2024 Guide For Non-Guaranteed vs. Guaranteed Universal Life Insurance

If you are wondering about non-guaranteed vs. guaranteed universal life insurance, well, you have come to the right place!

You’re reading this because you’ve been thinking about getting life insurance. You know it’s a good idea, but the options seem overwhelming.

What should I get? How much do I need? Is there anything else I should be considering before making my decision?

The truth is that buying life insurance is one of those decisions where everyone has an opinion – and most people don’t have your best interests in mind.

This article will help you find the answers to all these questions and more!

Table of Contents

- Non-Guaranteed and Guaranteed Universal Life

- What Is Non-Guaranteed Universal Life

- GUL Cash Accumulation Fund

- What Is GUL Life Insurance

- What Are The Benefits of Guaranteed Universal Life

- Guaranteed Universal Life Insurance Pros and Cons

- Is Applying For a GUL Policy Different Than Other Life Insurance

- What Is No Lapse Guarantee Life Insurance

- FAQs

- Conclusion

- More Life Insurance R

The Truth About Guaranteed Life Insurance Vs Non-Guaranteed

Above all, in this article, we will break down the guaranteed universal life insurance policies and how the non-guarantees vs the guarantees work. Unlike term life insurance and not to be mistaken for guaranteed acceptance life insurance, a GUL is one of the most cost-effective permanent life insurance policies.

Overall, when applying for a guaranteed or non-guaranteed you must have a life insurance illustration submitted with the policy. This is something that will show the cash value component, guaranteed cost of insurance, and what age the insurance is good until.

In general, most of these policies are good until age 85 to age 121. In addition, you can structure the policy to pay premium payments up until or in a shorter time. But again, life insurance companies will want to know that the insurance policy illustration was given to the client.

Furthermore, in most cases, you will have to take a medical exam to determine the rate class. Unlike the current assumption of whole life, these types of life insurance are not loss-sensitive. To clarify, this IS NOT a guaranteed issue life insurance policy.

It is important to realize if you are looking for life insurance that is permanent at age 65 and over, that this is the most cost-effective permanent life policy.

Another key point guaranteed universal life insurance for seniors is one of the best policies as you can pick an age and not worry as your funeral costs will be covered.

These policies are also used for different workers’ compensation as these are highly customizable. Mutual of Omaha offers a GUL express no medical up to age 70.

Enjoy the rest of the article in detail.

Non-Guaranteed and Guaranteed Universal Life

What you need to Know!

This is a topic I have been explaining a lot lately. In fact, it is usually from a life insurance agent not doing their job correctly.

For instance, they are selling a permanent policy without explaining the risks down the road. Above all, nothing is worse than seniors having a million-dollar policy thinking everything is taken care of than finding out rates go up!

All in all, when shopping for a policy such as a universal life you may come across the terms “non-guaranteed” and “guaranteed”.

Consequently, this is when it can become confusing for a client. In fact, this is what separates the real agents from the fly-by-night agent that won’t be around when the doo-doo hits the fan.

It is important to realize the difference when speaking to a client. Furthermore, Non-Guaranteed and Guaranteed are nothing alike.

In reality, they are very different and can be financially painful down the road if you do not know the difference.

For this reason, we will break down the difference in the rest of this article. Therefore, you will better understand why we are very big believers in the Guaranteed Universal Life (GUL).

What Is Non-Guaranteed Universal Life

To clarify, Non-Guaranteed universal life is in the family of the permanent types of life insurance. In other words, it covers you for life. In theory that is true, but will you be able to pay for it?

The first thing to remember is a non-Guaranteed policy carries a death benefit life any permanent life insurance policy but with an investment component that your premiums will be invested in.

For one thing, these policies would be a fantastic product in a high-interest rate environment.

However, in this day and age with the rates being off their historic lows, the client is usually unaware of the risks involved. Because rates are low the policy winds up being underfunded while the cost of insuring you increases.

Unfortunately, the typical agent will be trying to sell a high commission product while leaving out the possible risks involved.

In fact, I have seen this happen way too often without the client understanding the risks involved.

Consequently, down the road when they need the coverage the most, your premium payment usually increases in some cases over 100%.

As a result, you are on a fixed income and unable to pay premiums. Surprisingly, I receive calls like this all the time. Usually from a client that is over 75 that just wants to leave their spouse a little bit extra.

With this in mind, we are not a big fan of this kind of product especially if you are counting on it for final expenses.

GUL Cash Accumulation Fund

What does cash accumulation mean?

The biggest misconception is confusing cash value with the meaning of cash accumulation. When it comes to a non-guaranteed universal life policy, the cash value is not a death benefit!

The insurance company will keep that money if you do not withdraw it before you die. The cash value can be used for a no-lapse guarantee or to borrow from the policy.

However, if you pass away, they will take the money borrowed off the face amount to repay the loan.

So in essence, you are getting charged for borrowing via a surrender charge on money that was never yours in the first place as the life insurance company will keep that money.

What Is GUL Life Insurance

What is Guaranteed Universal Life (GUL)?

If a term life insurance and a whole life policy had a baby, it would be a Guaranteed Universal Life GUL. With this type of policy, the life insurance coverage is guaranteed and the insured bears no risk.

Furthermore, it’s not like a whole life as it does not build a guaranteed cash value.

In fact, it is much like a term. For instance, instead of looking at a 10,20, 30-year term, you can pick it to age 85, 90, 95, 100, 105, 110, and 121. The premiums are level and the death benefit is guaranteed to the age.

Unlike other permanent insurance products, there is no rate of return. This is the biggest difference from a non-guaranteed UL because you are without the cash value that results in expensive management fees.

Overall, the guaranteed Universal Life is more affordable than whole life and is one of the most favorable policies when considering pension and estate planning.

Guaranteed Universal Life Insurance Quote

The GUL is one of my favorite products to offer seniors that are looking at types of permanent life insurance. This will enable a senior to have low-cost life insurance in some cases to age 121 without a cash value component.

My favorite carriers for GUL have living benefits built in the policy via a critical, chronic, and terminal illness rider. These policies in most cases will require a medical exam especially those over the age of 70.

As an independent agent, these are the top GUL carriers I like to offer seniors over 75 compared to term and/or whole life (Burial Insurance).

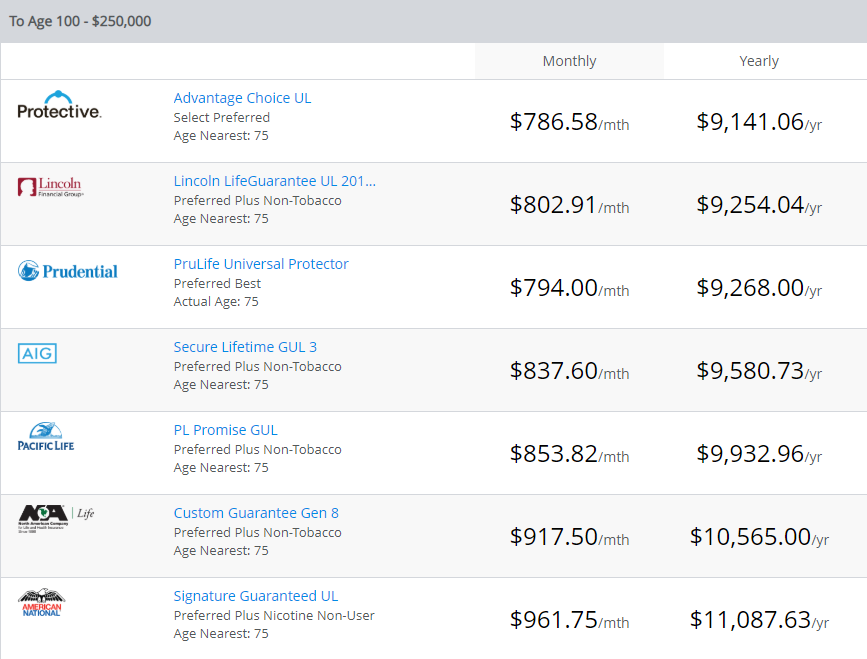

Our prospect is a 75-year-old healthy male qualifying for the best rate. He is shopping for a $250,000 GUL to Age 100.

Guaranteed Universal Life Insurance Rates

Mutual of Omaha also has a GUL but does not make the cut.

Clearly, Protective Life Advantage Choice GUL is the best priced. But some of the others have other options as well.

Here are the life insurance carriers that have a cashback feature or return of premium:

- American National – 100% cashback on years 20 and 25

- AIG – 50% cashback on year 15, then 100% on year 20 and 25

Here are the life insurance carriers that offer Living Benefits:

- North American

- American National

It is nice to know premiums are paid back if you want that option. It is also a plus to have living benefits. Our go-to carrier is AMERICAN NATIONAL!!

Guaranteed Universal Life Insurance for Seniors

If you are looking for affordable permanent life insurance and you are over age 65 then a GUL might be the best option.

This will assure that you have guaranteed level premiums until the age that you choose. In this case, 90/95/100/105/110/121.

What Are The Benefits of Guaranteed Universal Life

Above all, Guaranteed Universal Life is a great alternative to overpriced whole life. Especially, if the consumer is looking for that guarantee over the cash value part of the policy.

In fact, GUL’s are about 1/3-1/2 the cost of whole life.

With that said, let’s get into the most important reasons why I recommend it to clients.

Your Premiums will NOT change

In regards to Non-Guaranteed policies, the consumers’ premiums will more times than not increase every few years. In fact, if you are older on a fixed income this will be a major issue. I receive calls like this all the time. Believe me, you do not want to shop for life insurance in your 70’s. A Guaranteed policy your premium is fixed. For instance, it’s like a term policy that you can pick an age instead of a period of time to protect. You can guarantee premium to age 90,95,100 or to 121.

Coverage is Locked and NOT linked to an investment

I can not stress this enough to consumers. The Non-Guaranteed policy has to have the investments outperform consistently or the premiums will go up. Bottom line, no investments go up in a straight line. If the guaranteed interest rate goes down and the market is under-performing, the insured has to make up the difference. This usually happens either in a rate increase or a decrease in coverage, or both. In this low-interest rate environment, Non-Guaranteed policies put you at risk unless of course you are over-funding and the policy pays for itself. Again, Guaranteed policies you don’t have to worry about because the insurer TAKES ALL THE RISK!

Most people DON’T overfund a life insurance policy

Buying a Non-Guaranteed policy usually means you need to pay more money into it to manufacture cash value. Overall that cash value will build to offset any investments going bad or under-performing. With that said, if you pass away, the beneficiaries will get the death benefit. However, all that cash value the insurer keeps. What I always suggest, is if you are looking to invest, buy GUL and invest the difference. This is the great philosophy of Suzy Orman and Dave Ramsey. The end result is your family will have the death benefit and the investments when you pass.

Paying LESS up front is a great thing!

A Non-Guaranteed Universal Life Insurance policy has a much higher up-front cost versus a GUL. In some cases, 3 to 4 times the cost for the coverage.

Can be used for a deferred compensation plan

When you own a successful business then it would not be uncommon that your accountant has told you you make to much money. A great way to have a tax write off as a business is to offer employees a deferred compensation program via a flexible universal life or GUL.

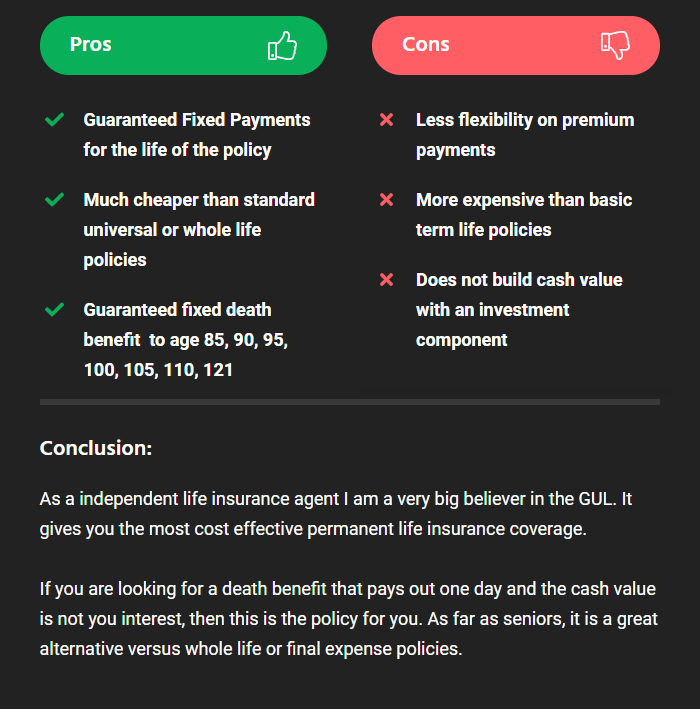

Guaranteed Universal Life Insurance Pros and Cons

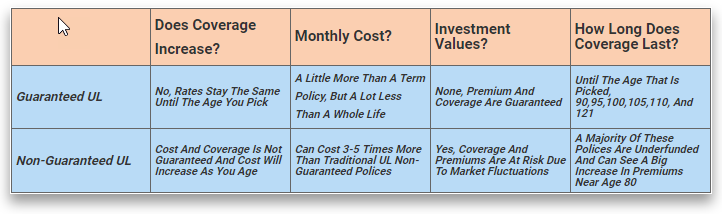

Comparing Non-Guaranteed vs Guaranteed UL

Above all, putting these two policies side by side will put aside any confusion. If you want to have a level premium with a guaranteed death benefit, then GUL is the way to go.

If you want to take more of a risk and invest in premiums, then a non-guaranteed policy is best for you.

Non-Guaranteed Vs. Guaranteed Universal Life Comparison

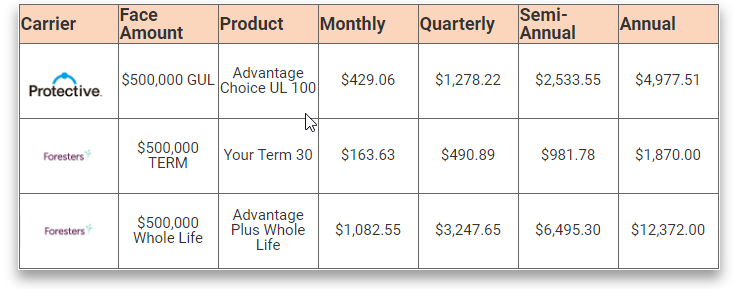

Comparing Rates of GUL Vs Term Vs Whole Life

Here is a comparison of term vs variable universal life insurance policy for a 55-year-old female, healthy-looking for $500,000 in coverage.

You can clearly see universal life insurance vs term has its advantages, especially if you have longevity in your family.

When I speak to a client in a circumstance like this, and we weigh the pros and cons of guaranteed universal life vs term, a majority of the time we go with the GUL.

In addition, you can see the cost advantages of permanent life insurance with guaranteed universal life insurance vs whole life insurance.

Is Applying For a GUL Policy Different Than Other Life Insurance

Although great questions, NO!

In fact, applying for Guaranteed Universal Life Insurance is the same underwriting process as a typical term.

For instance, you will have to take an exam. Furthermore, depending on age and if it is a multi-million dollar policy there may have to be an inspection report.

But all in all, it’s usually processed and approved within 30 days.

If you have any questions, feel free to call me at 855-380-3300×1. I have a very simplistic way of explaining this product with a common-sense approach.

Here are my top 5 GUL carriers:

- Protective Life

- AIG (Cash Back)

- American National (Living Benefits)

- North American (Living Benefits)

- Lincoln Financial Group

What Is No Lapse Guarantee Life Insurance

To maintain continuous coverage, you must pay the No-Lapse Guarantee premium, irrespective of how the policy actually performs.

In this period, premiums remain guaranteed against lapses even if cash values decrease. Cash values may hover around their current rate for years without significant fluctuations. Additionally, unexpected rises in claims costs, due to unpredictable events, can occur without any prior indication..

Overall, it becomes essential when buying life insurance as soon as you start making plans about retirement income needs in order to provide yourself peace before death comes knocking (literally).

Related Articles

FAQs

1. Q: What sets non-guaranteed and guaranteed universal life insurance apart?

A: The big difference lies in the guarantees. With guaranteed universal life insurance (GUL for short), your benefits and premiums are set in stone; they don’t change. On the flip side, non-guaranteed policies can flex a bit. This means premiums or benefits might shift based on various factors.

2. Q: Why would someone pick non-guaranteed over the guaranteed option?

A: That’s an insightful question. Some folks lean toward non-guaranteed policies because they offer a bit more wiggle room. If the policy’s tied investments do well, you might get the bonus of lower premiums. But remember, there’s a catch. If those investments stumble, you could end up paying more.

3. Q: Can you break down guaranteed universal life (GUL) for me?

A: Absolutely! Imagine GUL as the sweet spot between term and whole life insurance. You get the stability of a guaranteed death benefit, much like term insurance, but it stretches out for your entire life, echoing the perks of whole life insurance. And the icing on the cake? Your premiums are consistent, so you always know what to expect.

4. Q: Are there drawbacks to GUL?

A: While GUL shines with its consistent premiums, it might not pack as much punch in the cash value department compared to other life insurance options. So if you’re aiming for a policy that’s also a robust investment, you might want to explore a bit more before settling on GUL.

5. Q: What if I hit a rough patch and can’t keep up with my premiums?

A: Life can be unpredictable. If you find yourself struggling to make payments, some policies grant you a grace period, a little window of time to get back on track. But be careful. If you fall behind for too long, you risk losing your coverage. Always best to chat with your insurance agent to understand the nitty-gritty.

6. Q: So, is one type of policy superior to the other?

A: It’s not so much about superiority, but more about what jives with your personal needs. If you’re after peace of mind and solid guarantees, GUL is a winner. But if you have an appetite for some risk with the potential for sweeter rewards, you might find non-guaranteed policies intriguing.

Related Articles

Conclusion

The conclusion of this article is that the guaranteed universal life insurance and how it’s different from term life.

When you’re looking for a permanent policy, GULs is one of your best options because they combine low premiums with flexibility in coverage choices.

And unlike GUAs, which require medical underwriting on an annual basis to maintain their guarantee status, once a person has been approved for a GUL there will be no need for another round of physical testing or waiting periods before receiving benefits if death were to occur!

This helps make them more cost-effective than other types of policies available today. If you have any questions about these kinds of policies please reach out and we’ll be happy to answer as many as we can!

You must remember that when purchasing a GUL you have a non-guaranteed surrender value. And always talk to your independent agent about the differences of guaranteed vs non-guaranteed life insurance!!