Cheap Life Insurance Rates For Men 2024 Guide

If you are looking for Cheap Life Insurance for Men then you are in the right place.

Every year, the number of senior citizens in America increases. This means that more and more people are looking for cheap life insurance rates for men to ensure their families are taken care of should something happen to them.

In this blog post, we’ll discuss how to find these rates and what you need to do before purchasing a policy.

If you’re worried about your family’s future after you die, it might be time for you to start looking into cheaper life insurance rates for men!

This is a bold intro paragraph because Seniors will want information on finding affordable life insurance so they know their loved ones will be cared for if anything happens while they’re alive.

They may not know where or how to begin researching which type of policies would fit them best.

Article Navigation

- When Should I Get Life Insurance and How Much

- Why Do Men Pay More For Life Insurance?

- Life Insurance for Men at 50

- Best Life Insurance Carriers For Men

- Should a Single Man Have Life Insurance?

- How Much Does ‘No Medical Exam’ Life Insurance Cost For Men

- Can Mental Health Affect Life Insurance Premium For Men

- Term Life Insurance For Men

- $500,000 Term Life Ages 20-80

- Final Thoughts on Life Insurance for Men

- FAQs

- Conclusion

When Should I Get Life Insurance and How Much

Protect your family & save money now!

What about affordable life insurance rates for men? While no one likes to think about death, the reality is we are not invincible. When people depend on you financially, not having life insurance is irresponsible. If you passed away, loved ones would inherit your debt and need to pay for your final expenses.

Protecting your family with life insurance is very rewarding. You could have peace of mind, knowing that thanks to your life insurance policy, your family will be financially secure if something were to happen to you.

You are the HERO of your Family and ensuring their future is kept intact. Even in your Absence!

Why Do Men Pay More For Life Insurance?

Who pays more for life insurance by age male or female?

Men do pay more for life insurance premiums than women. Understand Why Now…

It’s true that men pay more for life insurance than women. In fact, this is because mortality tables show that women tend to outlive men by about five years on average, especially for the older male.

Furthermore, diagnoses of heart disease statistically happen earlier in life for men than women. Therefore, men are considered a higher risk by life insurance companies.

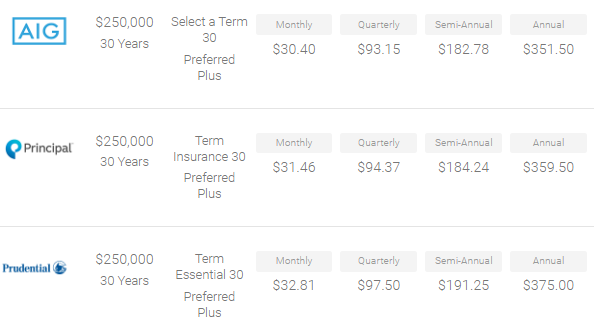

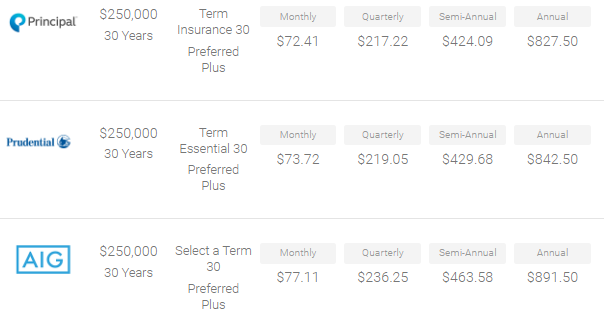

With all that being said, finding life insurance for men and the most affordable insurance is still achievable. For instance, take a look at these charts. 40 vs 50-year-old males.

The price difference if you put off purchasing life insurance. The key to purchasing “Cheap” term life insurance, the younger you are, the cheaper it is.

Cheap Quotes for Men

Life Insurance rates for men at 40:

Affordable term life insurance quotes for men at 50:

Life Insurance for Men at 50

As you can see above, as you age, the rates increase. All too many times our clients put off purchasing life insurance because of the following:

- Too busy

- Clients think they have plenty of time

- Wait until my birthday ~ biggest mistake in life insurance, as you age, prices increase!

- The new year

- I am healthy, I don’t need it

- Have life insurance through my employment ~ That job could be gone tomorrow. Plan wisely!

- Life insurance is too expensive ~ What?! Let me tell you something… You spend more on your daily latte at Starbucks! And trust me I have calculated this, In one year if the average person buys a latte daily. You spend $2,190 in ONE YEAR! Now, life insurance does not look so expensive after all, Does it?

Do any of these excuses sound like you?

Best Life Insurance Carriers For Men

Which is the best life insurance company? We hear this question often. There is no “one size fits all” carrier. We tailor-make you a policy based on your age, height, weight, health, etc.

However, listed below are some of the Top A+ rated carriers that we like. Remember, your agent will be best to guide you through the process and answer ALL of your questions from start to finish.

- AIG

- Prudential

- Banner Life

- Protective

Just to name a few that offer cheap life insurance choices for men. Each Carrier will look at you differently. The following are what a carrier considers in their underwriting and approvals.

- Age

- Health history

- Tobacco user/non-user/quit? how long ago

- Family history

- Lifestyle habits/extracurricular ~ Special Risk Lifestyle we speak of this below

- Employment

In addition, look at life insurance over 50 no medical exam for a possible faster process.

How are life insurance premiums calculated?

Smoking, for one, will have a huge impact on your life insurance premium. In fact, smokers can expect to pay 2-3 times more for life insurance. That should give you enough motivation to quit. Since smoking often causes life-threatening health issues, even the top life insurance companies charge smokers high premiums. In fact, the number of cigarettes smoked daily can affect the rate.

Your physical health is another big factor. Those in poor health will pay far more in premiums. Before you apply, try to improve your physical condition. Exercising regularly and making an effort to eat healthier can go a long way.

Of course, for those with pre-existing medical conditions, like diabetes, there is probably no way of getting around paying more for your life insurance.

Should a Single Man Have Life Insurance?

Do I need life insurance if I’m single with no dependents?

Death happens. Don’t put that burden on your family!

Single men need life insurance too. Death happens to everyone. Just because you don’t have a spouse and/or children, does not mean you do not have a family. As a matter of fact, if you die, who will carry the weight of that financial burden? Your parents and family! That financial burden includes:

- Your debt

- Medical bills if any

- Funeral/burial

You want to have enough coverage to cover your funeral and your debts. Equally important, the general rule of thumb is to multiply your income by 20. The reason being, your family will have enough to cover all funeral expenses, pay your personal debts and medical bills.

In fact, now is the time to get a policy in place. The rates will not get any cheaper than they are right now. Again, affordable term life insurance policies are easy to achieve. Call your independent agent today!

How Much Does ‘No Medical Exam’ Life Insurance Cost For Men

In the event that you are finding it difficult to get covered, no medical exam life insurance policies for men are always an option. While guaranteed acceptance and the coverage begins very quickly, know that these plans are more expensive. Don’t fret and do not get discouraged!

Danny at PinnacleQuote has over 25+ years with the top carriers, and relationships with the underwriters, so he knows which carriers will be best for you and your family’s needs.

And remember, life insurance over 45 years of age gets risky. Like we discussed as you age, your health changes and each year you age, your premiums will be higher.

Can Mental Health Affect Life Insurance Premium For Men

Your mental health is also relevant to your life insurance rates. People with Bipolar disorder, for example, maybe labeled a high-risk applicant because of their condition. Of course, every life insurance company has different medical underwriting, which is why it’s so important to shop around before deciding.

Lastly, if you frequently participate in any potentially life-threatening hobbies, such as rock climbing, hang gliding, skydiving, etc., then you may need to pay more for your life insurance.

This is considered special risk life insurance. You get the idea — anything about you that is remotely life-threatening can cause life insurance companies to raise the rates of your insurance.

Term Life Insurance For Men

What is the best age to get life insurance for men?

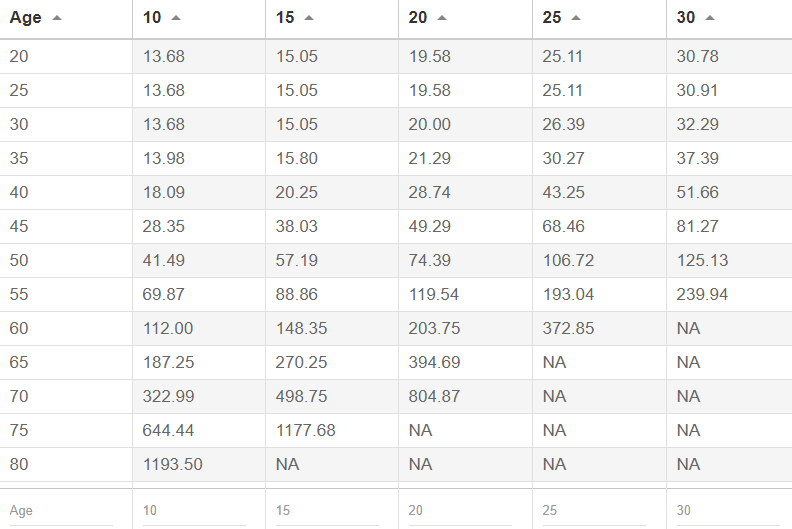

NOW is the best time to get insurance quotes. As the name suggests, term life insurance provides temporary coverage. Choose between 10, 20, and 30 year terms. Term life insurance is the most affordable life insurance option.

However, it is also the most basic. Unlike whole life insurance, term life insurance does not create cash value build up. Term life insurance is a popular option for those that want to take out a life insurance policy for the duration of their mortgage, or until their children are adults.

As a matter of fact, your rates will vary from company to company. You can research life insurance rates by age so that you have an idea of how much it will cost you. Most of the time, the rates displayed annual premiums.

Here are some rates for males ages 20-80. These are the best rates by A/A+ rated carriers!

$500,000 Term Life Ages 20-80

Final Thoughts on Life Insurance for Men

Waiting is risky and expensive. Here is why…

Waiting to buy life insurance is very risky, and it will also be more expensive. If you want to get cheap term life insurance, then you need to get it done soon. After all, getting life insurance while you’re young is much better than having to find life insurance in your 50’s. As you age, Premiums will Increase in price!!!!

Hiring an independent insurance agent is one of the best ways to get the most affordable term life insurance policy. As a matter of fact, an independent insurance agent will know which companies are more likely to offer you the cheapest rates.

This can save you a ton of time, hassle, and money. On top of this, it’s good to have an expert on your side that can answer your questions.

Choosing PinnacleQuote

Let’s face it, everyone is different. In fact, life insurance for men is not a one size fits all. Not everyone is a healthy, non smoking fit male. This is where your independent life insurance agent comes in.

Although you can shop online for various carriers and compare, and that is great. However, we shop multiple carriers at one time. We find you the Best Price, Best Carrier and that is something at PinnacleQuote, we GUARANTEE!

FAQs

Q: Is life insurance more affordable for men?

A: Life insurance rates are influenced by factors such as age, health, and lifestyle, rather than gender. However, men may pay slightly higher premiums than women of the same age due to statistical differences in life expectancy.

Q: How can men find affordable life insurance rates?

A: To secure affordable rates, men should maintain good health, avoid tobacco use, and compare quotes from multiple insurance providers. Shopping around and exploring discounts can help find cost-effective options.

Q: Does the term length affect the affordability of life insurance for men?

A: The term length can impact the cost of life insurance. Generally, shorter terms have lower premiums. Men should choose a term that aligns with their financial goals and the coverage needed during specific life stages.

Q: Are there any specific considerations for men in different age groups when purchasing life insurance?

A: Yes, age is a significant factor in determining life insurance premiums. Younger men typically enjoy lower rates. It’s important to secure coverage that meets current and future needs while considering budget constraints.

Q: What lifestyle choices can impact the affordability of life insurance for men?

A: Factors like smoking, excessive alcohol consumption, and participation in high-risk activities can increase life insurance premiums for men. Adopting a healthy lifestyle can contribute to lower rates.

Q: Can men qualify for discounts or incentives when purchasing life insurance?

A: Yes, insurance providers may offer discounts for factors like good health, non-smoking status, or bundling insurance policies. Men should inquire about available discounts during the application process.

Q: Are there specific types of life insurance policies that may be more affordable for men?

A: Term life insurance is generally more affordable than permanent life insurance. Men may find cost-effective coverage by choosing a term length that aligns with their needs and budget.

Q: Can men convert a term life insurance policy to permanent coverage later on?

A: Many term life insurance policies offer conversion options, allowing men to convert to permanent coverage without a medical exam. This can be advantageous if long-term coverage becomes a priority.

Q: How can men assess the appropriate coverage amount for their life insurance policy?

A: Calculating the coverage amount involves considering financial responsibilities, such as mortgage, debts, and future needs like children’s education. Online calculators and consultations with insurance professionals can help determine the right amount.

Q: Is there a specific process for applying for cheap life insurance for men?

A: The application process involves providing health information, lifestyle details, and selecting coverage options. Working with an insurance agent can streamline the process and help men find affordable coverage tailored to their needs.

Conclusion

Get Quote. It is your responsibility to make sure you and the people who depend on you financially are taken care of in case something happens. We can help find affordable life insurance rates for men by partnering with a company that understands how important it is to have coverage, no matter what stage of life you’re at or what kind of risk factors may apply to our situation. Give us a call today so we can get started finding the best policy for you!