coverage

No cost Value Added Riders

- Accelerated Death Benefit Rider

- Common Carrier AD Rider

- Family Health Benefit Rider

Foresters PlanRight Whole Life

The PlanRight Whole Life is Foresters final expense product. PlanRight is a level, guaranteed premium whole life that can take care of the final expenses. This product is perfect for those lower income/fixed income individuals ages 50-85!

They offer three types of coverage:

- Level Death benefit – 100% payout immediately after death, regardless of when death occurs

- Graded Benefit – If the policyholder passes away within two years, only a limited payout will be received by beneficiaries. If death occurs after the first two years, there is a 100% payout.

- Modified Benefit – With modified death benefit, the amount paid out for the first two years will be limited, but beneficiaries get all paid premiums plus 10%. If death occurs after the early two years, there is a 100% payout.

Here are some key features of the PlanRIght Whole Life From Foresters

- Coverage – Face Amounts Range From $2k-$35k

- Fast Approval – Medically eligibility determined at application

- No Medical Exam – Instant Approval

- Personal Health Interviews – For those with Health issues

Foresters Smart UL

What about Guaranteed Issue and No Exam Coverage

Foresters have many kinds of simplified issue life insurance policies. For example, this includes the guaranteed issue policy and the no exam policy. These policies do not require a medical exam which is very appealing to a lot of people.

Above all, especially those with pre-existing conditions that think they will have trouble getting insured. While there is no physical exam, they may request other kinds of information relating to your health. These policies will usually accept you quite quickly.

Further, it’s also a good option for those who want permanent life insurance coverage ASAP. However, know that these plans are significantly more expensive.

We consider Foresters one of our go-to carriers, especially for our senior market. Our review of Foresters is A+.

Can I Add Riders to my Policy? – Customize Your Coverage with Foresters

Yes, as a matter of fact, Foresters includes up to three riders with your base coverage! No additional cost or premium!

- Accelerated Death Benefit Rider ~ you may accelerate a portion of your death benefit if insure is diagnosed with a terminal illness (critical or chronic).

- Common Carrier Accidental Death Benefit Rider ~ will provide an additional benefit due to an accident as a “fare- paying ” passenger such as a plane or bus.

- Family Health Benefit Rider ~ helps cover health expenses including ambulance rides as a result of a natural disaster such as hurricanes or earthquakes. Also, there is a fraternal benefit society approved to carry out services.

What if I already have a policy with Foresters, am I paying too much? – Policy Review Time

Life changes over the years. All too often when we put a policy in place. We forget about it. As your family grows or you buy a home, or even your children are older. You may be paying too much for the policy you originally purchased. In fact, you may be overpaying by up to 20%. That is a lot of $$$ that belongs back into your pocket. These are some of the reasons you should consider calling Danny Ray, at PinnacleQuote Life Insurance Specialists.

Reasons for policy Reviews:

- New home

- Change in health

- Financial status

- New home

- Married recently or Divorced

- New baby

- Decrease or add the number of your dependents

- Change from term/whole or vise versa

During your policy review, your agent will ask you some questions. Such as:

- Health and lifestyle questions

- Type of policy you currently own

- Amount of coverage on that policy

- Beneficiary information

- Do you have riders

- Medical history

FAQs

In addition to traditional insurance benefits, Foresters offers unique member benefits, including community grants, legal counsel services, and scholarships.

Their term life insurance offers coverage for a specified period, typically 10, 20, or 30 years, providing a death benefit if the insured dies during the term.

Foresters’ whole life insurance provides lifelong coverage, fixed premiums, and a cash value component that grows over time.

Yes, Foresters offers various riders to customize policies, such as critical illness riders, disability income riders, and child term riders.

Member benefits include community involvement opportunities, financial counseling, legal services, and educational scholarships for members and their families.

Foresters’ universal life insurance offers flexible premiums and death benefits, along with a savings element that accumulates cash value.

The requirement for a medical exam depends on the policy, age, coverage amount, and health of the applicant. Some policies might offer simplified underwriting.

Foresters Financial is typically well-rated by insurance rating agencies, indicating a strong capacity to meet ongoing insurance obligations.

Evaluate your insurance needs, consider the unique member benefits, compare policy features and costs, and consider consulting with a financial advisor.

Claims can be filed by contacting Foresters’ customer service. They require documentation, including a death certificate and claim forms.

Related Articles

Conclusion

Foresters is a company that has been in business for over 150 years. They offer insurance and annuity products, but they also have other investments you can take advantage of to help with your retirement or save money on taxes. If you’re interested in any of the services offered by Foresters Financial Group, contact them today! Get a quote online now and see how much more affordable life insurance may be than what you are currently paying for. You won’t regret it!

2 Comments

MAURICE A ASKEW

I'm interested in getting a whole life plan with a cash value that accumulates over time and can potentially be borrowed against if need be. I am 43 years old with no health issues. I am a non smoker and I workout daily as well.

Danny Ray

Hi Maurice, we have one of the best products in the industry for what you are looking for. A paid-up addition whole life policy with a 20yr pay will accelerate the cash value accumulation. In addition, provide a tax-free income as well. I will email you the information. Or feel free to call me on Tuesday at 855-380-3300, Danny Ray (Founder)