Facts About Life Insurance Rates For Overweight 2024

If you are looking for a life insurance rates for overweight, you’ve come to the right place.

Getting Life insurance for overweight consumers presents rates that are higher. This is because life insurers typically consider these individuals to be at greater risk of dying from heart disease, diabetes, and other weight-related health issues.

Despite the statistics that show an increase in life expectancy among those who are overweight or obese, many insurance policies take into account a person’s height/weight ratio as well as their blood pressure, cholesterol levels, and activity level when determining the rate they will pay for life insurance coverage.

In order to save money on premiums, it may be advantageous for someone who is heavier to lose some weight before applying for new coverage.

Article Navigation

- Can You Get Life Insurance If You’re Overweight

- Will All Life Insurance Companies View Me The Same

- If I Am Obese, Can I Find A Good Life Insurance Policy?

- What Factors Affect Life Insurance Coverage

- Delaying Getting Life Insurance To Try To Lose Weight? Not A Good Idea

- Life Insurance Tips For Those That Are Overweight Or Obese

- FAQs

- Conclusion

Can You Get Life Insurance If You’re Overweight

Will life insurance be much more expensive if I’m overweight?

There are nearly 130 million Americans that qualify as overweight, with over half of them categorized as obese. General health, of course, plays a significant role in the rates that life insurance companies will offer you.

Overweight people are often considered high-risk applicants by insurance companies. Especially if they have underlying health problems in addition to their weight. Which means they are forced to pay higher rates for their life insurance. And that’s if their application is accepted.

Weight is just one of many factors that a life insurance company considers when assessing the risk of their applicants.

Even though it is possible to be overweight and be healthy in every way, insurance companies are just playing the statistics — people who are obese are far more likely to have (or eventually get) type 2 diabetes, cardiovascular issues, high cholesterol, high blood pressure, etc.

Underwriters will need plenty of specific information, including your body proportions and your BMI. Be prepared to be asked if your excess weight is due to any disease. Insurance companies will be interested in your weight patterns; they’ll want to know if your weight fluctuates or if it has remained more or less the same over recent years.

Will All Life Insurance Companies View Me The Same

Certainly not. Each life insurance company has different medical underwriting. In fact, this means that while some companies may view your weight as high risk, others may offer you an affordable life insurance policy.

It’s necessary for high-risk applicants like those overweight, or those with a condition like bipolar disorder to compare companies. Furthermore, most life insurance companies will consider you high risk if you are very overweight.

How Do Height And Weight Affect My Life Insurance Rate?

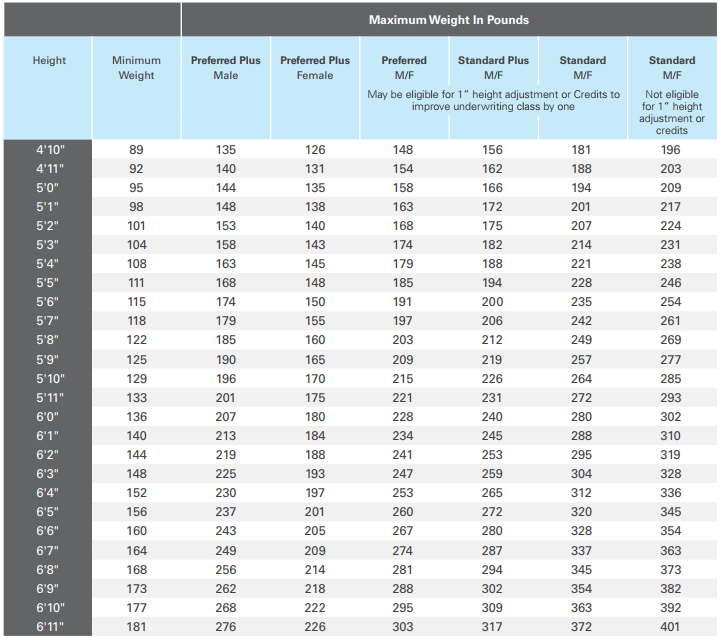

Above all, height and weight are some of the most important fundamental aspects that life insurance carriers utilize to help determine an individual’s rate class.

Furthermore, there are build tables that all insurance carriers have. I fact, all these can vary between many life insurance carrier’s guidelines.

Men And Obesity

Additionally, statistics say the typical adult man in America is overweight. In fact, BMI charts are the culprit. For instance, if an individual indulges in holiday meals during Christmas and gains a few extra pounds, he would then be classified in a different build category.

I am guilty of it myself, good eating over a six-week period happens to all of us.

Women And Obesity

In terms of ladies, we observe an ordinary height for women to be of 5’4″-5’5″, using a normal burden of 165-170 lbs. In fact, this is officially considered “overweight” by most standards.

However, the ordinary woman would continue to be in a position to meet the requirements for the best life insurance for obese consumers policy quotes by many organizations.

Normally, she would need to weigh significantly more than 120 lbs before being rejected for coverage by several life insurance companies.

If I Am Obese, Can I Find A Good Life Insurance Policy?

Life Insurance Rates and Being Overweight

Yes! Consumers that are not at the preferred weight class for their height, might still find a policy that matches their demands. We’ve examined a number of the guidelines regarding weight recommendations and found some interesting facts.

In fact, folks that are of average weight may gain over a hundred pounds until they truly are unable to purchase life insurance.

For example, a consumer with a height of 5’8″ would need to weigh over 300 lbs to be declined. However, before facing a potential decline for life insurance, hire an independent agent like us at PinnacleQuote to ensure proper evaluation. Your agent can guide you from how much your death benefit should be, to which carrier is most lenient to how much your rates will be.

Remember, each life insurance carrier has different build charts. so it is very wise to look at a few carriers that are lenient to build.

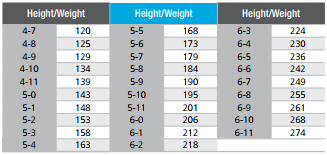

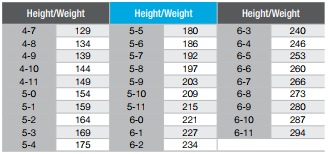

Below are height and weight guidelines for life insurance.

Between Protective Life and Banner Life. You can see how they differ from one another.

Protective Life Build Chart

Select Preferred Rate Class

Select Preferred Rate Class

Banner Life Build Chart

As you can see, every life insurance provider follows their own build graph. These are guidelines to follow. Life insurance agents base the rates that customers may receive.

What Factors Affect Life Insurance Coverage

Weight isn’t the only thing that goes into factoring in your insurance rates, of course. Here’s a list of some of the things that could also have an impact on your life insurance:

- Age (life expectancy) ~The older you are, the more expensive your life insurance premiums will be.

- Sex ~ Generally speaking, men pay a significant amount more for life insurance.

- Bad Habits ~ If you smoke or use alcohol excessively, your rates may be up to 2 or 3 times higher.

- Driving Record ~If you have a DUI on your driving record, your rates will almost certainly go up in price.

- Health History (family medical history) ~ Those that come from families that are prone to health risks or health problems such as cancer, heart disease, etc. may have to pay higher prices for their life insurance. It is important to get a routine medical exam especially if you have family history.

- High Risk Activities ~ such as racing cars for instance.

Delaying Getting Life Insurance To Try To Lose Weight? Not A Good Idea

I have a number of people who tell me they want to put off life insurance to lose weight or become healthier. What they don’t realize is that in most cases they will end up spending more money.

Remember, any weight over 10 pounds and the carrier will put back 50% of the weight. Some carriers will base your rate on the highest weight in the previous twelve months. So you can really knock the cover off the ball and lose thirty pounds and still not get the rate you want.

Also, all of us get busy and fall into familiar patterns. In this case, you usually wait another year when rates are higher. After age 50, it becomes even harder and harder.

Insurance underwriters are going to be looking at your cholesterol levels and blood sugar levels. Especially if you recently dropped a lot of weight. They want to know if there was a history of diabetes or elevated blood sugars.

In order to qualify for a Preferred Best rate, you will need to fall within the stature and weight recommendations and classify as a minimal risk across all the board. This is far easier to take action in your 20’s and 30’s.

Once you hit your 40’s, some health issues may arise. Your metabolism slows down, so it’s more challenging. I say every day, I know why athletes retire at around 40. They either can’t see the ball anymore, or their body won’t keep up with the youth.

Obese Vs. Overweight. Does It Make A Difference On Life Insurance?

There are several things that a person can do to lower their life insurance rates. If you are interested in getting cheaper life insurance, consider these tips:

- Quit using tobacco — as mentioned above; smoking will cause your rates to skyrocket. Quitting all tobacco products a year before applying can cut your premiums in half.

- Exercise more, eat healthier — As an overweight person, improving your physical fitness before applying for life insurance increases your chances of being offered an affordable policy.How’s that for motivation?

- Take measures to lower your blood pressure before applying — high blood pressure, or hypertension, is a big red flag for life insurance companies.

- Compare companies — the more quotes you get, the better chance you have of finding affordable life insurance policy. Hiring an independent insurance agent can connect you to the best life insurance companies, and have an understanding of which companies have more lenient underwriting for people that are overweight.

Bariatric Surgery And Life Insurance Rates

Here at PinnacleQuote, we specialize in getting life insurance for customers who’ve had various types of bariatric weight loss surgery. These include a gastric bypass procedure or perhaps a lap band.

Above all, the “half weight-loss credit” applies, but only a few insurers only give a partial charge for two years post-surgery. Many companies also postpone considering your application until 12 months have passed since the completion of your surgery. However, some will just give you a substandard rate until you have your annual follow-up.

If you haven’t experienced any complications from surgery, life insurance companies will often accept your application six months after completing your operation. But again, you will pay for it. What I do with clients is get the most cost-effective term, usually the 10 years.

The strategy would be to then replace once you’re at the full year. At this point then we would go out long term.

Because of these underwriting guidelines, you are going to need the service of an independent life insurance specialist. At PinnacleQuote we will find you the best carriers that have the leniency to any weight loss surgery. This will provide our customers with their very best options and the best cost.

Life Insurance Tips For Those That Are Overweight Or Obese

Here are some tips you can focus on when you are getting a life insurance policy. Focus on these to put yourself in the best position for the best rate available.

- Be 100% Honest About Your Weight: There is no hiding it. If you go a fully underwritten path then an examiner will come out and weigh you. If you do a no med term life insurance then they will get medical records. It’s always best to just be honest. We will handle the negotiations with the carrier.

- Find An Agent That Is Independent: Above all, this is probably the most important key to the success of getting the best-priced policy available. STAY AWAY, from captive agents. These agents have a one size fits all mentality. Imagine going to a clothing store and there are only sizes that fit someone with a perfect physique. Here at PinnacleQuote, we will tailor make you a policy.

- Exam Preparation: The best way to get the rate you deserve is to go through with an exam. Gives you the best chance of getting the best rate that you qualify for. No medical policies tend to be more expensive because they do not see your fluids. They look at you as a higher risk. Also, you want to make sure you take your exam first thing int he morning. This is when your the lightest, and you self-fasted the night before.

- Big Weight Loss Can Hurt You: Life insurance carriers like to see steady weight. They don’t like to see fluctuations of more than 10 pounds. They also base everything on statistics. So a significant weight loss in the last twelve months they will go by what the statistics say. That you will probably put at least half the weight back on.

- Waiting Can Put Your Family At Risk: Remember, putting this off can be detrimental to the rate. We are all one ER visit away fro not being uninsurable. Also, people just die!! I have had clients of mine who procrastinated and died. It is the worst phone call to get when a spouse calls and asks if her husband/wife had coverage. Then having to say no, they put it off. Bottom line, don’t put your family at risk. Let us at PinnacleQuote devise a strategy to make sure you get what you need now. But don’t overplay later.

FAQs

BMI is a common measure used by insurance companies to assess general health. A BMI in the obese range, according to health standards, typically leads to higher premiums.

Yes, losing weight and improving your BMI can help reduce premiums. Some insurers may reassess your rates if you maintain a healthier weight for a certain period.

Yes, it’s still possible to find affordable life insurance. Rates vary among insurers, and some have more lenient underwriting standards for weight.

Many insurers will consider overall health improvements related to weight loss, such as reduced blood pressure or improved cholesterol levels, which can positively impact rates.

Compare different insurers, consider policies tailored for higher-risk individuals, and focus on improving health factors that are under your control.

Term life insurance might be more affordable. However, the choice of policy type should also consider coverage needs, financial goals, and other health factors.

Be prepared for questions about your health, lifestyle, and possibly a medical exam. Accurate disclosure of health information is crucial.

The impact varies by degree. Being slightly overweight may have a lesser impact on rates compared to being in the obese category, as per BMI standards.

Related Articles

Conclusion

Every day, more and more people are realizing that they need to get life insurance. If a medical condition has recently been diagnosed in you, or you have a history of ailments in your family, now might be the time to start shopping for the right insurance carrier.

You need someone skilled in working with individuals whose weight falls outside the range traditionally considered healthy — and we can offer that help!

Founded on a belief that everyone deserves quality coverage regardless of health status, our team specializes in providing policies tailored specifically for individuals who struggle with overweight issues such as diabetes and heart disease. Contact us today if this sounds like something you might be interested in learning about!