Burial Insurance With No Waiting Period 2024 Complete Guide

In this 2024 guide to burial insurance with no waiting period, we will break down everything you need to know. So get comfy and let’s dive in!

Do you have a family member that is approaching old age and is worried about finding cost effective final expense plans? Or perhaps they are concerned with the out of pocket costs their loved ones will endure.

If so, then you are not alone. A recent study found that as of today in 2024, Americans spent an average between $7,000 and $12,000.

Whether you opt for a burial insurance plan, a comprehensive final expense insurance policy that encompasses funeral costs and more, or a dedicated funeral pre-payment plan, you’ll be significantly easing the burden on your loved ones.

To avoid this expense and ensure your loved ones will be taken care of after they pass away, it may be worth looking into purchasing or looking into burial insurance policies with no medical exam a form of life insurance for seniors.

With today’s competitive final expense insurance market there are many companies who offer affordable rates for these policies with no waiting period – meaning you can purchase coverage immediately.

In addition to these savings, many policies also offer benefits such as pre-paid expenses for caskets or cremations which could assist in lowering costs further!

My question to you, how much does your current life insurance policy cover? Do you have enough?

The Truth About No Waiting Period Life Insurance

One of the most common questions I get from clients is if I get a life insurance policy today and die tomorrow will the policy pay out?

I am sure you are asking the same question. In this article, we will discuss instant life insurance approval but primarily burial life insurance no medical exam, and no waiting period.

Overall, there are many types of traditional life insurance for seniors and it is important to know the different burial life insurance products.

In fact, knowing what funeral services you want whether it is cremation services or traditional burial will determine the overall life insurance coverage and /or the death benefit.

For instance, if you have a health issue such as cancer or dementia, you may only be able to get a guaranteed acceptance life insurance policy.

This is still no medical exam life insurance, however, the beneficiaries receive no death benefit within the first 2 years.

So we will focus on immediate coverage of burial insurance policies that will cover the costs of traditional burial and the cost of cremation. Unlike a term life insurance policy, these are the types of policies the life insurance company will not require a medical exam.

These are simplified issued with instant approval life insurance and as long as you pay the premiums your policy will stay active for the long term.

So whether you are looking for a traditional burial or a cremation insurance policy these are the policies that will be there when the day comes to make arrangements with the funeral home.

How Can I Find Cheap Burial Insurance Policies For Seniors

What is life insurance no waiting period mean?

Most consumers close to retirement need to know how to purchase the best burial insurance plans and life insurance no waiting period has been more and more popular! But above all, affordable funeral policies!

What is the senior final expense life insurance program and what does it mean to you?

When you pass away, it’s always going to be extremely difficult for your family. Above all, don’t leave them to cover your final expenses.

Furthermore, Even cheap funeral plans cost thousands and they need money to pay!! Be on top of it, it is our duty!

Again, a memorial service is not cheap! You need to find an affordable burial life insurance policy that will cover funeral costs, your casket, flowers, etc. Funeral expenses alone are usually around $10,000.

Final Expense Senior Care Life Insurance For Burial

When you are shopping for final expense it’s important to know the inner workings of the policy. All too often, life insurance agents offer graded or guaranteed issue policies as senior funeral insurance.

Above all, funeral plans over 65 years of age come down to your health which ultimately will determine the rate. So if you are a healthy senior, why would you want a policy that is geared for seniors with significant health issues?

Overall, a guaranteed issue policy will be more pricey. Whereas, the level day one coverage will give you what you need immediately and is usually 30% cheaper.

In addition, make sure you read our article on prepaid burial/funeral plans before you make any decisions as they are not a good plan at all.

Burial Insurance Quotes For Seniors

What Is The Difference Between Level and Guaranteed Issue

Above all, almost every single “Direct to Consumer” final expense product is a two year waiting period!!

You know the ones, here are just a few that you need TO STAY AWAY FROM!!:

- Colonial Penn 995 plan

- AARP Guaranteed Acceptance Whole Life

- AAA

- Trustage GIWL

- Physicians Mutual

- ETHOS

- State Farm

Below we will show you the difference between day one coverage for a 70 year old male and female versus the Guaranteed Issue Whole Life with no questions and a 2 year waiting period.

Male Senior Plan Life Insurance $5,000-$40,000

| Coverage 70/M | Level Benefit | Guaranteed Issue | Overpaying % |

|---|---|---|---|

| $40,000 | $288.82 | $469.58 | 62.5% |

| $35,000 | $237.22 | $411.25 | 73.3% |

| $30,000 | $203.76 | $352.92 | 73.2% |

| $25,000 | $170.30 | $246.58 | 44.7% |

| $20,000 | $136.84 | $197.45 | 44.2% |

| $15,000 | $103.38 | $146.27 | 41.4% |

| $10,000 | $69.93 | $98.18 | 40.3% |

| $5,000 | $36.47 | $50.09 | 37.3% |

Female Senior Plan Life Insurance $5,000-$40,000

| Coverage 70/F | Level Benefit | Guaranteed Issue | Overpaying % |

|---|---|---|---|

| $40,000 | $203.35 | $399.58 | 96.4% |

| $35,000 | $178.33 | $350.00 | 96.2% |

| $30,000 | $153.31 | $300.42 | 95.9% |

| $25,000 | $128.29 | $187.46 | 46.1% |

| $20,000 | $103.28 | $150.15 | 45.3% |

| $15,000 | $78.26 | $110.78 | 41.5% |

| $10,000 | $53.24 | $74.52 | 39.9% |

| $5,000 | $28.22 | $38.22 | 35.4% |

The Truth About Funeral Expense Insurance

Above all, the types of burial insurance policies that you are exposed to you want to make sure you are dealing with the best final expense companies.

In fact, it’s not about affordable burial insurance policies and getting the best burial insurance, but making sure you are with a top burial insurance carrier.

Furthermore, it is not difficult to find affordable burial insurance. Let’s face it, you get this type of insurance to protect family members but to also take care of burial expenses.

For instance, premium payments will determine if you have any health issues. Overall, you will need to answer health questions to determine what is the best life insurance plans.

Again, dealing with an experienced independent agent, you will find the best funeral insurance quote because the agent will know the underwriting niches for any health profile.

Remember, life insurance companies all look at you differently and it can impact what you pay if you are with the wrong one.

The good thing is you won’t have to go through with a medical exam as these are simplified whole life policies.

Unlike gimmicks like whole life insurance companies Colonial Penn, we only offer the best funeral insurance plans with carriers that guarantees that your death benefit will NEVER go down and premiums will never go up.

Immediate to Short-Wait Burial Insurance: Your Solution Even with Health Concerns

Now that you know how to get the best burial insurance quotes, it is now as easy as ever. You can get burial insurance and apply online and be covered anywhere from immediately to a few days.

Unlike traditional life insurance that companies offer, these will give you peace of mind when you need it the most.

Even if you have severe health issues we can always get our clients a guaranteed issue or guaranteed acceptance policy.

These in some cases allow payments by credit card. Most have a 2-3 waiting period until the death benefit pays out. So once you find out what the funeral is costing, make arrangements with the funeral home.

Is Burial Insurance Worth It? What are the Pros and Cons?

Well, that depends. If you are like most consumers then you probably do not have $5000-$15000 set aside for burial or funeral expenses. Unfortunately, free burial insurance policies do not exist!

If you don’t have this type of money set aside then you do need waiting period burial insurance. Otherwise, your loved ones will be stuck with the bill, and to be honest, it should not be their responsibility.

The good thing is there are many types of burial insurance companies. So if you are asking yourself how to pay for a funeral with life insurance you have a lot of options.

We have over 3 dozen carriers that we work with, the most important thing is to figure out your rates classification to determine the best fit for you.

Low-Cost Burial Insurance And How To Apply For Coverage

When looking for low-cost burial insurance rates or cheap funeral plans it is important to shop and get the best burial insurance quotes.

In fact, talking to a life insurance specialist like Danny Ray that is independent will assure you a low burial insurance cost and get the cheapest funeral possible.

In addition, the cheapest burial policy is not always the best option. Furthermore, finding the best product with the best options may be the best burial insurance for seniors.

For instance, ask an independent agent about the possible hidden benefits that are available if any.

Again, affordable funeral policies with hidden features like a waiver of premium or nursing home confinement rider may be worth the few extra bucks.

We have low-cost burial insurance with the features above. Be sure to ask your PinnacleQuote agent.

What Is Burial Insurance And What You Need To Know

Burial insurance is the best way to protect your loved ones from financial burdens when they die. It is otherwise known as funeral insurance with no waiting period.

After you pass away, the death benefit is paid to your beneficiary. This helps them pay the funeral costs.

When looking at which final expense company is best to fit your needs, you will want to contact your independent agent for guidance. When seeking affordable burial insurance, this is the best way to go.

We will shop you to multiple burial expense insurance companies in one phone call. This saves you much time and frustration.

In fact, it’s the best way to achieve an affordable funeral policy.

What is the difference between life and burial insurance policies?

The answer is, NOTHING! Burial insurance is life insurance!

Low-Cost Final Expense Insurance

If you are looking for affordable burial insurance for seniors you came to the right place. We specialize in cheap final expense coverage regardless of health impairments.

Is cheap final expense insurance possible to achieve? YES!

We work with the top dozen A+ rated carriers that offer same-day coverage. Unlike State Farm Funeral Insurance that is 50% higher in price, we will place in the best possible product with the lowest price.

We also have carriers that will offer funeral insurance for those under 50 years of age which is a cheap funeral cover option.

Again, call up or fill out the quote box on the right to be in touch with a burial expert to assist in finding cheap final expense coverage.

Funeral And Burial Insurance Policies, Whats The Difference

Of course, you’ll need to choose between a burial or cremation, as insurance for funeral and burial costs vary significantly. We will go over this more in this article.

Or your PinnacleQuote agent will guide you through the process of finding the best Burial Insurance policy that is best for you.

Above all, it is very important to achieve the best type of life insurance policy coverage for a proper funeral service! So you will need an independent agent to find the low-cost funeral insurance you deserve.

If you want the best funeral insurance, even if you have a health problem, be careful of the following.

The three life insurance companies to stay away from when it comes to burial coverage is State Farm burial or State Farm funeral insurance, Lincoln Heritage Life Insurance company, and funeral coverage with AARP life insurance.

With Lincoln Heritage will add on membership from the Funeral Consumer Guardian Society, but it is not FREE as they claim!

In fact, seniors will be shocked to find out that one is usually 30% higher and the other is not guaranteed for life.

So it is very important to find the right type of policy with the right carrier when securing a burial plan!

Funeral Coverage With No Waiting Period

Above all, a funeral benefit program assists seniors in making sure they have the proper protection to not leave a financial burden on their loved ones.

Furthermore, it’s important to know that ALL burial insurance programs are no waiting period. In addition, funeral insurance with no waiting period is the same.

However, depending on the convenience of having severe health issues, there may be a waiting period of two years if you purchase a guaranteed issue whole life policy.

Regardless, whether it’s AARP burial insurance senior coverage (We don’t recommend it) or one of our top burial policy, it is important to know there is no waiting period coverage.

In addition, having an affordable budget funeral cover will prevent you from lapsing the policy. These policies also build cash value after two years, and most carriers will offer this up to age 85 years old.

In some cases, we have people over 85. We have products that will give seniors coverage up to age 89 but not 90 years of age.

Funeral Insurance For Under 50

If you are in search of burial insurance with no waiting period for those under 50 you will have limited options.

In most cases, burial insurance is for the ages of 50-85.

However, there are a few products that we offer to our clients as early as 18 years of age. Below are the rates we have available as an example.

| Age | Amount | Monthly Rate | Annual Rate |

|---|---|---|---|

| 18 | $25,000 | $27.80 | $300.50 |

| 25 | $25,000 | $33.69 | $364.25 |

| 30 | $25,000 | $35.06 | $379.00 |

| 35 | $25,000 | $40.82 | $441.25 |

| 40 | $25,000 | $47.94 | $518.25 |

| 45 | $25,000 | $57.74 | $624.25 |

As always, its always best to get burial insurance early and often.

How To Get An Affordable Funeral Policy

What is the best cheap final expense policy?

When you get to a social security age and all your kids are grown there are usually two things to protect. Your spouse, and your family of having a financial burden upon your death.

Let’s face it when you are in your mid-sixties health issues are very possible to arise. You want to make sure you have a final expense life insurance policy to cover the cost of your funeral.

Overall, this will provide peace of mind knowing a family member will not have the financial burden of paying the funeral home.

When purchasing burial life insurance for seniors you want to make sure the amount of coverage will not only provide for burial but perhaps medical bills as well.

Above all, you want to deal with a well-known burial insurance company.

In fact, you are going to want the type of insurance the company offers to be what you are looking for.

There are a few types of life insurance that will not require a medical exam.

Of course the healthy you are the more you will save money. Here are the three types of life insurance coverage you will receive when looking for a burial policy.

These will all have a premium payment that is different. However, the good thing to know is even if you have a severe health issue there are policies that offer guaranteed coverage.

Our go-to carriers for this are:

- CICA Life

- Guarantee Trust Life

- Royal Arcanum Graded

- Gerber

- Wellabe Great Western

Keep in mind, these policies normally have a 2-year waiting period where if you die of an illness the premiums are refunded plus 10% so at least you get back more than you paid.

What Are Burial Insurance Prices For Seniors In Your 50’s

It’s important to know what are the best rates available to you.

For instance, when you are shopping for the best rates you may have multiple burial insurance agents pulling you in different directions.

It is important to figure out who the makers are and who the fakers are.

Below are the rates for level, graded, and guaranteed issue for both males and females, ages 50-89.

Burial Insurance Rates for age 50-59

Here are the rates for ages 50-59 for both males and females.

Female

| Gender/Age | $5,000 | $10,000 | $25,000 |

|---|---|---|---|

| F/50 | $14.07 | $24.03 | $55.09 |

| F/51 | $14.05 | $25.01 | $57.02 |

| F/52 | $15.08 | $26.04 | $59.07 |

| F/53 | $15.09 | $26.06 | $60.05 |

| F/54 | $15.04 | $27.07 | $62.03 |

| F/55 | $15.06 | $28.08 | $64.01 |

| F/56 | $16.02 | $29.05 | $66.00 |

| F/57 | $17.03 | $30.06 | $69.04 |

| F/58 | $17.07 | $31.08 | $71.06 |

| F/59 | $17.05 | $32.09 | $74.08 |

Male

| Gender/Age | $5,000 | $10,000 | $25,000 |

|---|---|---|---|

| M/50 | $16.05 | $31.10 | $71.25 |

| M/51 | $17.06 | $31.12 | $74.30 |

| M/52 | $18.07 | $32.14 | $75.35 |

| M/53 | $18.08 | $33.16 | $77.40 |

| M/54 | $19.09 | $34.18 | $81.45 |

| M/55 | $20.10 | $36.20 | $84.50 |

| M/56 | $20.11 | $37.22 | $88.55 |

| M/57 | $21.12 | $39.24 | $92.60 |

| M/58 | $22.13 | $40.26 | $96.65 |

| M/59 | $23.14 | $42.28 | $99.70 |

Cheap Burial Insurance In Your 60’s

Overall, you can still get cheap but good burial insurance at 60 years and over. However, you do not want to kick the can down the road.

For instance, age and health are the biggest factors when determining the price you pay. Getting an online quote for cheap burial life insurance is done sooner rather than later.

Above all, when you get to age 60 you are coming to the age where low-cost final expense coverage becomes scarce. Below is the cost for final expense life insurance aged 60-69.

Burial Insurance Rates for age 60-69

Here are the rates for age 60-69 for both males and females.

Female

| Gender/Age | $5,000 | $10,000 | $20,000 |

|---|---|---|---|

| F/60 | $18.25 | $32.64 | $62.25 |

| F/61 | $18.87 | $34.48 | $65.75 |

| F/62 | $19.36 | $36.45 | $68.65 |

| F/63 | $20.25 | $37.47 | $72.36 |

| F/64 | $21.23 | $39.68 | $74.43 |

| F/65 | $22.42 | $41.67 | $78.85 |

| F/66 | $23.34 | $43.52 | $83.12 |

| F/67 | $24.17 | $45.61 | $88.95 |

| F/68 | $25.85 | $48.42 | $93.62 |

| F/69 | $27.52 | $50.74 | $98.63 |

Male

| Gender/Age | $5,000 | $10,000 | $20,000 |

|---|---|---|---|

| M/60 | $23.47 | $43.52 | $83.68 |

| M/61 | $24.23 | $46.89 | $89.76 |

| M/62 | $26.58 | $49.14 | $94.37 |

| M/63 | $27.49 | $51.62 | $99.83 |

| M/64 | $28.36 | $53.75 | $103.92 |

| M/65 | $28.94 | $53.87 | $104.46 |

| M/66 | $30.12 | $57.33 | $110.79 |

| M/67 | $31.67 | $60.21 | $116.43 |

| M/68 | $33.85 | $63.79 | $123.58 |

| M/69 | $35.74 | $66.97 | $129.89 |

Affordable Burial Insurance In Your 70’s

Here you are, in your 70’s. At this time you should be well into retirement, playing with grandkids, and possibly swinging the golf club occasionally.

However, you may be still working, maybe a part-time job to keep you busy. Overall, you are probably thinking about end-of-life costs especially as you see some at your age passing.

Or, you have seen some people close to you have to struggle in an effort to fulfill loved ones dying wishes.

If you are thinking about making sure your loved ones don’t have a financial burden, then NOW IS THE TIME TO ACT.

Here are the rates for burial insurance in your 70’s.

Burial Insurance Rates for age 70-79

Below will be the best rates available for ages 70-79.

Female

| Gender/Age | $10,000 | $20,000 |

|---|---|---|

| F/70 | $53.47 | $102.95 |

| F/71 | $56.32 | $109.78 |

| F/72 | $58.21 | $114.89 |

| F/73 | $86.76 | $124.63 |

| F/74 | $68.59 | $132.47 |

| F/75 | $72.88 | $142.76 |

| F/76 | $78.45 | $153.92 |

| F/77 | $84.67 | $164.34 |

| F/78 | $88.53 | $174.06 |

| F/79 | $93.49 | $184.98 |

Male

| Gender/Age | $10,000 | $20,000 |

|---|---|---|

| M/70 | $70.24 | $136.48 |

| M/71 | $75.67 | $147.34 |

| M/72 | $81.29 | $158.58 |

| M/73 | $86.75 | $169.50 |

| M/74 | $92.84 | $180.68 |

| M/75 | $97.22 | $191.44 |

| M/76 | $107.93 | $209.86 |

| M/77 | $113.56 | $222.12 |

| M/78 | $119.77 | $235.54 |

| M/79 | $126.89 | $249.78 |

What Are The Rates For Burial Insurance In Your 80’s

Above all, if you are looking for burial insurance in your 80’s rates will be based off of your health and age. At thsi age you are well past statistic mortality of age 76.5 for men, and 80.5 for women.

Furthermore, it is highly advised to purchase burial insurance as sooner rather than later as health issues increase at this age.

Burial Insurance Rates for age 80-89

Below will be the best rates available for ages 80-89.

Female

| Gender/Age | $10,000 | $15,000 | $25,000 |

|---|---|---|---|

| F/81 | $106.56 | $158.84 | $261.77 |

| F/82 | $114.22 | $169.33 | $280.95 |

| F/83 | $121.68 | $180.52 | $298.04 |

| F/84 | $129.47 | $191.21 | $317.63 |

| F/85 | $136.79 | $202.18 | $335.90 |

| F/86 | $171.85 | $255.78 | $423.67 |

| F/87 | $206.39 | $307.58 | $510.97 |

| F/88 | $239.14 | $356.71 | $596.85 |

| F/89 | $260.53 | $388.79 | $683.22 |

Male

| Gender/Age | $10,000 | $15,000 | $25,000 |

|---|---|---|---|

| M/80 | $135.94 | $201.89 | $332.57 |

| M/81 | $143.57 | $213.86 | $353.92 |

| M/82 | $153.23 | $227.85 | $376.49 |

| M/83 | $162.88 | $242.32 | $400.76 |

| M/84 | $171.47 | $255.91 | $423.83 |

| M/85 | $178.52 | $266.78 | $440.65 |

| M/86 | $236.93 | $353.39 | $585.07 |

| M/87 | $277.68 | $413.52 | $686.24 |

| M/88 | $317.34 | $474.51 | $788.67 |

| M/89 | $357.89 | $534.27 | $888.95 |

Senior Burial Insurance Program [Be Aware]

First, State farm is fantastic for auto and home, I have them myself. But my state farm agent tried adding a policy in a bundle not knowing that I am a life insurance agent.

First off, it’s a sales gimmick, you can’t bundle life insurance as it is “ONLY” an add-on product. Second, it is usually 25-40% more expensive than the best rates.

With burial insurance with AARP, they claim it’s for your entire life. But, burial insurance AARP is not.

In theory that is correct, but there will be age/years that it will go up! So yes, it is for your entire life, if you can pay for it.

However, when you are over 70 and on a fixed income, most times a price hike of a few hundred bucks may take the bread out of the cupboard. In addition, you need to be an AARP member for the discount.

In fact, AARP is New York Life burial insurance, it is NOT EVEN AN INSURANCE COMPANY.

The Truth About Lincoln Heritage Burial Insurance

Lastly, Lincoln Heritage and their late-night TV commercials boast how they will take care of everything for your funeral, especially for the elderly over 80. In fact, it’s a total scam. Lincoln Heritage Funeral advantage program assists seniors scam, as I call it.

They promise how when you die that they will take care of all your funeral arrangements by shopping you to local funeral homes and talking to a funeral director. That is all theatrics!!

In reality, you will be paying a 30% premium compared to the best rates. Far from affordable funeral policies!.

BEWARE, stay away from these 3 carrier if you are looking for a life insurance burial policy!

Cheap Final Expense Burial Insurance 50% off

It is possible to find affordable burial insurance policies for senior citizens. Amounts of insurance coverage are usually between $2,000 – $40,000.

Most carriers offer this product up to $25,000, so there’s no reason to leave these expenses for your family to pay.

Even with a lifestyle issue like DUI or a health impairment like diabetes, you can have no challenges getting a guaranteed acceptance or guaranteed issue policy.

A guaranteed issue life insurance no medical exam no health questions is a life insurance program that will not look at your medical history.

However, there is a graded period of 2 years. This is the waiting period that the insured must wait to receive the full death benefit due to illness.

After the 2 years are completed, the policy pays out in full. Keep in mind, these are permanent life insurance policies. The carriers we prefer that offer guaranteed acceptance life insurance is AIG, UHL & Gerber.

Above all, our go-to carrier and product are Mutual of OMAHA and the name of the product is the living promise.

In most cases, you will see up to a 50% discount in premiums versus State Farms burial coverage, Lincoln Heritage, and funeral coverage with AARP.

MOO’s Living Promise is a far superior product as well!

The living promise is the best type of policy for affordable burial insurance, PERIOD!!! They are among the cheapest burial policies.

What Is The Best Affordable Burial Insurance For Seniors

You have been shopping around for a while now, you may be overwhelmed and you are at the point of frustration and you are asking the burning question, what is the cheapest burial insurance?

Sometimes the cheapest isn’t always the best. It is always good to get carrier comparisons from your agent. Each carrier has a certain niche.

If you have been reading I am sure you have come to the conclusion of who we prefer the best burial insurance for over 70.

However, life insurance is not a one-size-fits-all and sometimes requires a special product for a special situation. That special type of coverage maybe is for just burial and final expense.

Here are the top 5 Burial Insurance Companies that we will bring to our clients. They present the best value funeral insurance available.

These are among the best funeral insurance companies. United of Omaha burial insurance is our #1.

They also offer funeral insurance for those under 50 and start out at age 45.

We are going to use a $25,000 healthy male that is 60 years old.

| Carrier | Amount | Product | Monthly | Annual |

|---|---|---|---|---|

| Mutual Of Omaha | $25,000 | Living Promise | $102.08 | $1147.00 |

- 100% Day One Death Benefit (If you qualify)

- Face Amounts $2,000-$40,000

- Issue ages 45-85

- Underwriting: MIB, Script Check, Random PHI

| Carrier | Amount | Product | Monthly | Annual |

|---|---|---|---|---|

| Royal Neighbors Of America | $25,000 | SIWL | $121.37 | $1395.00 |

- 100% Day One Death Benefit (If you qualify)

- Face Amounts $5,000-$25,000

- Issue Ages 50-85

- Voice Signature, No Paperwork, Active in under 30 minutes

- Discount Membership Program (Average annual savings, $437.00)

| Carrier | Amount | Product | Monthly | Annual |

|---|---|---|---|---|

| Liberty Bankers Life | $25,000 | SIMPL Final Expense | $107.55 | $1162.75 |

- 100% Day One Death Benefit (If you qualify) Pref/STD

- Face Amounts $3,000-$30,000

- Issue Ages 18-80

- Voice Signature, No Paperwork, Active in under 30 minutes

| Carrier | Amount | Product | Monthly | Annual |

|---|---|---|---|---|

| United Home Life | $25,000 | Express Issue Premier | $105.20 | $1209.25 |

- 100% Day One Death Benefit (If you qualify)

- Face Amounts up to $100,000

- Simple Phone Interview

- Cash Value Growth

| Carrier | Amount | Product | Monthly | Annual |

|---|---|---|---|---|

| Prosperity Life | $25,000 | New Vista | $109.04 | $1211.50 |

- 100% Day One Death Benefit (If you qualify)

- Face Amounts $1,500-$35,000

- Issue ages 50-80

- Underwriting: Health questions, MIB, and a prescription drug check

***Mutual of Omaha, Royal Neighbors of America has Living Benefits Attached to the policy. That’s the coverage you don’t have to die to have access to.

Low-Cost Final Expense Coverage

Is Burial Insurance A Good Idea?

Purchasing affordable burial insurance works primarily the same as any other final expense life insurance policy.

In fact, it’s specifically designed to cover any final expenses such as funeral or cremation service, or debt such as credit cards and medical bills.

For many insurance companies, you must be at least 50 years of age to be eligible for funeral insurance.

However, Mutual of Omaha burial insurance will offer it from ages 45-85 with face amounts of $2,000-$40,000. Our final expense review on this carrier is A+.

Burial insurance is Usually a fixed premium rate. Primarily, you won’t have to pay more as you get older.

Furthermore, life insurance rates vary for all ages when it comes to burial insurance.

The younger you are the cheaper it is. Above all, it’s important to shop to find out what companies offer so call us and allow us to do that for you!

What Is Covered By Burial Insurance

It is one thing to get prices for cheap funeral insurance, but I am sure you are asking, What is covered?

It’s important to realize what a burial policy covers so there isn’t any confusion for your family when that dreadful day comes. It is generally for covering the cost of a funeral and/or cremation services.

Both of these funeral insurance costs are very different.

Now if you’re OK with having your family member cremated and their remains handed to you in a bag and zip-lock, then you can find these as low as $1,000.

The average cost of burial insurance varies. But a small service, urn, and a proper farewell can be as much as $3,000-$5,000.

For a funeral, the average cost is around $10,000-$12,000, and as much as $25,000.

Above all, it’s important to know the proper amount of coverage that your loved ones will need in the event of your death. This is a very important conversation to have.

Funeral Cover With No Waiting

How does burial insurance work

Pre-Need or Pre-Paid?

Although there are many types of insurance, there are two kinds of plans to choose from Pre-Need Funeral Insurance or Pre-Paid Funeral Insurance.

Pre-Need coverage plans are purchased straight from the undertaking establishment.

With this type, you’re committed to a specific funeral home. Pre-Paid Funeral coverage will leave your funeral home up to your loved ones.

This is all-important when discussing funeral insurance for parents or burial life insurance for seniors over 60.

What Are The Pros To Getting Burial Insurance

Above all, burial insurance with no waiting period is great. Most obviously, a final expense policy will pay for any final expenses.

However, there are some other benefits to burial insurance.

It’s always better to know what are my options for life insurance. We’ll list a couple of these below:

- Final expense policies usually have lower premiums than traditional life insurance plans, primarily a no medical exam life insurance company.

- Burial insurance is usually a very quick and easy process. Acceptance is generally pretty lenient, and you won’t need to take a medical exam.

- Those in poor health won’t be denied burial insurance like they might for a traditional life insurance plan. This is usually senior life insurance with no waiting period.

Who Needs Burial Insurance And Who Is The Right Fit

Also, they have been denied or declined life insurance, or can no longer afford life insurance. It’s important to calculate how much your final expenses will cost before buying.

Consider the cost of your burial plot, transportation, casket/cremation, etc.

Keep in mind, even if you have unmanaged blood pressure and or high cholesterol, you will still be able to get a burial policy.

Also, even if you are looking for life insurance with multiple sclerosis you will be able to get a burial policy and/or a guaranteed issue policy. Even life insurance for seniors over 75 can get a burial policy.

We recently took on AETNA’s final expense which provides burial insurance for over 85.

I hate to sound like a broken record, but MOO is by far the best burial insurance and/or final expense policy in the industry.

The underwriting is fast, prices are among the top rates in the industry.

In fact, it comes with riders like accelerated death benefit, terminal illness, and nursing home confinement rider. Look above for more details.

They are our go-to carrier for burial insurance for seniors over 80.

How To Buy Burial Insurance for Parents

Can you buy funeral insurance for someone else?

We are or all will be there one day. Looking for senior burial insurance for parents is very common. Our parents get older and maybe they aren’t able to take care of their own burial.

In fact, when this happens it can be a major financial blow on a family. Usually, when our parents are near mortality we are starting out with a family or have middle-aged kids.

All things considered, the unexpected death of a parent and not properly prepared can be a huge financial blow. So it is very important to look at quality funeral insurance plans.

You see it all the time, “Go Fund Me” pages or going into debt that will take years to pay off. So for your parents, usually a final expense life insurance policy will work best.

Furthermore, burial insurance for parents is very important.

With that said, none of us have an account “earmarked” someone else’s funeral. However, there is an answer.

Age, Health, and Timing: The Triple Threat of Delaying Burial Insurance for Your Loved Ones

The most important thing in determining whether or not you can acquire a burial policy for your parents is an insurable interest.

In simple terms, insurable interest means you as the family member will accrue a financial loss or go into debt in the event of your parent passing away.

Above all, you don’t want to put off or kick the can down the road when considering getting life insurance for your parents.

Once they get to retirement age they are prone to health issues as their bodies break down naturally.

As these breakdowns happen, it will affect the price as so will getting older. Ultimately putting it off will cost you thousands of dollars more.

Also, an unexpected death will cause you to come up with $10,000 or more. Or even worse, giving your loved one a funeral that wasn’t in their wishes.

For example, wanting a funeral but you only afford a cremation.

Not giving your parents the proper funeral of their wishes because of not being prepared will surely bother most for years to come.

How Much Does Burial Insurance Cost

Most family members haven’t the slightest clue what rates will be when considering getting a burial policy for a parent. But what we do know and want to help you achieve is getting you the BEST cheap funeral insurance possible!

Burial Insurance Quotes or funeral insurance quotes vary from carrier to carrier.

The biggest mistake consumers make causing them to overpay is going to the agent that sold them their homeowners and/or auto insurance.

These agents are usually captive and offer proprietary products. They also mostly sell you the gimmick of “bundling”. Life insurance can’t be bundled to save money but is only an add-on product.

So Beware of these sales gimmicks because you will pay over 35% more.

Fast Quote Burial Insurance

When you considered pre-retirement or during retirement, this is the best time to take care of a burial policy. At this age usually, your health has minimal health impairments and a level of benefit will be very possible.

This is the best time to shop for a burial policy for seniors to get the lowest rate possible.

Burial Life Insurance for Elderly Parents

Let’s face it when you are middle-aged and have senior parents, it’s very common to wonder about burial insurance for elderly parents.

For instance, when they do pass, did they have this taken care of? This can be very stressful for a family that has to come up with thousands of dollars on a couple of days’ notice.

Above all, no one has $10,000 earmarked for someone else funeral sitting in a bank account. Below we will give you examples of the cost of a burial.

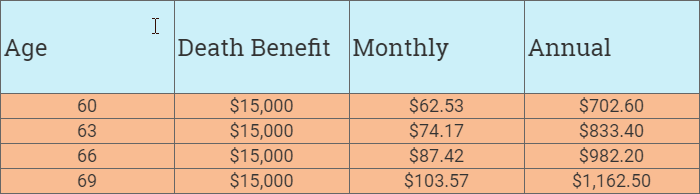

Best rates for burial insurance for parents over 60.

After the social security age of 65, year by year as you see above prices drastically start to increase. For instance, once you are in your 70’s mortality age for both men (77) and women (81) are within a decade.

These rates really start to change year by year.

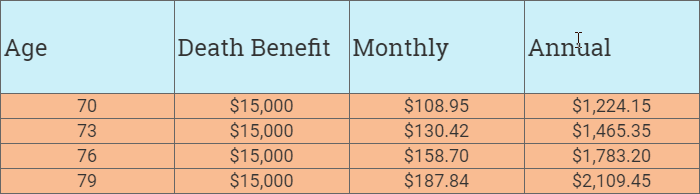

Here are the best rates for burial insurance for parents over 70.

If you are looking for a funeral policy for over 80 years old, about 95% of the carriers will not take the risk of covering you.

Once over 85, coverage is very limited as only 10,000 death benefit is available.

However, we can get you coverage up to age 90. Ask your local agent if you can pull that off. That’s what separates us and makes us the BEST!!

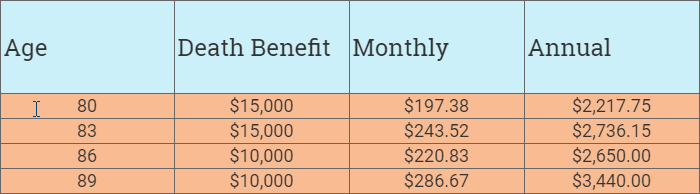

Here are the best rates for burial insurance for parents over 80.

Ok, so now you are above 80 years old and approaching 85. The mortality age for men is 77, for women about 81. Once you get over 80 the options start to get limited.

Burial Insurance For Parents over 85

If you are searching for burial insurance over 85 you will be told by many agents that they can’t help you. Overall, you are just talking to the wrong agent!

Once you are over the age of 85 if you want burial insurance there are only a few options available. In addition, the coverage amount is limited to a maximum of $10,000 as stated above.

Outside of burial insurance, if a larger face amount is needed we have GUL products available for ages over 85.

Should I Get Funeral Insurance Policy or Life Insurance Policy

If you are in good health and believe you’ll live for several more years, a traditional policy is an ideal choice. In fact, term life insurance policies may be an option.

However, if you’re in poor health, and you don’t have enough money for life insurance, the final expense coverage is appropriate.

Again, our agents will help guide you through the entire process from start to finish, they will make finding a cheap burial insurance policy or final expense policy so simplistic.

Another avenue, and if you are over 50, getting a 20-year term life policy would bring you right to mortality age, male(77), Female(81).

What Kinds Of Burial Insurance Plans Are Out There

You’ll have to look around for the best burial insurance. When you call PinnacleQuote, our agents shop for you with the top carriers out there, so you don’t have to.

Each company has unique offers for burial insurance. Life insurance for seniors is an ever-expanding market. That’s why it’s important to compare several carriers before settling on one for your final expense coverage.

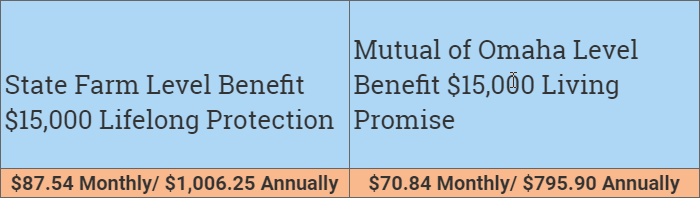

State Farm Burial Insurance VS Mutual Of Omaha

See below the price comparison between State Farm and MOO.

Most of our clients are on a fixed income. Affordability is very important to us as we know it is important to you.

As you can see from the example above the Living Promise Plan, is a low-cost burial insurance choice. $210.35 per year savings to be exact.

That is $$ back in your pocket where it belongs!!!

SOCIAL SECURITY OR DISABILITY AUTO DRAFTS

If you qualify for one of the burial insurance plans, that you will be able to set your payment draft day depending on which day of the month you receive your benefits.

Whether that is the 1st, 3rd, or the 2nd/3rd or 4th Wednesday of the month.

Burial Insurance Companies

Of course MOO is one of our favorite for burial insurance. They offer a Living Promise. A level benefit plan for ages 45-85. Also, a Graded benefit plan for ages 45-80 (NY 50- 75).

Here a just a few of our other fave companies:

- Royal Neighbors of America

- Liberty Bankers Life

- Phoenix

- Sentinel Security Life

All great companies. As you know the average funeral cost in each state varies a bit. Here in Florida, the average burial cost is about $9,000.

Knowing that you have provided one of these fine choices to your family in the event of your death, gives you and your family peace of mind. Doesn’t it?

Guaranteed Acceptance Burial Insurance Companies

Here are some burial policies for seniors that may have been declined in the past. These carriers will approve you right on the spot. These are guaranteed issue whole life insurance policies.

Although a graded period will be in effect, accidental death coverage is immediate at issue! Premium payments are level and the death benefit is guaranteed!

These policies are available for any health impairment with no questions asked, and no waiting period!! When you need to have a cheap funeral covered, this may be your only option.

How Can I Get Cheap Burial Insurance Or Final Expense Quote

When looking to purchase low-cost burial, you’ll want to receive several quotes from the top final expense companies out there.

MOO is an example of a life insurance company that is both reliable and affordable. Quotes are easy to get — you can receive quotes on premiums without needing to purchase their policy.

Important to know, when you apply for final expense coverage, you will not need to take a physcial.

In fact, this makes the process much more manageable.

However, you will need to fill out a brief questionnaire that will ask you some personal questions, such as your age, job, whether or not you use tobacco, etc.

Smoking cigars will not affect burial insurance.

What About No Medical Exam Life Insurance

Many look to final expense coverage because they are having trouble finding life insurance protection, due to age or severe health conditions, such as diabetes or any other high-risk health impairment.

However, they can still be covered by life insurance. They just need to check out no medical exam life insurance for seniors.

Above all, this will provide much more coverage for your family than final expense coverage will.

However, it will be more expensive, of course. No medical exam premiums can be absurdly high.

Also, some special risk coverage will not be covered by the traditional term life, so a burial policy is the only alternative.

Can A Funeral Home Be A Life Insurance Beneficiary

Yes. If you purchase burial life insurance, and you intend to use the policy strictly to pay for your funeral expenses, then you can make the funeral home the beneficiary.

Who Can Help Me Get Affordable Final Expense Insurance

Here at PinnacleQuote, we will know which carrier to connect you with, and which life insurance companies to avoid for a final expense policy.

Our agents can help you find the very best cheap burial coverage and final expense policies at the lowest rates, from the top 10 final expense carriers on the market.

Working with us will likely save you a lot of time and money.

Although, if you’re looking for life insurance in your 30’s, burial policies have age restrictions. However, looking for life insurance over 50, burial policies are available.

In fact, some of our burial carriers offer voice signatures with same-day approval.

Actually, PinnacleQuote is a licensed national independent life insurance agent in all 50 states. Based in Jacksonville, Florida. As a matter of fact, we are in Duval County. The home of the Jacksonville, Jaguars football team!!!

We have relationships with dozens of carriers.

These carriers specialize in all aspects of life insurance not limited to burial policies but also, universal life, whole life, and term life policies.

In any event, if you’re looking for a simple process, then let PinnacleQuote not only hold you by the hand but guide you through the entire process from start to finish!

FAQs

1. What exactly is burial insurance?

Burial insurance, simply put, is a type of insurance that covers the costs related to funerals and burials. It ensures that when someone passes away, their loved ones won’t have the extra worry of handling big funeral bills. Think of it like setting aside money for a rainy day, only this is for a very specific kind of event.

2. Why is it important to have burial insurance?

Having burial insurance is like having an umbrella on a rainy day. It offers protection. It means that during a tough time, like the loss of a loved one, the family can focus on healing rather than stressing over funeral expenses. It’s a caring way to have things in order for the future.

3. How can seniors find burial insurance on a budget in 2024?

Great question! For seniors looking to find burial insurance on a tight budget in 2024, it’s essential to compare various policies and companies. There are many options available tailored specifically for seniors. Additionally, consider policies with smaller coverage amounts, as they often have lower premiums. Remember, every penny counts, and just like looking for a sale in your favorite store, it’s all about finding the right deal that fits your needs.

4. Are there any age restrictions for getting burial insurance?

Most of the time, burial insurance is geared towards older individuals, but there isn’t a strict age limit. Many companies offer policies for folks from their 50s and up. However, the older you are, the rates might differ. It’s like when you’re trying to buy a movie ticket – kids, adults, and seniors all have different prices.

5. Is burial insurance different from life insurance?

Yes, they’re a bit like apples and oranges. While both provide financial peace of mind after someone’s passing, life insurance often offers a larger payout that can cover more than just funeral expenses. On the other hand, burial insurance specifically focuses on covering funeral and related costs. So, while both fruits are sweet, they serve different needs.

6. Can the burial insurance policy prices change over time?

While some policies have fixed premiums that don’t change, others might. It’s crucial to understand the terms when picking a policy. Think of it like locking in a price for a vacation; sometimes it stays the same, and other times it can go up.

7. How do I know how much coverage I need?

The best approach is to estimate future funeral costs and any other final expenses you’d want covered. Consulting with a funeral home or an insurance expert can also help provide clarity. It’s a bit like planning a trip: you need to know how much you’ll spend on food, lodging, and activities to budget correctly.

Related Articles

Conclusion

When it comes to buying a burial policy, you want one that’s affordable yet still offers the coverage and benefits your family needs.

Let us help you find an inexpensive funeral insurance plan with no waiting period so you can be sure your loved ones are taken care of when the time comes.

We offer quotes from multiple providers in minutes so all you have to do is answer some questions about yourself and submit a form for approval. Get started today by getting a quote now!