Affordable Life Insurance For Diabetics In 2024

If you are looking for an affordable life insurance for Diabetics, you came to the right place.

Diabetes is a very serious condition that can have many negative health effects. If you are diabetic and considering life insurance, it may be difficult to find affordable rates because of your pre-existing condition.

There is good news though! In the past few years, there has been an increase in insurance carriers offering policies for diabetes patients with limited exclusions or waiting periods.

This means you would be eligible for coverage regardless of how long you’ve had diabetes and how well-controlled it is at this time. So don’t let diabetes stop your financial future from happening – get life insurance today!

Is a Diabetes Insurance Policy Possible?

Yes. Above all, it is very possible to acquire a life insurance policy with diabetes. I get questions all the time, “Can a diabetic take a term life insurance policy and get approved”, and again, yes!

Although there are many policies to choose from it will come down to a few very important things.

- your management, (A1C)

- age of diagnosis,

- if you are a smoker,

- if you are overweight

- and if you have had complications like neuropathy or retinopathy

Overall, the underwriting for diabetes life insurance will detail the above. This will determine which carrier and/or product would be best for your unique health profile.

Where Do I Go For The Best Life Insurance Quotes For Diabetics

Can I get life insurance if I have diabetes?

To find the best life insurance for diabetics you need to be talking to a seasoned professional. The local agent at State Farm or Progressive just does not have the tools to get the job done when it comes to high risk life insurance.

You need to talk to an independent agent that has the knowledge of the underwriting that is required for a successful result. This will determine the best life insurance for type 2 diabetes and type 1.

A PinnacleQuote Independent Agent will have the experience to place you with the best options available. It’s just what we do!

What Needs To Be Done To Get The Best Life Insurance Rates For Diabetics

Above all, you will need to know the underwriting difference between type 2 diabetes insurance coverage from type 1.

The difference and the benefits of fully underwritten versus no medical exam coverage. Knowing that for some a term life insurance policy for diabetics may be a decline and knowing what won’t!

In fact, knowing that having good health care and managing diabetes is the key to a successful and affordable life insurance policy.

Overall, pre-diabetes and life insurance are underwritten the same way as a fully diagnosed diabetic.

Can Diabetics Get Life Insurance

Many clients ask, Can you get life insurance with diabetes? How can I get Affordable Life Insurance Rates for Diabetics? What about diabetes life solutions?

A statement regarding the American Diabetes Association and life insurance is that 1.5million Americans are diagnosed every year. It can affect how and if you can get life insurance.

As a diabetic, you have so many questions to ask. It can be overwhelming. The importance of proper coverage for your family is an understatement.

Unfortunately for those with diabetes, it can be far more challenging to get a reasonable plan. Without it, your family is left with massive amounts of debt, with no financial assistance. Some may worry that they won’t be able to get coverage with diabetes. However, we’re here to tell you that you can.

Luckily, due to the massive amounts of Americans dealing with diabetes, many insurance companies have begun specializing in offering affordable life insurance for type 1 and type 2 diabetics.

Here at PinnacleQuote, we can help connect you with the best company. Below, we’ll go over how you can get affordable coverage for a diabetic. The good news is, overall health will help assist in getting the best rate available.

Furthermore, do not worry, we have a few life insurance carriers that specialize in coverage for diabetics. We offer the best chances to apply for life insurance and be successful!

Denied Life Insurance Because of Diabetes

Let’s face it, a diagnosis of diabetes will place you at a higher risk for life insurance coverage. In fact, term life insurance carriers look to see if your diabetes is controlled.

For instance, if you have type 1 or type 2 diabetes that is uncontrolled then a decline will happen.

With that said, it will come down to what agent you are doing business with. Above all, you need an independent life insurance agent that knows the underwriting guidelines of the life insurance companies that specialize in diabetes.

For example, Prudential life insurance for diabetes is one of the best carriers along with AIG life insurance for diabetes. They both are diabetic friendly.

Above all, applying for life insurance when diagnosed with diabetes the underwriters will want to know your medical history. In fact, they will want to see a history of your A1C levels.

If you have a history of an A1C above 10 then they may cause other health issues in the future like heart disease or kidney issues. So they will look at the long term effects of your diabetes by looking at your medical records.

Other risk factors that can cause higher life insurance quotes is the age of diagnosis. The earlier your diagnosed as far as age, the more high risk you are to develop complications. This is especially important to the underwriter if you are type 1 and insulin-dependent.

However, if you have a history of control and keep your weight down and your diabetes is well managed, then affordable life insurance is absolutely obtainable.

But it is imperative to speak to an independent agent like us here at PinnacleQuote. We will match you up with the right carrier that is based on your profile.

Mortgage Insurance for Diabetics

Can you get a mortgage with diabetes! Of course, it will be no problem obtaining mortgage protection life insurance. If you were to pass away due to complications of diabetes your mortgage would be paid off in a lump sum.

When you purchase a home then you probably have a sizable mortgage. What happens if you die? Especially when you are the primary breadwinner? What happens if you are a diabetic?

Above all, the right amount of life insurance coverage will protect your family from this burden.

First, you need to know which life insurance carriers specialize in diabetics. Second, understanding what life insurance underwriters look for is equally important. In addition, controlling your diabetes will be the best way to get affordable mortgage life insurance for diabetics.

The death benefit will be determined by the mortgage size. The most common policy for this is a term life insurance or a decreasing term life insurance policy. These will help lock in affordable rates.

Does Type 2 Diabetes Affect Life Insurance?

When you are at the point that you are about to apply for life insurance you will want to find the best life rates. This will require you to take a paramedical exam to determine A1C levels. In addition, the carrier will order medical records to determine if there are other health issues like high blood pressure or heart disease.

Also, the carriers will want to know what age you were diagnosed with diabetes whether it was type 1 or type 2 diabetes. This will all be the determining factor when getting approved at a good rate. People with diabetes that have it controlled usually are rated standard.

Now, what about if you don’t have it under control? Then you will still be able to get a guaranteed issue life insurance policy. These policies are limited to coverage and have a waiting period.

Diabetes Facts

Pre-Diabetes Facts

According to the CDC (Centers for Disease Control and Prevention), the following statistics are based on the CDC website. Their site last updated on March 22, 2020.

18 years or older Total: 88 million adults are prediabetic. This is 34.5% of the US adult population!

65 Years or older Total: 24.2 million senior adults!

Diabetes Facts

According to the CDC (Centers for Disease Control and Prevention),

Total: 34.2 million people in the US have diabetes! This is 10.5% of our nation’s population!!!

Diagnosed: 26.9 million people

Un-diagnosed: 7.3 million people. This is 21.4% who are walking around the US not properly diagnosed and on a maintenance plan

Statistics of Diabetes and Death

The most recent information I have researched is from 2015. The statistics state that diabetes is the 7th leading cause of death in the United States. This information is based on the cause of death on death certificates. In total, 252,806 certificates to be exact. It is 2019, that number is significantly higher!

Think about it this way. If you are reading this, and you are a diabetic. Don’t you think it is imperative you have a policy in place in the event of your death? Life insurance is NOT FOR YOU.

It is for who survives when you are gone. Depending on the decision you make today regarding coverage, it will depend on if your family can survive financially in your absence!

How Do You Get The Best Term Life Insurance for Diabetics?

When finding the best life insurance company when having diabetes you want to find a life insurance carrier or carriers that specialize in diabetics. The carrier will look at a few details when considering life insurance coverage.

- What age was diagnosed with diabetes

- Type of Diabetes

- A1C level

This will ultimately determine what life insurance rate you will qualify for.

Can Diabetics Get Term Life Insurance And What is The Process?

The answer is yes.

Again, this will all depend on how good you are controlling your diabetes. In general, if controlled, you will be able to get among the best rate classes available.

Above all, purchasing term insurance for a diabetic person is no different than any other as far as underwriting. It will all come down to control, A1C, age of diagnosis, medications and if there were any complications.

If it is a fully underwritten policy then a paramedical nurse will come to your home. As far as diabetes, they will check your fasting blood sugar and A1C.

If a no medical exam term is your preference, then you may pay a little more but the underwriting will be based on a prescription check and possible medical records depending on age.

How Does Diabetes Affect Life Insurance?

It depends on several factors.

First, what kind of medical treatment, if any, are you using to treat your diabetes? Are you taking medications? If so, what dosage? Most carriers take all of this information into account before giving you your quote.

In fact, if well-managed, there is no reason why finding acceptable rates for life insurance for people with diabetes. Another thing that is relevant is when you were diagnosed — if you were diagnosed as an adult, the rates should be lower.

It’s very common to be taking cholesterol and blood pressure medications as a maintenance cocktail to keep your diabetes managed.

Above all, If you’re a smoker, underwriters will frown upon that and in some cases add two to three tables in the rate. This combination makes this a high risk and a special risk and will impact the rate.

Life Insurance Diabetes Questionnaire

What should you be prepared to answer:

The questionnaire below covers the best life insurance for type 1 diabetes and life insurance for diabetics type 2.

If you’re looking to get a high risk life insurance term policy, there are several things you’ll need to have. You’re going to need your medical records, for one. Below, we’ll list some common questions that you should know the answers to before applying.

- When, exactly, were you diagnosed?

- Are you on any other medications?

- Do you have other health issues, such as high blood pressure, overweight and obese, kidney disease, etc.?

- Do you smoke?

- On average, how many alcoholic beverages do you consume per day?

- Do you use drugs?

- What’s your current height?

- What’s your current weight?

- How much did you weigh a year ago?

- How do you control your diabetes (insulin, diet, medication, etc.)

- Blood sugar levels, Fasting, and the most recent A1C?

You get the picture. While it’s not necessarily imperative for you to have all of this information on hand, it does help speed the process up significantly.

However, if you’d like to avoid this process, consider getting approved for coverage without an exam, though you’ll likely have to pay higher rates.

You can go to our PinnacleQuote website www.PinnacleQuote.com and click on the INSTANT QUOTE link button.

There are a few questions that can help determine a “ballpark” quote. Although, it is always best to make a direct call to us to get a more accurate quote.

We understand that time can be the devil for us all. We also can send you a link with a health and lifestyle questionnaire. This takes about 60 seconds to do in the privacy of your own home.

Again, this will give you a “ballpark” quote. For an accurate quote, speak with one of our independent agents.

Diabetes Questionnaire For Life Insurance

- Date of diagnosis: ___________ Age at Onset: ___________

- Most current Glycohemoglobin (HbA1C) test reading: _________________ Date: __________ Avg A1C: ________________ It is very important to have these numbers for any useful pre-underwriting premium estimate. If the proposed insured is unaware of recent values for this test, please have her/him obtain these values from their health care provider. A typical value lies between 5 and 9, often expressed with a decimal, such as 7.3. Slightly higher or lower values are possible.

- How often does the proposed insured visit their physician for a diabetic checkup? Monthly Every 3 Months Every 6 Months Once a Year Less than Yearly

- The proposed insured controls his/her diabetes by: Diet/Exercise Oral Medication: _____________________________________ Insulin: _________ (units per day) (6) Does the proposed insured take any other medication(s)? If yes, please list: Name of Medication (Prescription or Otherwise) Dates used Reason for Rx Diagnosis Date

- Recent readings: Current Height: __________ Weight: ____________ Weight one year ago: __________ Reason for change: _____________ Avg Fasting Blood sugar reading: ________________ Blood Pressure: ________________

- Does the proposed insured take any other medication(s)? If yes, please list: Name of Medication (Prescription or Otherwise) Dates used Reason for Rx Diagnosis Date

- Has the proposed insured experienced any of the following? If yes, provide details below under question:

Weight problems High blood pressure Chest Pain Insulin shock Coronary Artery Disease Abnormal ECG Elevated Lipids Diabetic coma Neuropathy Retinopathy Kidney Disease Alcohol/drug abuse Protein in the Urine Albuminuria Glycosuria Other

8. Please provide any additional details regarding the proposed insured’s medical condition:

How much does A1C affect life insurance rates?

The insurance carrier will have a look at heaps of distinct elements to ascertain how much they will charge you for a policy. Among the greatest factors is the general well being or health.

In case you have any pre-existing conditions, like diabetes, then you might encounter several issues when you are attempting to find cheap life insurance.

Diabetes is a fast-growing health problem in the USA. This disorder is characterized by the body’s inability to make insulin or not having the ability to use insulin efficiently. The consequence of getting diabetes is high blood glucose sugars. To maintain good health, one must be actively tracking to make sure it is controlled by anybody who’s a diabetic.

Diabetes does impact premiums, however, how much it impacts your premiums is dependent upon your degree of blood glucose management.

Your A1C is most likely the largest factor in determining your rate. In fact, type 1 diabetic is looked at differently than type 2 and usually riskier for the insurance company.

Other factors will determine the rate class as well. For instance, if you use oral drugs or whether you’re insulin-dependent, or if you’re diagnosed with diabetes as a kid or at age 50.

Life insurance is among the most significant investments you will ever make for your nearest and dearest. We know that buying life insurance is never an enjoyable adventure, but we are here to make it as fast and easy as possible for you.

A PinnacleQuote agent will research the way your A1C levels will affect your health rating which determines prices. In fact, we’ll also provide strategies in ways in which you could save money and put it back in your pocket where it belongs.

Can You Cheat an A1C Test?

Overall, it is very difficult to lower your A1C or cheat on a life insurance exam. In fact, your A1C is an overall average of your percentage of your blood sugar over the previous 90 days. If your life insurance A1C levels are under 7.0 you are considered optimal.

The only way you could is if you used someone else on your test. This would be insurance fraud. In addition, if you died and the life insurance company investigated your history and found out you committed fraud, then the death benefit might not be paid. This would defeat the purpose.

It’s always best to be 100% honest with the life insurance carrier.

How To Cheat A Fasting Blood Glucose Test

Again, not really possible to cheat. However, you can manipulate it. My advice is if you have an increased fasting blood sugar do a 3 day fast before your exam.

What About Other Medical Problems

Often, it’s not diabetes that concerns life insurance companies, but rather the additional medical problems.

For example, being overweight, being a smoker, or having a family history of poor health will, of course, make carriers more risk-conscious and more hesitant.

If you have diabetes, pulmonary disease, heart disease, obesity, or cancer, it’s essential that you compare several rates before settling on a company. Spending the time to do this, or hiring someone to do it for you, can save you a ton of money.

Those seniors and those over 75 will be rated higher unless they are well managed. Also, life with a DUI will impact rates considerably with a diabetic because of uncontrolled alcohol consumption. Alcohol is poison to a diabetic

I often get questions about diabetic oral medications. In fact, the question most asked, “is Metformin good for your heart”? As a matter of fact, Metformin is the drug of choice for treating patients with diabetes.

Physicians find that patients who take Metformin indeed have a lower risk of heart disease and death. This study is compared to patients on insulin.

Diabetic Life Insurance And Gestational Diabetes

When you are pregnant and expecting a child it one of the best gifts you will ever have in life. Above all, you want a natural and healthy childbirth. Unfortunately, sometimes that does not happen.

One of the biggest complications of carrying and being pregnant is gestational diabetes. In fact, 20% of all pregnancies develop gestational diabetes. For instance, it is normally the third trimester when the baby is beginning to be fully developed.

So it is no shock that getting life insurance with gestational diabetes might affect the rate. Above all, it is important to have life insurance before pregnancy. However, if not then the first two trimesters is the key for affordable gestational diabetes quotes.

In addition, when applying for life insurance the insurance company might consider postponing to after the birth of the child.

With a history of gestational diabetes once resolved over 5 years then preferred rates are possible with most carriers. However, when present, standard plus is the best available rating as long there is no other complications or health conditions

Gestational diabetes would be considered a Pre-Existing condition. Many companies may postpone your application until after you have the baby. It may be better to postpone than risk getting a denial. Each case is treated differently.

A few factors will determine how your agent will guide you.

- Have you been in the hospital

- Are you taking medication

- How severe is the condition

- Risk factors

Again, each carrier will look at every person differently. Speak to your agent. Allow them to guide you with the best tools. And then make an educated decision together.

No Medical Exam Life Insurance For Diabetics

We mentioned this briefly above. While no medical exam policy is a reliable option, they in some cases are more pricey. For those that are having trouble, this may be a better avenue.

However, saving money, it may be a better option for taking a medical exam. Again, these plans will likely be far more expensive. There are also more limitations when purchasing, capping off around $250,000 max.

*We speak about American National Insurance Company (ANICO) later in this article. Our personal favorite and the Best term coverage for diabetics, hands down!

Affordable Coverage For Diabetics That Smoke

How do you get the best life insurance rates for diabetics who smoke?

Everybody knows that smoking is not great for you, but just how can this impact someone with diabetes? Perhaps you’re a smoker and you’ve only been diagnosed with Diabetes.

Or maybe only a smoker searching to get coverage to protect your family. Regardless it is important that you learn how smoking relates to diabetes.

Diabetes is a disorder where blood glucose levels are greater than usual. The majority of foods people eat have turned into glucose (sugar) for your body to utilize for energy. This sugar instead will develop in the blood causing high glucose levels and a top A1C reading.

Furthermore, type 2 is by far most common in the United States for adults and accounts for nearly 90 percent of new diabetes cases. Fewer individuals are diagnosed with type 1 diabetes, even more frequently developing in kids known as Juvenile Diabetes.

Bottom line, carriers do not like when a consumer with diabetes uses tobacco. In fact, smoking can double the risk of developing kidney damage and we have seen major increases in retinopathy.

For instance, smoking reduces blood circulation which is harmful if you have high blood sugars. Also, major risk factors for heart attack and stroke when using cigarettes and other tobacco.

Quit Smoking! Get Your Diabetes Under Control!

Finally, if you’re a smoker with diabetes, then stop smoking today. Above all, it’ll benefit your health immediately. Individuals with diabetes who cease have greater control of their glucose levels. Stopping smoking won’t just help save you money on your coverage.

However, you’ll feel that health benefits instantly. Provided you’re able to become tobacco-free for at least a year you can qualify for nonsmoker prices.

More About Affordable Life Insurance With Diabetes

Before applying, we have some tips that could potentially save you a substantial sum of money. You need to know that when you apply, you’re going to want to be as healthy as possible.

This way, life insurance companies will give you lower rates and better policies. The 20-year term policy is a very common policy for diabetics and many other health impairments.

So, we recommend exercising regularly, eating healthier, and quitting or cutting down on your bad habits. Quitting smoking for a year before applying for coverage will have a HUGE impact on your quote. Also diet and exercise!

However, working on your health isn’t the only thing you can do to get the most affordable coverage with diabetes. By hiring an agent at PinnacleQuote, we can set you up with the best possible life insurance companies.

Making sure you are getting the cheapest life insurance rates possible. We know this is incredibly important to you.

Overall, getting coverage for diabetics can be reasonable. Pair up with a great agent and he will be guided through the process with ease!

This will save you time, money, and you will be far more likely to get a better policy.

Best Life Insurance Companies For Diabetics

The 2 biggest questions I receive when shopping for life insurance for a consumer with diabetes is, “Can you get life insurance if you have diabetes”, or, “Can diabetics get life insurance”.

In fact, yes, getting a life insurance policy for diabetics will come down to how well managed it is. Below are the top companies I use when finding the best diabetes life insurance quotes.

Best whole life insurance for diabetics and best term life insurance for diabetics!

- Banner

- Protective Life

- American National Insurance Co. Only offer Signature UL (NoTerm)

This is important because as you know with diabetes you are at risk for the following:

- Stroke

- Heart Attack

- Blindness

- Loss of Limbs

I just recently had a client who as approved with ANICO at a standard T2 rating. He was a 64-year-old male, with an A1C ranging from 6.5-7.2. In fact, the client was diagnosed at age 38!! Above all, it was a no exam term that was approved in 3 days!

Living Benefits For Diabetics

Best Product

Above all, consumers with diabetes are at risk of other health impairments over time. Especially if diabetes is not managed properly. In fact, in my professional opinion, if you are a diabetic then you need to look at a policy with living benefits.

These policies give you access to the death benefit without you having to die. Put it this way, it’s like you are the beneficiary of your own policy.

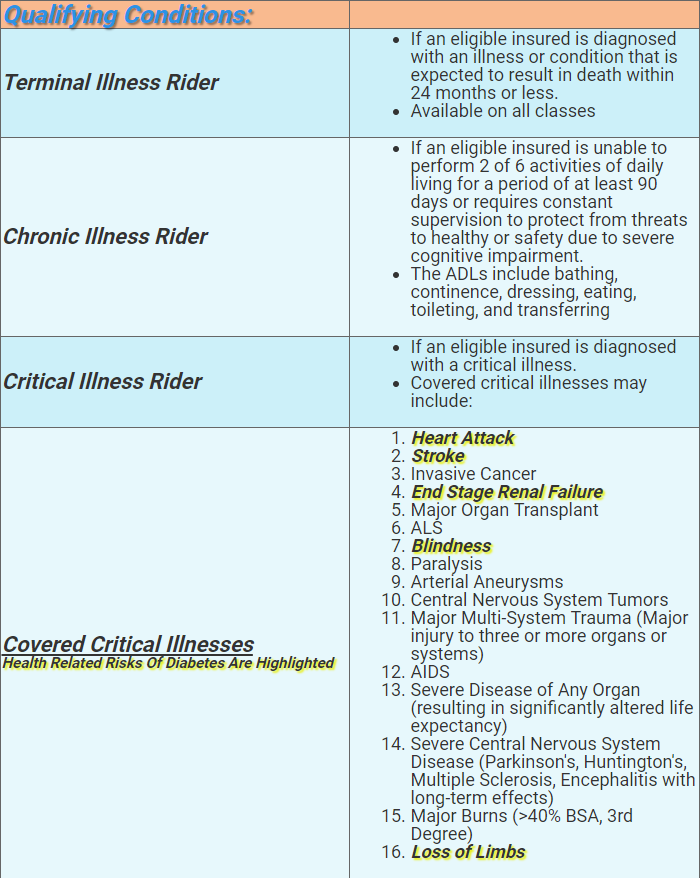

Accelerated Benefit Riders

Living Benefits are designed to provide access of the death benefit for an insured diagnosed with a life changing illness.

- Terminal Illness – life expectancy within 12 – 24 months depending on state limitations

- Chronic Illness – insured unable to perform two out of six activities of daily living

- Critical Illness – insured diagnosed with any of a list of 16 critical illnesses (states vary, ask your Independent Life Insurance Agent)

Above all, if you were diagnosed with diabetes then you learn what the risks are. In fact, when you hear heart attack, stroke, and renal failure it becomes scary, to say the least. Furthermore, add in possible blindness and possible loss of limbs and it gets really scary.

Getting coverage with a product that has living benefits is so important! As an agent, that is my first goal when speaking with someone that has diabetes, offering the best options possible. American National, in my opinion, is the best carrier with living benefits.

Critical Illness Insurance for Type 1 Diabetics

Getting life insurance coverage for diabetics is important, however what about the health risks that come with diabetes?

Critical illness insurance for diabetics is important!

Whether you have type 1 or type 2 diabetes you are more prone to high blood pressure, stroke, kidney issues, heart attack and/or heart disease. So what happens if you have complications such as a stroke? What good is life insurance for a person with diabetes if you don’t die?

Getting a critical illness policy when being a diabetic will put you at ease about the risk factors. In the event you have a heart attack or stroke you will be out of work. Who will pay your bills? Will your employer still cut you a paycheck while you are recuperating? Not likely.

Having a critical illness policy will protect you against heart attack, stroke, and cancer. In addition, they have riders to help cover treatment in the ICU.

I highly recommend looking into a critical policy if you are a diabetic.

Can You Get Long Term Care Insurance If You Have Diabetes?

When it comes to type I diabetics, it will be difficult to get covered if you are insulin-dependent. However, if you are prescribed “insulin therapy” then there is a possibility. The key to qualifying for long term care is to be taking less than 70 units a day and your A1C needs to be below 8.5.

As far as long term care insurance for type II diabetics all LTC carriers will approve.

Trying To Get Life Insurance For A Diabetic After A Decline

The number one reason diabetics have been turned down for coverage is they simply applied to the wrong carrier. Above all, each individual life insurance company has unique guidelines they use to underwrite a policy.

Some carriers are far more beneficial to type 2 diabetics with great management, while some other carriers may bump the exact same individual in using a diabetic medication with ordinary control.

Again, one company might cover a type 1 diabetic, while the other carrier might provide standard rates to some type 1 diabetic with great control, based on the conditions. It all comes down to making sure you are dealing with an agent that knows all the guidelines, products and services.

The trick to getting life insurance coverage with diabetes is knowing the underwriting standards of insurance guidelines. Quite often, you get turned down because you simply didn’t fall in accordance with the diabetic criteria for your carrier’s guidelines.

If you are only looking for a cheap burial policy then a simplified issue with Mutual of Omaha might be the best route.

Were You Denied Because Of A High A1C?

As a diabetic, blood glucose control is the most important component of staying healthy and preventing long-term complications. The daily work it requires to maintain your blood sugar stability is what’s going to show if your insurer checks your A1C.

If you have been diligent about tracking and stabilizing your sugar levels, then your A1C will probably be under 7.0 which is well managed in the eyes of the insurance company.

If your blood sugars are high, then your A1C will inform the carrier that your diabetes is not well managed causing a higher rate

When a diabetic has been turned down for life insurance, it’s because their A1C is above (10.0). Find out more suggestions about the best way to treat this and get it lower.

The acceptable A1C scope for every provider differs, which explains the reason why it’s necessary to do your research and also have a plan for how you manage it. Also knowing the best carrier for your circumstances.

Life Insurance Underwriters Ratings For Diabetics

Every insurance carrier and underwriters will look at each person differently. There is no “one size fits all” in this industry. Be honest with your agent.

He/she is very knowledgeable about all health impairments and has relationships with each carrier and their underwriting teams.

Health Rating For Term Insurance for Diabetics

Type 2 – single medication, or diet controlled

- Age of Onset 0-17 – Decline

- Age of Onset 18-34 – Table 3-5

- Age of Onset 35-49 – Table 2-4

- Age of Onset 50-65 – Table 1-3

- Age of Onset 66+ – Standard Plus – Table 2

- Add 1 table per 1% of A1C over 7%

- If 2 medications, add 1 table

Type 1 – Diagnosed <30

- Age at issue – 18-34 Table 4-6 (lower table for a shorter duration (< 7 years) since diagnosis)

- Age at issue – 35-49 Table 3-5 (lower table for shorter duration (< 7 years) since diagnosis)

- Age at issue – 50-65 Table 3-4 (lower table for shorter duration (< 7 years) since diagnosis)

- Age at issue – 66+ Table 2-4 (lower table for shorter duration (< 7 years) since diagnosis)

- Add 1 table per 1% of A1c over 7%

Proper Amount Of Coverage For Diabetics

Not only do you need to consider how much life insurance you’ll need, but you’ll also need to decide exactly when you should get coverage. You’ll need to calculate your debts, how much you owe on your house or car, etc. Other things to consider, funeral prices and student loans.

On top of this, you also have to think about how much you make, and how much your family will need when you are no longer getting these paychecks. Although getting cheap coverage can be more difficult, it’s well worth the financial protection of your family.

Remember, your paycheck dies with you!

FAQs

Life insurance for diabetics is a policy specifically tailored to meet the needs of individuals with diabetes. It takes into consideration the unique health risks associated with diabetes and often requires a more detailed medical assessment.

Diabetes can affect life insurance rates depending on its type, control level, complications, and the overall health of the individual. Typically, well-managed diabetes has less impact on rates compared to poorly controlled diabetes.

Yes, there are policies specifically designed for diabetics. These may offer more favorable terms for individuals with well-controlled diabetes and no additional health issues.

Key factors include the type of diabetes, age of diagnosis, current age, diabetes control (HbA1c levels), presence of diabetes-related complications, overall health, and lifestyle habits.

Absolutely. Diabetics can find affordable life insurance, especially if their condition is well-managed. It’s advised to shop around, compare quotes, and consider working with insurance brokers or agents specializing in high-risk profiles.

Related Articles

Conclusion

There are a number of people that have diabetes and need life insurance. It can be hard to get affordable life insurance for diabetics, but it is possible! Term life policies are the best option because they offer coverage for a set period of time. You may not know this, but I’m an independent agent with my own agency so you don’t pay me commission when you buy your policy from me. If you’re ready to take the next step towards securing your future and getting term insurance quotes today, just click on the button below!