How to Save Over 50% By Stacking Life Insurance Policies

If you are curious on how to save over 50% by stacking life insurance policies, you came to the right place!

Life insurance is a necessity for many families, but it’s not always an easy decision to make. What if you’re already paying for a car or home insurance policy?

To help keep life insurance more affordable, we have created the Life Insurance Stacker Plan. This plan allows you to combine your current policies into one so that you can get both types of coverage at the same price!

This blog post will explore how combining life and property/casualty (P&C) policies together can save consumers money.

Layering Term Life Insurance

When shopping for life insurance the best strategy is to stacking life insurance policies to save money. Above all, these term life strategies are best for life insurance over 50 as this is the best time to do it for maximum savings.

Layering term policies can save clients tens of thousands of dollars. Also known as stacking life insurance strategy or ladder strategy. Overall, the laddered term life strategy is buying multiple life insurance policies with different term lengths.

As an independent life agent, I am focused on making sure my clients have enough life insurance to protect their families. The amount of life insurance they need today may not be the amount they need tomorrow.

For instance, as you get older life insurance rates to get costlier. Especially when you are purchasing life insurance over 60.

Also, as you get older, you’re at high risk of health impairments that can prevent you from getting the best rate.

These include high blood pressure, diabetes, heart disease just to name a few. So how can you have enough but don’t overpay years later for something you don’t need anymore?

The solution is layering life insurance policies!

Term Life Insurance Ladder

Bill needs about 20 times his income because his youngest is not even a year old. Based on his income of $50,000/yearly, he would need about $1 million.

In other words, if Bill dies anytime in the next few years, his paycheck dies with him resulting in leaving a family in financial disarray.

To achieve his goal of protecting his family and getting past retirement, we will price out a 30-year term.

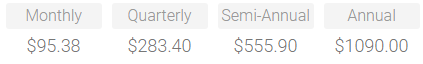

$1,000,000 30 year term in good health,

Total financial outlay over the next 30 years if he outlives the policy is $34,336.80. Now, remember, after ten years Bill already survived about ten years of his income.

Also, when his youngest graduates he would have outlived 20 years of his salary, so why pay for something you don’t need anymore. How about having 1 million in coverage for the first ten years.

Than $500,000 in coverage over the next ten years. Then when all kids are grown having $250,000 to get you through retirement.

Example Of Layering Policies

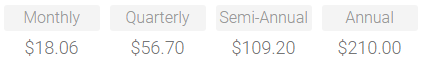

$500,000 10yr term, total financial outlay over ten years $2167.20.

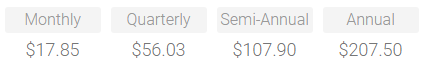

$250,000 20yr term, total financial outlay over 20 years, $2142.00

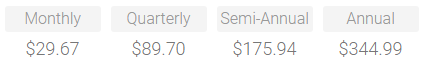

$250,000 30yr term, total financial outlay over 20years, $10,681.20

Total financial outlay over 30 years, $14,990.40

The Conclusion…

To compare, total monthly premium if Bill purchased a $1,000,000 30-year term would be $95.38.

- On years 1-10, with the layered policies total premium for $1,000,000 would be $65.58. That’s a savings of 29.80 a month, or $3,576 over ten years.

- On the 11th year, the ten-year term would expire, and your coverage would come down to $500,000 for the next ten years. However, your premiums would come down to $47.52. The total savings from year 11-20 is $6,103.20 over ten years.

- On the 21st year, the 20 year term would expire, and your coverage would come down to $250,000 for the remaining years of the 30 year term. However, your premiums would come down also to $29.67. This is nice because you’re coming up to retirement, total savings from year 21-30 is $7,885.20 over ten years.

Total savings over 30 years with the layered strategy is $17,564.40, about 51% compared to one policy for 30 years.

This strategy makes affordable life insurance a reality!

Now again, you buy term life insurance not for when you die, but if you die. You need to protect the loved ones that depend on you.

Layering Life Insurance Tips and Strategies

The life insurance ladder is a great way to save money and not paying for what you don’t need later on in life when your kids are grown and the house is paid off.

An experienced life insurance agent will present you with multiple level term policies, with different time lengths.

This enables you to save money to take care of your financial obligations and focus more on retirement planning. When you buy tiered life insurance you can use one insurance company or multiple life insurance companies.

Furthermore, you can use permanent life insurance as well in addition to term policies and universal life. The idea of the ladder strategy is to have the most coverage to protect your family in the most important decades.

As the decade’s pass, insurance decreases both face amounts and premiums. You see, as you get older, your financial obligations decrease with financial responsibility.

If you can get to social security age when all you need is the final expense taken care of and a little extra for the spouse.

Life Insurance Ladder Strategy

How to save money on life insurance with the ladder strategy?

When you are shopping to buy life insurance, it’s important to isolate the carrier that will have the best ladder life insurance quotes.

In recent years the ladder life insurance reviews have been unanimous!! It is such a commonsense way to protect your family financially.

You can go to an experienced independent agent or a company that specializes in a niche market like Fidelity Security Life Insurance.

Layering Life Insurance for Full Coverage

You can save over 50% on Term Life Insurance with a Layered Strategy

If I told you that you could save over 50% on your life insurance, would you be interested?

What if I told you that if you were shopping for life insurance in your 20’s, your 30’s, 40’s or 50’s that you would save tens of thousands of dollars.

Would you believe me?

How about a hundred thousand dollars? You want to know how to don’t you; it’s easy.

Below I will explain how a simple solution can put thousands of dollars back in your pocket. You will pay less, get more, and never pay for something you don’t need down the line.

Why would you need layered policies

That’s the million-dollar question. When you purchase a term policy, you want the most coverage for the most affordable term life insurance price.

In fact, the longer-term you buy, the costlier the rate is. That is because the longer you live the closer you are to mortality age or dying.

So, the layered policy strategy would give you the opportunity to lock in your age and health today.

Above all, not be committed to paying a higher premium for twenty or thirty years long after the “why” you bought it is gone.

More importantly, getting more coverage today, for a lesser cost, with the costs going down every ten years. Sounds too good to be true, right?

How Does Layered Term Life Policies Work?

First, instead of buying one term policy for 20 to 30 years, you buy multiple policies with different terms. Remember, the lower the term the most cost-effective life insurance coverage is.

Next, you must figure out exactly how much life insurance you need.

Thirdly, we must proactively figure out the most crucial time frame for that coverage. In fact, the most critical decade is the first ten years of the term.

Usually, that’s when you have children, buying a house, and getting established. Eventually, your kids will grow and the older they are, the less you need to protect them.

Because you are outliving income that you were protecting, make sense? On the day your kids will be all out of school, and it takes about 20 years until they are.

So, one question, do you need as much coverage when your youngest is in college than when he/she was in diapers?

Probably not, because the last 20 years you are making more money, you paid down your house, and usually, you don’t need to protect as much. Now the last decade is generally getting you to retirement.

However, should you be paying the same as you did when your kids were young and when you first bought your home?

The Layered Policy Strategy

Now I am going to show you how you can save tens of thousands of dollars over thirty years. For example, we have a 40-year-old couple names Linda and Bill that have been married for a few years and have children ages 4, 2 and a few months old.

So I always focus on the youngest, because that’s the person relying on the primary breadwinner the most. Bill makes $50,000 a year and has a small policy at work. Probably not enough to cover his family for more than one year.

So he wants to make sure he can have coverage well into retirement and beyond to adequately protect his family.

Layered Term Life Policies Video

Other Benefits Of The Layered Policy Strategy

This strategy works very well and here are some of the benefits of using it.

- Very flexible, and you can customize it based on your goals

- Savings of over 50%

- You purchased at an early age and optimal health

- You never pay for something you don’t need

This strategy also works well with people with health impairments like multiple sclerosis, heart disease history, elevated cholesterol or a cancer history.

By splitting up, the polices it enables you to put money back in your pocket where it belongs.

If you have any questions about the strategy contact us at 855-380-3300, or at pinnaclequote.com.

Related Articles

FAQs

Stacking life insurance policies involves purchasing multiple smaller policies instead of one large policy. This can sometimes lead to savings in premiums and greater flexibility.

Insurers often price larger policies at a higher rate. By stacking smaller policies, you may fall into lower pricing tiers, potentially reducing the overall cost.

While not universally common, it’s a strategy used by some individuals to tailor coverage to their changing needs and possibly save on premiums.

Both term and permanent life insurance policies can be stacked, depending on your coverage needs and financial goals.

Stacking is ideal for people whose insurance needs might decrease over time, such as after paying off a mortgage or when children become financially independent.

The savings depend on various factors, including the insurer’s pricing structure and the policyholder’s age and health. A 50% saving is possible but not guaranteed.

Managing multiple policies can be more complex, and if not done correctly, you might end up with gaps in coverage or overlapping policies that don’t provide the intended financial benefit.

Evaluate your long-term financial goals, coverage needs, and consult with a financial advisor or insurance expert to understand if this strategy fits your situation.

Yes, you can purchase policies from different insurers, which might be beneficial in terms of diversifying your coverage options and potential savings.

Your health at the time of each policy application will impact your premiums. If your health changes, it can affect the cost and availability of subsequent policies.

If your insurance needs change, you have the flexibility to adjust coverage by canceling or reducing one or more of the smaller policies.

Beneficiaries might have to file multiple claims in the event of your passing. It’s important to keep clear records of all policies and inform beneficiaries about them.

Stacking can be more complex with permanent life insurance due to cash value components. It’s best to discuss with a professional if considering stacking permanent policies.

Yes, but keep in mind that life insurance generally becomes more expensive as you age, so starting earlier might be more cost-effective.

Conclusion

Get a quote for life insurance now and put your mind at ease! Have you stacked term policies to maximize savings? If not, it’s best to do so while the costs are still low.

Contact us today or get in touch with one of our agents through phone or email if you have any questions about how stacking can work for your needs. We’re here to help make this process as easy and painless as possible.

What’s been your experience when shopping around for life insurance quotes? You should never hesitate to ask an agent a question because they’ll be happy to answer them. How has “stacking” helping you save more money on a policy that meets all of your needs?