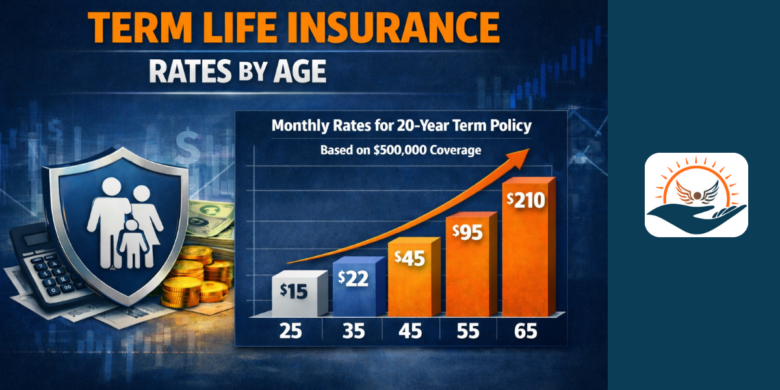

Term Life Insurance

Compare Level Term Rates Nationwide

Term life insurance is the most efficient way to protect income, debts, and family needs for a set period of time. At PinnacleQuote, we shop top-rated carriers to match your health, budget, and goals with the right term length and coverage amount. Use this page to understand how term works, see sample rates, and explore your best options in one place.