The Truth About Prepaid Funeral Plans [Must Read] 2024

If you want to know the truth about the prepaid funeral plans, this article is for you.

We’ve all heard the horror stories of people who have been taken advantage of when it comes to paying for funerals. It’s a sad reality, but one that is unfortunately true. But what if we told you there was a way around this problem? What if we gave you the opportunity to prepare in advance so that your loved ones don’t have to worry about these things when it really matters most? That’s exactly what prepaid funeral plans offer.

Article Navigation

Prepaid Burial Policies Are a Good Idea or Are They

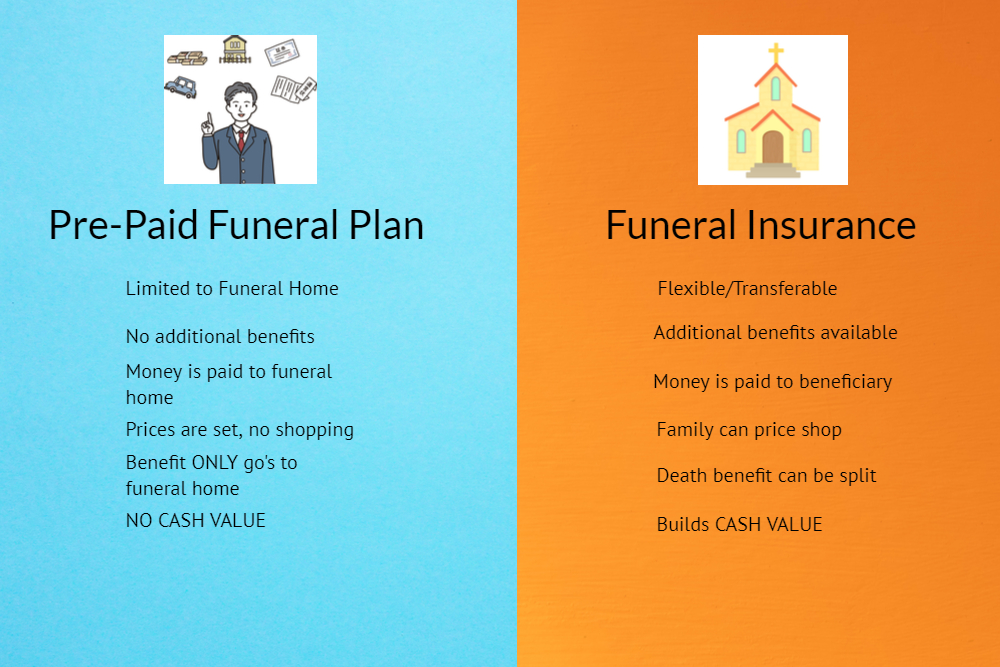

Overall, there are many disadvantages of prepaid funerals versus a fully owned final expense or burial policy. For instance, when you pre-pay a funeral plan you are paying for something in hopes that it will be available when you die.

In fact, the younger you do this the longer your family will find out if the funeral home fulfills their commitment. So it is important to know the pros and cons of prepaid funeral plans.

It is important to realize when you pre-pay for a funeral you don’t really own anything, you are leaving EVERYTHING up to the funeral director. That is to say, if they are around in 10, 20, 30+ years later.

Or worse, if funds are mismanaged, the funeral home declares bankruptcy or taking funds out of the escrowed bank account. The bottom line, there is too much to leave at the chance, especially for a “for-profit” business.

Consequently, your family may be left holding a funeral bill in the thousands at the worst possible times. Remember, you are not going to get a prepaid funeral refund.

More Reasons To NEVER Get a Prepaid Funeral Insurance Policy

In the event that you are deciding whether or not to get cheap monthly funeral plans remember that you get what you pay for. Think about the things you prepay in life, and why.

Purchasing a prepaid funeral care plan you can not ever replace it. What happens if you move to another state? You can’t take it with you!! In addition, some states don’t guarantee your prepaid funeral plan in case the funeral home becomes insolvent.

I remember back in 1999, the Loewn Group Inc filed for bankruptcy-court protection totaling $2.3billion. You would think how is this possible, I prepaid and it was held in escrow? Many, many families got hurt by this. Also, some states do not offer protection in these cases.

However, you do not have to worry about this with a Final Expense insurance policy as the state has a guaranty fund to protect consumers from this as well as you can take your policy anywhere you move to.

The Truth About Life Insurance Versus Prepaid Funeral Plans

Having life insurance is the ONLY way to make sure you have peace of mind knowing the death benefit will be paid. Furthermore, funeral costs are only going to rise and you do not want high-cost funeral expenses to fall into your loved one’s laps.

In the event that funeral costs continue to rise how is a prepaid funeral plan going to be sufficient decades from now? With inflation increasing 3.25% a year, your family will be taking care of much of the “EXTRA” costs.

In other words, today’s prices can easily double leaving your family holding the bag. A stand-alone final expense policy will payout by the insurance company when that day comes.

DON’T Do a Funeral Payment Plan Under 50 Years of Age

Overall, pre-paid funeral plans for under the 50s are setting you up for catastrophe. In this case, you are better off setting up a Totten trust.

In addition, you will pay a monthly payment for funeral plans for many many years. What happens if you die a week after you make your first payment?

Your Family Covers The Difference…….

With a final expense burial insurance policy, your family will have a payout immediately!! YES, even after ONE payment!

In addition, state laws protect your death benefit if a life insurance company becomes insolvent. On the other hand, a prepaid funeral plan will not if the funeral home goes out of business.

The other benefit of a final expense policy is that the insured/owner can make a beneficiary an irrevocable trust preventing any changes to be made without the consent of the insured’s beneficiary or beneficiaries.

Are Pre-paid Funeral Plans Worth It

In my opinion, NO! You have no control. You pay and then you rely on a business that is made for profit to pay, years, if not decades down the road.

Do yourself a favor, purchase a final expense burial insurance policy. You own it, you can cash it out if you change your mind years down the road. There are NO GUARANTEES with a prepaid plan other than the funeral home is guaranteed to get YOUR MONEY!!

So above all, go with a highly rated carrier with the best options. Most burial insurance plans come with hidden protections like critical, chronic, and terminal illness riders. You can have a death benefit that far exceeds that of a prepaid funeral plan.

You can get extra to pay off debts left behind or to leave a legacy to grandkids or loved ones. In fact, it should not even be a discussion, the cons tip the scales heavily in the favor of burial insurance versus a prepaid funeral plan.

To conclude, the best way to purchase a cost-effective burial insurance policy is NOW!! Do not put it off.

FAQs

Risks include the financial stability of the funeral home, potential hidden costs, and the possibility that the plan may not cover all future expenses due to inflation or changes in service prices.

In some cases, investing the money you would put into a prepaid plan into a savings or investment account could yield higher returns, providing more flexibility for future funeral expenses.

Prepaid plans can be quite rigid. Changes in your wishes or circumstances might not be easily accommodated without additional costs.

If you relocate, your prepaid plan might not transfer to a funeral home in your new location, potentially leading to financial loss or additional costs.

Yes, if the funeral home goes out of business, your prepaid plan might be at risk, and recovering your funds can be complicated.

Prepaid plans often have limited flexibility for changes made by family members after your passing, which could create complications or additional expenses.

Alternatives include life insurance policies, saving in a high-interest account, or investing in financial products that can offer greater flexibility and potentially higher returns.

Some plans may not be fully transparent, with fine print and clauses that can lead to unexpected costs or limitations.

Related Articles

Conclusion

Conclusion paragraph: In the end, it is your decision whether you want to pre-pay for a funeral plan or not. What’s important is that when making this choice, you are fully aware of all the disadvantages and benefits associated with both options. If you’re looking for some unbiased advice on what might be best for your family in the future, we can help! Just give us a call today at (855) 380-3300 and our team will be more than happy to answer any questions about final expense plans versus prepaid funerals.