Getting Life Insurance After Stroke in 2024

Getting life insurance after a stroke is often difficult, but it can be done. The first thing to do is to figure out what type of life insurance you need and how much coverage you will provide. You can then research various companies that offer those policies and find the one with the best rates for your needs.

Life insurance provides peace of mind and financial security to our loved ones. But if you’ve experienced a stroke, you might wonder about your eligibility. This article sheds light on the essentials of securing life insurance after a stroke, offering guidance and addressing common concerns.

Remember that having some degree of disability does not mean you cannot get life insurance; just be upfront about your condition as this will increase your chances of finding what’s right for you.

Table of contents

Life Insurance Policy For Stroke Patients

If you were wondering if life insurance payout for stroke victims really happens then you came to the right place. Overall, a life insurance company must honor the death benefit if death occurs after a stroke. We will go into this topic more in detail in this article.

Above all, the best policy to have when you have a high-risk medical condition like stroke is a life insurance policy with living benefits. In fact, if you have any sought of family history then your life insurance agent should have mentioned it to you.

For instance, if you were to have a cerebrovascular accident or any other type of stroke and have any kind of residuals, you may very well be able to tap into that policy. YES, without dying.

Furthermore, this is the best policy to get for life insurance for stroke survivors. In addition, you can still get affordable life insurance rates for life insurance for stroke victims.

Read on and you will get some valuable information to assist you in getting the right coverage.

Can You Get Life Insurance If You Have a Stroke

Life Insurance for stroke victims, is it possible?

People who suffer a stroke have many questions concerning life insurance. Above all, we know that having a stroke can be one of the hardest things someone can go through.

In fact, it is equally hard for family members. Understanding the warning signs and getting to the hospital FAST is the key to reverse any paralysis. This is absolutely pivotal in preventing permanent damage.

If you can get to the hospital in time to have medical personnel administer Thrombolytic drugs such as TPA (Tissue Plasminogen Activator) otherwise known as clot busters. Then the CVA cerebrovascular accident can be limited to no physical impairments.

These medications can stop the stroke and prevent brain damage by continuing blood flow. Other terms are Cerebrovascular Accident or CVA. When given these medications you will be monitored very closely for the next 24 hours.

Can you get affordable life insurance after a high-risk event such as a stroke?

What Happens To My Life Insurance Rates After Stroke

The Basics of Post-Stroke Life Insurance:

Above all, the best thing to do is have life insurance early especially if you have a family history of health impairments such as stroke. In fact, once you have a stroke, basic life insurance will cease to exist.

Getting life insurance after a stroke will affect the rate class which will determine the price you pay. The good news is, you will probably still be able to get life insurance.

The bad news is, you will probably be table-rated. In addition, if it was a severe stroke you may only be able to get a final expense policy where the death benefit only goes as high as $50,000.

Overall, getting life insurance a year after stroke will probably improve your rating class as underwriters like to see you on the up and up.

For instance, they found a consistent drug cocktail that has you stable. This usually includes blood pressure medication and cholesterol medication accompanied by a blood thinner.

This will tell the underwriter that you are stable and lowering the risk of having another.

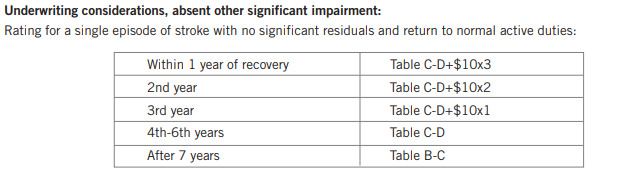

Stroke Underwriting Ratings:

- CVA under age 45 – Decline

- CVA over age 45 after 6 months – Table 3-5

- <6 months – Postpone

- Other cardiac impairments – likely declined

- Currently smoking – Decline

Stroke-and-TIA – underwriting questionnaire

Here are the rates for a healthy 60-year-old female vs a stroke victim that had a mild stroke vs a severe stroke. This will be based on a 20yr $250,000 term policy.

| Rating/Age/Gender | Term | Face Amount | Monthly Rate |

|---|---|---|---|

| Preferred Plus/60/F | 20 Years | $250000 | $76.13 |

| Table 3/60/F | 20 Years | $250000 | $196.92 |

| Table 6/60/F | 20 Years | $250000 | $279.10 |

| Table 8/60/F | 20 Years | $250000 | $333.89 |

Now you can understand why the best life insurance for stroke victims is already having life insurance in place before the event. According to the American Stroke Association, life insurance is important to have in place as the costs are over $140,000 post-stroke.

Overall, if you have any history of stroke in your family. be proactive and get a policy with living benefits. This will give you access to policy benefits in the event of a severe stroke.

Life Insurance for Stroke Patients

If you have had a stroke in the past you know how scary that can be. in addition, it’s very scary for the family members of the stroke victim as well.

My mom had a stroke at age 52. Unfortunately, she did not make it to the hospital in time to have TPA (tissue plasminogen activator) administered. These are otherwise known as clot busters.

Above all, because my mom did not get to the hospital in time she had permanent paralysis in her leg (30%), and her right arm (70%).

Because of this, it will be very difficult to get stroke insurance coverage. It’s very important to have very little if any residuals if you want the best stroke life insurance.

The reason I explain this example is to show the impact of not getting to the hospital in time.

American Stroke Association and Life Insurance

Now if you have had a stroke already then your rating class will depend on the severity of the stroke. Overall, life insurance underwriting will take place by getting your medical records to see the severity of the stroke and your treatment.

If the underwriters determine it was a severe stroke then you will probably get a table rating policy at best. However, if you did not have a severe stroke then a standard rating is possible. Once you apply, you will have to take a medical exam.

If you have had multiple strokes or multiple TIA’s (Mini Stroke) then there is a possibility you may be declined for term life or universal life. If this happens, then a guaranteed issue policy would be great to cover final expenses.

Now for the ASA, the average stroke victim’s medical costs are over $140,000. This includes inpatient care, rehabilitation, and other additional care. SO again, getting a policy with living benefits is key to living a good life after a stroke.

Can I Get Term Life Insurance After Stroke

If you are reading this and either you are the one or a loved one who has had a stroke it will come down to knowing who the right carriers are and the way they will look at you.

For instance, they will ask you questions about treatment, type of stroke, family history, and your medical history. These questions are very similar to the questions asked when getting health insurance for stroke victims.

These are very important when determining life insurance quotes for stroke survivors. In addition, this will be followed up with a medical exam.

I am a national independent agent that has helped hundreds of stroke victims over the years obtain life insurance coverage. This is something that should not be taken lightly!!

After a CVA, or if you have a family history of a CVA, YOU SHOULD BE COVERED!!! PERIOD!! Call us to go over your options. There will be no sales pressure, just the best options that you can pick and choose from!

Underwriting Stroke Patients

Applying for life insurance after having a stroke and getting approved will be based on many factors. So if you are wondering if life insurance payout for stroke happens, the answer is YES!!

In fact, life insurance companies all have different guidelines when it comes down to life insurance for stroke survivors. When it comes to insurance for stroke patients they will wonder if it was (Mini stroke) TIA (transient ischemic attack).

Most of them will ask:

- Was it the first stroke occurrence?

- What age at the time of stroke?

- Was it a full blown stroke or a mini stroke?

If you had a CVA before the age of 45, then chances are it will be a decline and a guaranteed issue policy may be the only path.

Also, if you have any other cardiac impairments such as atrial fibrillation or a history of heart disease or diabetes then likely a decline.

However, if you are over 45 and it has been over 6 months since having the CVA then you will be looking at a table-rated policy between 3-5, at the very best!

What About Hemorrhagic Stroke and Life Insurance

When it comes to having a CVA, the brain cells are deprived of oxygen and can start dying within minutes.

The impact of CVA usually result in permanent brain damage, disability, or even death. You can understand why the carrier will consider you as high-risk stroke insurance.

Getting term life insurance after a stroke can be even more challenging. Furthermore, when determining the insurance rating they will want to review medical records to determine risk factors.

Life insurance for stroke victims will be more pricey if you are not following the doctor’s orders. In some cases, it will be a decline.

However, if you are being consistent with follow-ups and taking the medication prescribed then as long as you have distance between the event you should have the peace of mind knowing you will get coverage.

Cerebrovascular Accident (Stroke)

A CVA or when a stroke occurs is when obstruction of the blood flow to the brain leads to permanent damage. It is also known as cerebral infarction.

If the symptoms are only temporary then it is considered a TIA. Also, a rupture of an artery or blood vessel in the brain is also called a stroke, full stroke, or CVA term (Cerebrovascular Accident).

Signs of Stroke and Symptoms of a CVA:

| Weakness |

| Numbness |

| Headache |

| Dizziness |

| Nausea/Vomiting |

| Paralysis of one side of the body |

| Speech Difficulty |

| Memory defects |

The kinds of tests that are used to determine a person who has had a CVA is a CT Scan of the head or a brain MRI to find any blood clots.

Here are some types of treatment after a stroke:

- Physical Therapy (Rehab)

- Anticoagulants (Blood Thinners like aspirin and/or Coumadin)

- Hypertension control (High Blood Pressure Medications)

Here are some of the factors that can affect the life insurance rating if you have a history of a critical illness such as a cerebrovascular accident:

- Hypertension

- High Cholesterol levels

- Generalized Atherosclerosis (Plaque Buildup in arteries)

Can you get life insurance after a Transient Ischemic Attack (TIA)

Can you get life insurance after a TIA?

In some cases, a mini-stroke, otherwise known as a Transient Ischemic Attack TIA is when a stroke only lasted a short period of time, usually a couple of minutes.

For instance, the blood supply is briefly blocked and it happens suddenly. Symptoms of a TIA are similar to some stroke symptoms like numbness or weakness in one side of the body.

Although the underwriting guidelines are very similar for TIA life insurance, as long as it is a single episode then it is possible to get a standard rating.

Furthermore, if you smoke tobacco or have a history of heart attack or stroke from the past you will be an automatic decline.

So the question, “does life insurance cover heart attacks and stroke”, answer is no if you had a history of both.

Life Insurance After Mini Stroke

After having a mini-stroke you might think it will be cheaper to get life insurance or “stroke quotes” versus if you had a full-blown stroke.

In fact, the rating class is virtually the same. However, this might not be after 3-5 years. For instance, you are more at risk of having another mini-stroke or a severe stroke within 12-18 months of having an episode.

In addition, it will come down to medications that will determine stroke quotes’ medical rating. This rating will ultimately determine the price.

Life Insurance Underwriting Questions and Ratings

You may wonder about the life insurance underwriting questions you will be asked.

Whether you are years after a CVA and are looking for term life insurance after a stroke the importance of approval is based on the questions that are asked and the rating that you can get.

Your agent will go over this in detail to alleviate any concerns.

One of the best carriers when it comes to life insurance for stroke survivors is Prudential.

These are the ratings and questions that are asked when determining rate class.

These questions and answers are also in your policy under product disclosure statements.

Underwriting Questions

If your client has a history of CVS/Stroke, please answer the following:

| 1. Please list date(s) of CVA(s): |

| 2. Is your client on any medications? |

| 3. Does your client have any current neurological residuals? |

| 4. Has your client smoked cigarettes in the last 12 months? |

| 5. Please check if your client has any of the following: |

| a. High blood pressure |

| b. High cholesterol |

| c. Coronary artery disease |

| d. Atrial fibrillation |

| e. Diabetes |

| f. Peripheral vascular disease |

| g. Heart murmur |

| h. Carotid disease |

| 6. Does your client have any other major health problems (e.g.: cancer, etc.)? |

Here are the ratings based on medical history and answers to the above questions.

Keep in mind, if you have had multiple episodes affecting parts of the brain, dementia, or significant physical or mental impairment then you will generally be a decline.

You will still be eligible for a guaranteed issue or graded policy from other carriers we represent. These policies can be purchased for any trauma cover and are sometimes called trauma insurance.

Stroke survivor insurance coverage

Obviously, whether it’s cancer, heart attack or a CVA getting life insurance after these events is a must if you are able to.

All three of these pre-existing conditions have a risk of it happening again as high as 40% in the first 5 years.

Don’t put it off!! Rolling the dice with your family’s financial future is not a good plan. You must make sure they are financially ok for the long term.

What about term life insurance after a stroke?

With that said, let’s see what life insurance for a stroke victim will cost with a trauma insurance quote.

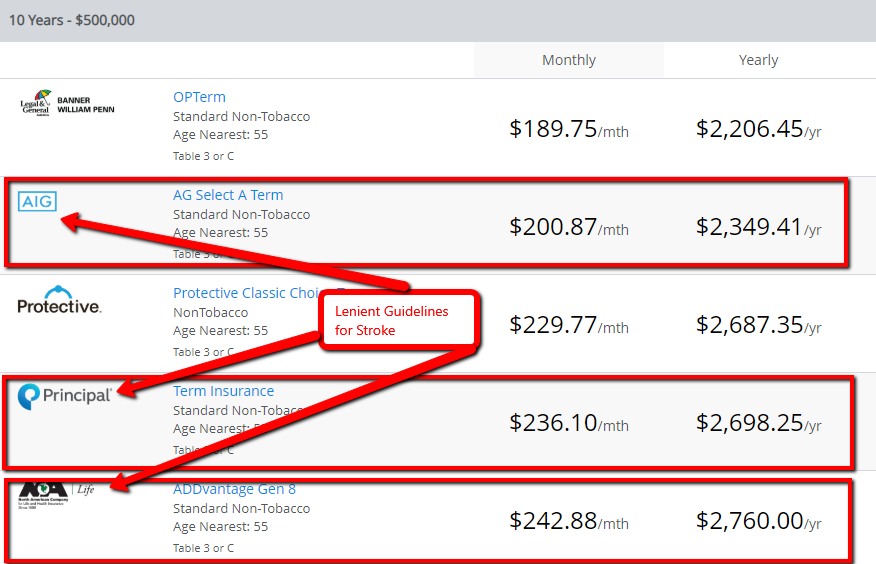

Example:

John is a 55-year-old new grandfather to twin girls. After his stroke just 1 year ago he has been doing great and no symptoms or paralysis. He just did his one-year follow-up and his Doctor says he is doing great.

John wanted to make sure in the event of this happening again, he wanted to make sure his family is taken care of until his retirement age of 65 when he can take a large pension.

John figured he would need about $500,000 in life insurance for 10 years to make sure the mortgage is taken care of and his wife with a little cushion. This would be paid out as a lump sum.

Best Life Insurance For Stroke Survivors

Is LifeLine Screening a Good Idea

Lifeline screening has been around since 1993. It is run privately. They specialize in prevention and wellness.

They have been featured in The Wall Street Journal. LifeLine has screened over 9 million people in the last 25 years. You may have seen their ads in newspapers or commercials on your television. And you may be asking yourself, is the lifeline covered by insurance? The short answer, NO.

Medicare and Medicaid do not cover most of the costs either. It is best to give them a call to inquire about the cost per screening.

Is screening with LifeLine the right choice for me? If you have a family history of strokes, high blood pressure, diabetes, obesity, etc. Then Life Line’s screening may be an option for you.

What does LifeLine Screen For

- Carotid Artery Disease

- Atrial Fibrillation

- Peripheral Arterial Disease

- Chronic Kidney Disease

- Type 2 Diabetes

- Cancer

- Osteoporosis

and much more!

LifeLine Screening Phone Number Contact Information

Address:

LifeLine Screening

Barton Oaks Plaza 2, Suite 130

901 South Mopac Expressway

Austin, TX 78746

LifeLine Phone Number:

(800) 718-0961

Related Articles

FAQs

1. Can you still get life insurance after a stroke?

Absolutely. While some providers might be hesitant, many insurance companies offer policies to stroke survivors, albeit with some conditions or increased premiums.

2. How does stroke severity impact my premiums?

Insurers often classify strokes based on their severity. A minor stroke or TIA (Transient Ischemic Attack) might have less impact on your premiums than a major one.

3. Are there any exclusions for stroke in policies?

Some policies might have specific exclusions or waiting periods related to strokes. Always read the fine print and consult with your insurance agent.

4. What if I’ve undergone rehabilitation after my stroke?

Rehabilitation can play in your favor. Insurance companies value efforts towards health improvement, and it can influence your rates.

Conclusion

Life after a stroke presents challenges, but securing life insurance doesn’t have to be one of them. By understanding how insurance companies view stroke survivors and exploring your options, you can find a policy that’s right for you.

Remember, every stroke survivor’s journey is unique, so it’s crucial to consult with an expert to find a policy tailored to your needs. Life insurance is about planning for the future – and with the right knowledge, that future can look bright.

Get started today by getting an online quote or call our team of experts at 1-800-380-3300.

More Life Insurance Resources