Finding No Medical Exam Term Life Insurance In 2024

Finding a No Medical Exam Term life insurance is not as hard as you may think. In fact, it is a great option for healthy senior consumers because it does not require a medical exam. It can be taken out at any time and the premiums are typically lower than those for whole life insurance.

The coverage will end when you die, so if you have an extended family with heirs that need to be provided for, this might not be the best option.

Is there anything else I should know about term life?

Article Navigation

- How Do I Get a No Medical Exam Life Insurance Policy

- Sagicor’s One Million No Medical Exam Life Insurance

- Life Insurance Quotes No Medical Exam Seniors

- NO Medical EXAM LIFE INSURANCE FOR SENIORS OVER 70

- No Exam Life Insurance Quotes For Seniors Over 80

- What Types of Life Insurance No Exam Policies are there

- TRANSAMERICA NO EXAM LIFE INSURANCE

- HOW MUCH LIFE INSURANCE DO I NEED (Needs Calculator)

- HOW QUICKLY CAN I GET A NO Medical EXAM LIFE INSURANCE POLICY

- Guaranteed acceptance life insurance no health questions

- Conclusion

Cheap Term Life Insurance Without Exam

How do I get Cheap Life Insurance Without Medical Exam?

FIND OUT HOW THIS WORKS…

Is it possible to get cheap term life insurance quotes, no medical exam?

Well, here you are faced with many questions. You are also asking yourself, how much life insurance can I get without a medical exam?

You finally got to the point of embracing the importance of coverage. In fact, the no medical exam life insurance policy is convenient and in some cases priced within the top rates in the industry.

In fact, life insurance no medical exam no waiting period is easily achieved. Especially if you have no history of health problems.

In general, if you’re shopping for life insurance coverage and apply with a no medical exam carrier, they still can require an exam which includes a blood test. Especially if they find a pre-existing medical condition.

These exams usually take 30 minutes in the luxury of the consumer’s residence.

Furthermore, when applying with a no exam product, life carriers usually issue policies within a week to 10 days with a simple underwriting process.

For No Medical Exam Life Insurance Apply Online…

Let’s see how the No Exam Policies Match Up!!

Life Insurance with No Health Questions and No Waiting Period

The types of policies that do not require any health questions asked would be guaranteed issue whole life. In fact, these types of policies will require a two-year waiting period. For instance, if you die within that time the accelerated death benefit will not payout. However, you will receive 100% of the premiums plus 10%.

Also, these types of policies will be approved regardless of medical conditions and/or health conditions.

Here are the life insurance companies that we work with that offers the best GI products.

- AIG

- Gerber

- Great Western

Above all, these companies application process is quick and easy and are with A-Rated companies or better.

Life Insurance Quotes Without Medical Exam

Some of the products we offer clients do not come with a medical exam. In fact, the underwriting process is fast and easy. For instance, these products have another name, accelerated underwriting.

These are the types of policies that do not require an exam. In addition, if you are in excellent health the process is much faster than a traditional fully underwritten term policies.

Here are some of our carriers that offer no exam life policies.

- American Amicable Term Made Simple

- Americo Mortgage Protection Term

- Foresters Strone Foundation Term

- Mutual of Omaha Term Express

The carriers and agents will be successful in getting term insurance quotes no medical exam.

How Do I Get a No Medical Exam Life Insurance Policy

Still that question, Really, Do you need a medical exam for life insurance? lingers…

No medical exam policy has both pros and cons.

In fact, here is the good stuff — you can get a no exam life insurance policy very quickly, you will get accepted despite any health issues, and, for those who hate medical exams, you don’t have to get a medical exam.

In general, although getting coverage will not require a medical exam, you will have to answer some health questions. These policies are sometimes called simplified issue life insurance. The application process is simplified with no physical exam.

However, if you have serious health impairments it is possible that some carriers no medical coverage would require a paramedical exam. This would require a height, weight, blood pressure reading, and a small blood and urine sample.

On the other hand, permanent life insurance policies are more expensive, because companies will have to assume you’re a high risk individual such as life insurance for diabetes. Also, some lifestyle and hazardous employment could be labeled as a special risk.

In addition, getting no Medical exam life insurance for smokers would make sense.

However, if you use marijuana, the carrier may insist on an exam to see the levels of THC that are in your system.

Furthermore, we will expand on more of these pros and cons below.

Buy Life Insurance Online No Medical Exam

Online life insurance no medical exam vs. Traditional Term Life Insurance

Can I get term life insurance no medical exam?

As a matter of fact, At the end of the day, no medical exam coverage and no matter which traditional term lengths coverage are quite similar. However, the main difference, of course, is that no medical exam life insurance means you can get covered without getting a medical exam but in some cases paying more money.

In detail, this means that people with serious health conditions can still be guaranteed coverage, whereas a traditional term policy might deny them.

In other words, no exam term life insurance policies are more expensive.

For example, people looking for life insurance for people with diabetes might assume that they are better off going with coverage without physical policy.

However, in most cases, it’s still possible to find more affordable rates, despite any health conditions.

Nevertheless, for life insurance for cancer patients, there is a shot of getting a no exam after 10 years of last treatment especially if you’re in overall good health.

Life Insurance Quotes No Medical Exam Questions

Not only will you not have to apply with companies that require a medical exam, but you will also be approved and consider to be in good health.

Above all, insurance agents will hold you by the hand and walk you through the application to approval.

Most companies offer solid carriers during this time.

250000 Life Insurance Policy No Medical Exam

The 250k term life insurance policy is very popular. Again, this will not require a physical exam with the carriers we use. In fact, if you had a heart attack more than 5 years ago some of our no medical exam carriers will take the risk.

These policies are popular for the 20-year term. In fact, this will properly protect your family.

Some of our top carriers that offer 250k no medical exam term are:

- American National (Living Benefits)

- SBLI

- Sagicor

- Nassau RE

- Assurity (350k)

- Foresters (400k) Seniors over 65 (150k)

500k Life insurance No Medical Exam

Getting life insurance policy quotes no medical exam is challenging if you have severe health issues. However, if you are healthy than it should be simple.

The 500k policy will protect your family form most financial burdens. For instance, mortgage, debts, and final expenses.

Sagicor’s One Million No Medical Exam Life Insurance

Sagicor finally has done it!!! Sagicor No Exam Life Insurance!!

The 1000000 life insurance policy is no longer synonymous with fully underwritten life insurance!!

Sagicors million dollar term life insurance no medical exam is here. The Accelerating underwriting will have a 2-minute automated underwriting decision in most cases.

They will do a simple MIB (Medical Information Bureau) check and in some cases a possible APS (Medical Records) on all 10, 20, and 30-year term life insurance policies.

Sagicor Sage Term Million Dollar Life Insurance will have rating classes from standard, Preferred and Preferred Plus. This gives Sagicor a huge advantage over the so-called Non-Med carriers!!

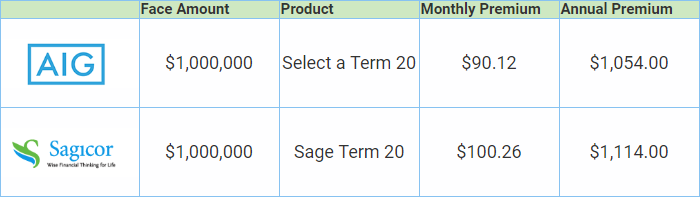

Here are sample quotes with Sagicor Sage term one million Life insurance vs Fully Underwritten.

*45 Year Old Male, Healthy

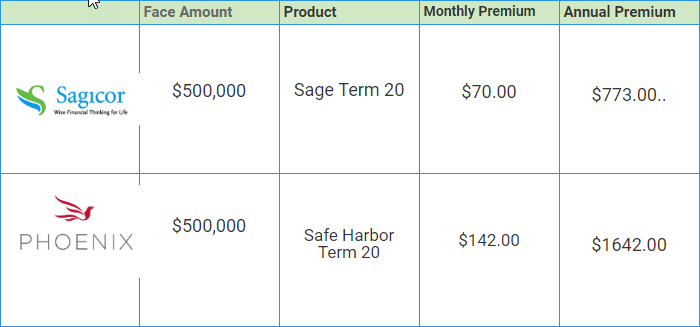

Life insurance no medical exam 500000 (half Million)

If you are a healthy 45-year-old male and you are looking for a half-million-dollar coverage, see the chart below. You will find the rates are fantastic with Sagicor!

Who offers life insurance no exam, no medical questions?

AIG is the best carrier for no medical exam and no medical questions. Typically chosen if you have some underlying health impairments.

In this case, a no medical life insurance company such as AIG or even Great Western would come with a 2 year waiting period meaning, if the insured dies from natural causes within first 24 months, premiums paid plus 10% will be paid to the beneficiary.

Ask your agent if you have questions regarding this type of policy.

Although a 2-year waiting period, you will have same day life insurance coverage with AIG. That is true, instant life insurance no medical exam!

Life Insurance Quotes No Medical Exam Seniors

Is there a no exam life insurance for seniors? In reality, after retirement when you’re on a fixed income, coverage can become very expensive if you continually kick the can down the road.

It’s important to realize if you’re a senior over 65 then a no medical policy is obtainable if you are healthy. Carriers issue policies within days. Talk to your agent about which carriers offer term life insurance no medical exam for seniors.

Or you can call us and we will go over the options that are available to you.

NO Medical EXAM LIFE INSURANCE FOR SENIORS OVER 70

By all means, if you are healthy it is very possible to get a term life insurance policy with no medical exam. With this in mind, here are some of the rates for a senior over 70.

These are a 10 year term and a 15 year term rates.

No Exam 10 year term rates for age 70

No Exam 15 year Term Rates For Age 70

No Exam Life Insurance Quotes For Seniors Over 80

So what about no medical exam life insurance for seniors over 80? Some people think this is not possible to achieve.

Above all, when you get to age 80 you are already past mortality age as a male (77). Also, about a year away from mortality age of a female which is 81. Particularly, life insurance carriers will look at you as a risk.

In this case, they know they are going to have to pay a death claim. In fact, statistics say so. To put it another way, that means they will make you pay for it.

Below is life insurance quotes no medical exam for an 80-year-old male on a 10-year term.

What Types of Life Insurance No Exam Policies are there

There are four main kinds of no medical exam life insurance policies to choose from: graded death benefit, level final expense insurance, simplified issue, and guaranteed issue. We’ll summarize these policies below:

- Accelerated Underwriting — is a fully underwritten policy that uses new data and modeling techniques to determine if a consumer qualifies without having to take a paramedical exam

- Graded death benefit — with this policy, money is released per year, increasing in amount/year

- Level final expense — burial insurance plans with smaller policy amounts and more lenient questioning

- Simplified issue — optimal for people in OK health that would prefer not to take a medical exam. However, you’ll need to fill out a medical questionnaire, and they have stingier health qualifications than the others.

- Guaranteed issue life insurance — The same as a simplified issue, just without the health questionnaire. Guaranteed issue life insurance policies are open for anyone health-wise, but there are age limits.

Of course, each of these has there pros and cons. Which you go with is entirely up to your situation and preference. Besides, if your looking for life insurance for those over 55, the maximum would be a 20-year term policy.

You have to make sure you shop wisely with an independent agent that knows the products and services to multiple carriers. This will assure you getting the best rate and carrier! Again, health problems past and present will likely have an impact on the rate.

WHAT ARE SOME OF THE BEST NO EXAM REQUIRED LIFE INSURANCE COMPANIES

What’s equally important, is choosing from several options is the best way. To explain, we will list some of the best insurance companies that do not make you take a medical exam:

- SBLI: No Medical Exam Life Insurance SBLI is Fast, convenient, and highly-rated. Range of coverage between $100,000-$500,000. So they have the legitimate 500000 life insurance no exam policy.

- Assurity Life Insurance Company: Check out our Assurity Review post. Offers between $50,000-$350,000. Most of the process is online!

- Phoenix Life: Express Underwriting for $25k-$400k ages 18-50, $25k-$300k ages 51-60, $25k-$200k ages 61-70, $25k-$100k ages 71-80.

- Sagicor: Now going $1MM without an exam potentially. Up to $500K non-med and $500K – $1MM Accelerated Underwriting (possible exam), Ages 18-45 up to $1MM, Ages 46-55 Up to $750k, Ages 56-65 up to $500k

- Foresters: $50,000 to $400k coverage amounts, ages 18- 55 and up to $150k from age 55 to age 80! Apply in Foresters’ portal and a decision is made within 10 minutes.

- American National (ANICO): Up to $1,000,000 non-med for those that qualify, with Living Benefits, in most cases $250,000 is the ceiling.

- Fidelity Life: Check out our review of Fidelity Life. Extremely fast coverage, with decent health between the ages of 18-65, you may be looking at $25,000-$250,000 worth of coverage. Fidelity Life also has reasonable life insurance for seniors (50-70 years of age). Also life insurance for seniors over 75.

The first thing to remember, these are just a few recommended examples. Of course, there are several more options out there. It’s crucial to shop around and compare rates/policies before deciding.

These are the best priced legitimate Non Meds/No Medical Exam term life insurance policies.

TRANSAMERICA NO EXAM LIFE INSURANCE

With Transamerica, most of the policies require a med exam. However, if you are under a certain age and applying for a certain coverage amount, you could possibly get a no medical exam policy. As always, in order for you to qualify and accepted will depend on your health questionnaire. In addition, at age 60 you may be able to purchase a term for 30 years.

No Medical Exam Life Insurance Quotes

HOW ARE MY RATES DETERMINED BY NO EXAM POLICIES

How does non-medical underwriting work?

Most of the time, you’ll need to take a brief medical questionnaire. In addition, other factors include medical history, driving history, family history, etc.

Here is a short video comparing fully underwritten vs no exam term life.

Also, life insurance rates by age will determine the price you pay. Furthermore, A.M.Best rating agency is the superior rating company, make sure the company you’re looking at is A/A+ rated.

Additionally, life insurance for smokers will have 2-4 times more premium to pay even with a no exam policy.

However, Smoking Cigars and Life Insurance Options, won’t have an effect on premiums as long as its an occasional cigar, and its admitted on the application.

Not to mention, Life insurance after DUI with a no exam will be challenging. If it’s been over 3 years, then a no exam will be an option.

PinnacleQuote’s Simple Process

At PinnacleQuote, we are not in the business of selling. We are actually against that. We like to educate our clients and provide them with the best options. In fact, we based those options on the specific profile of the client. So we tailor make you a

HOW MUCH LIFE INSURANCE DO I NEED (Needs Calculator)

Above all, this is one of the most important financial decisions that you’ll ever need to make. And you wonder, how much life insurance can I get without a medical exam. With this in mind, many factors go into this decision, and it will take some calculations. Here’s a list of some things you’ll want to consider:

- How much debt do I have?

- How much will my children need to get to adulthood?

- What about my children’s college tuition?

- Funeral expenses?

- What will my family need without my salary?

Calculate Your Life Insurance Needs

How much life insurance they should buy?

HOW QUICKLY CAN I GET A NO Medical EXAM LIFE INSURANCE POLICY

On the positive side, no exam policies issues in as little as 4-5 days, with the right carrier! Furthermore, life insurance in your 30’s is a prime time to get a no exam term policy. However, some may take up to a month waiting on an APS, “attending physician’s statement”.

For example, Treated blood pressure and life insurance may take more time because the carrier wants to know your history. For example, I have Multiple Sclerosis — Can I Still get coverage? Yes, but probably not a no exam policy.

Also, Treated High Cholesterol and Life Insurance Rates will vary depending on your HDL/LDL ratios and your overall cholesterol under 300. To conclude, the only policy you can get quicker is a cheap burial insurance policy or guaranteed acceptance coverage.

Guaranteed acceptance life insurance no health questions

This is a great option for people who are not in the greatest health. In fact, really the last option if you are not qualified for other types of policies. Although, tends to be a bit more expensive.

One thing to keep in mind. The first 2 years of a guaranteed acceptance policy if you die from natural causes, the policy will pay out the premiums paid to date to the beneficiary. In addition to that 10%. If you die from an accident, the policy will pay out the full death benefits to the beneficiary.

Very important to speak to your agent about this. If this ends up being your only option, it is best to have something in place than nothing at all. Remember, “Go Fund Me” is not life insurance!

HOW CAN I GET THE BEST HELP

At PinnacleQuote, we know precisely the right life insurance companies to set you up for family protection correctly. Life insurance companies vary based on several categories. That is to say, depending on your circumstances (financially, health-wise, etc.) we can help you find the coverage that works best for you!

Conclusion

The best way to get a term life insurance policy is by getting the cheapest one you can find without medical exam. There are many different companies that offer these policies, so it’s important to do your research before buying anything. If you need help with this process we have experts available 24 hours a day who will be glad to answer any questions and provide quotes from reputable providers in minutes. Simply fill out our quick form below or contact us at 1-855-380-3300 and let us know if you want more information about no medical exam term life insurance!