Affordable Life Insurance Over 60

If you are looking for an affordable life insurance over 60, you came to the right place!

As a senior, it is important to plan for the future and take care of your loved ones. One way to do this is by purchasing life insurance over 60 years old.

This blog post will provide you with some information about how affordable life insurance can be for seniors who are over 60 years old.

The following points should be addressed in order: what are the benefits of buying life insurance after age 60; why buy at age 60 or older; how much does it cost per month; and finally, where to go for more information on this topic.

Life Insurance For Seniors Over 60

Do I need life insurance after 60?

It’s never too late to buy life insurance. You may be surprised at how many people over the age of 60 are looking into life insurance policies.

While it’s true that many people over the age of 60 are already insured by previously purchased policies. Also, you must remember that for anyone who bought term policies in their 30s, 40s, 50s, terms run out around this time.

Although over the age of 60 don’t usually have people that are financially dependent on them. For example, (Insurance for a person in your 30’s).

Furthermore, there are still many reasons why people in this age range may want to get a term life insurance plan. Even a 20-year term. We’ll go over some of these reasons below.

The Problem:

When you are in your 60’s the type of life insurance that you purchase is as important as actually getting affordable life insurance.

Furthermore, when you are in your sixties you are close to retirement so having the need for life insurance is not as great as when you were younger or when your kids were still in your home.

At this age your body starts to break down, you may have a health condition or you might be taking blood pressure or cholesterol medications. Or maybe even metformin for diabetes.

The bottom line, coverage only gets more pricey especially in your 60’s and 70’s.

The Solution:

At this age, you have to be aware of being on a fixed income at retirement. So you want to be able to purchase affordable life insurance over 60 and the best life insurance over 60 that money can buy!

Moreover, you have to choose what you need the coverage for. Is it for funeral costs? Do you want it for a number of years or do you want permanent life insurance?

You have to make sure you have peace of mind and you can afford the monthly premium.

Best Value Life Insurance For Over 60s

Over 60 insurance plans will start to creep up in price. In fact, the earlier you get it the more money you will save in retirement.

You are not too late, the best life insurance deals for over 60 can still be had. The key is finding an independent agent that knows where to find the best life insurance policy for over 60.

As you will see below, over 60 life insurance quotes can change year by year. Over 60 insurance is best purchased NOW rather than later.

The best value of life insurance in your 60’s will be term life. This will work best in covering your debts like a mortgage. In fact, this will protect your family from financial hardship upon your death.

In addition, every term policy we offer to our clients can be converted at the end of the term or age 70, whichever comes first.

Best Life Insurance For Over 60

Once you hit your 60’s it is about time to lock up over 60s life insurance before a health issue arises. There are many options such as life insurance over 60 no medical questions.

These policies can be very convenient as they have minimal underwriting. In fact, it is usually a basic background check and a prescription check. Above all, this is one good way to get affordable life insurance over 60.

The best thing to do initially is to talk to an independent life insurance agent. This type of professional will guide you to the best life insurance quotes over 60.

Affordable Life Insurance for Seniors Over 60

Getting affordable life insurance coverage when you are in your 60’s is achievable but you need ACT NOW!! Over 60 insurance plans only go up in price!

Above all, it is important to understand the rate increase between age 60 and 70. Insurance for over 60’s will jump up 300% in one decade.

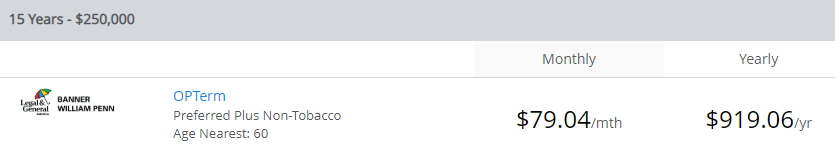

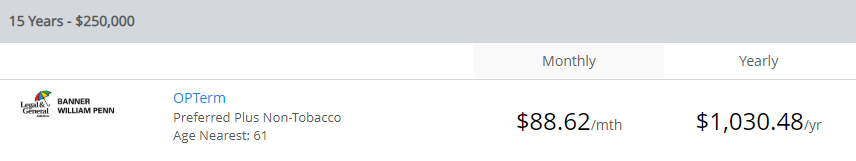

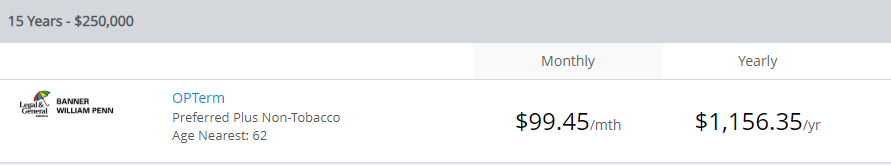

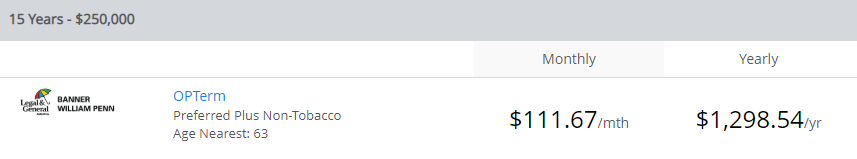

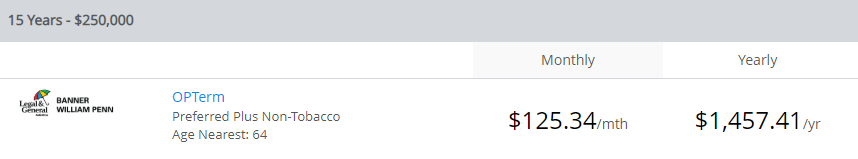

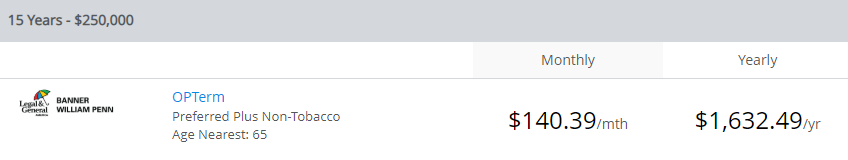

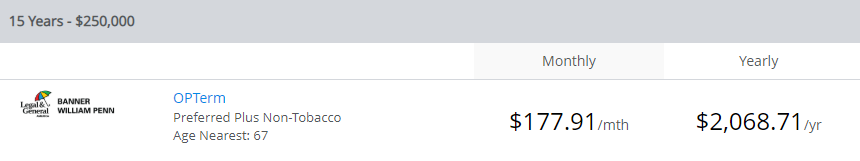

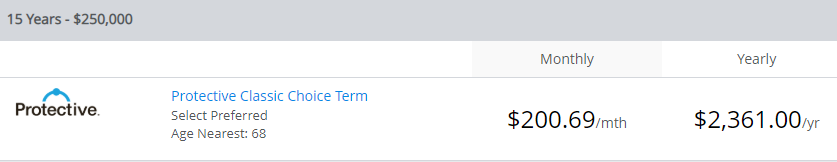

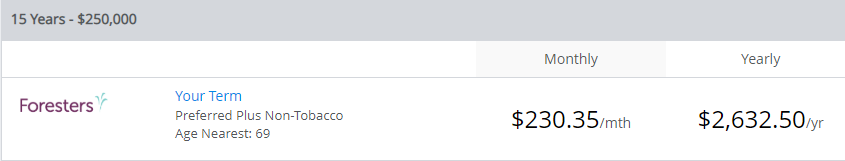

Here are the rates on $250,000 15yr term for age 60-69, year by year for a healthy male that qualifies for the best rates.

Looking for Life insurance for age 60

For Life insurance for age 61

If you are Age 62

Life Insurance For Age 63

Life Insurance For Age 64

Insurance For Age 65

Life Insurance For Age 66

If you are Age 67

Life Insurance For Age 68

Life Insurance For Age 69

You can clearly see that life insurance quotes for over 60 drastically increases between the age of 60 and 70. AT age 60 the rate for a $250k 15yr term is $79.04/month compared to $230.35/month at age 69.

That’s a 291% increase because of age!

Furthermore, if you are shopping for life insurance for people over 60 then there is no better time than now!

Term Life Insurance For Seniors Over 60

Buying a term life insurance over 60 is very important. At this age, you want to fill gaps such as making sure the mortgage is paid for or making sure the spouse will be ok in the event of your death.

However, at this age what is the best options for getting life insurance policies for over 60?

Term life insurance for seniors over 60 may be a great option, here are the pros and cons of term life insurance over 60 years of age.

Term Life Insurance Over 60

Life insurance in your 60’s can still be affordable. But you need to act now!

Pros and Cons of Purchasing a Term policy in your 60’s.

Pros

- Affordability

- Level Premiums

- Larger Face Amounts

- Income Replacement

- Conversion Before 70

- Simple to Understand

Cons

- Outlive the term

- No Cash Value

- Limited Conversion Capabilities

- Health Issues after term is up

- No extended coverage

- Rates increase after a term

Term Conclusion

Again, buying a term policy will be the most cost-effective way to protect your loved ones from a financial burden. These can be very affordable over 60 life insurance plans.

As there are “no medical exam terms” available up to age 65, you will get a better price for a medical exam life insurance policy. So if you need the best price and you are healthy then a term policy is the right policy for you.

Whole Life Insurance For Seniors Over 60

If you are in your 60’s and looking for life insurance then chances are it’s more so going to be for final expenses. At this point, your kids are grown, your mortgage is paid off and you are living off retirement and/or social security.

The only thing left, usually is to make sure you are not a financial burden on your kids when you pass away.

If you are not buying a traditional whole life insurance policy then you are looking at a final expense or a burial policy. These are basically small whole life insurance for over 60.

What to avoid!

You may see some companies on late-night TV offering you burial insurance such as AARP/New York Life, Colonial Penn, and Lincoln Heritage.

Beware of these companies as they offer hybrid products and their rates don’t compete with the best rates available.

Even if you are or have severe health issues, we can still offer a guaranteed issue whole life that is great life insurance over 60 no medical questions!

Whole Life Insurance For Over 60

Buying whole life insurance over 60 years of age can be expensive. However, if it is for final expense or burial in might just be the best option.

Pros and Cons for whole life policies in your 60’s

Pros

- Level Premiums

- Guaranteed Death Benefit Until age 121

- Cash Value

- Rates never go up

Cons

- More expensive than term life

- Limited on face amount, usually less than $50,000

- Not convertible

This type of policy is great if you are just looking to cover final expenses and funeral costs.

Reasons For Life Insurance Over 60

To protect their pension, fill the gap!

One of the major stresses for people as they get older is living long enough to receive their pension. Besides, life insurance plans often purchased to protect one’s retirement.

Primarily, in the event that they pass away early. Likewise, affordable term policies are widely available, even for those above the age of 60.

Of course, policies will still be far more expensive than for those that are younger, or in better health. In some cases, a guaranteed universal life policy may be the cheaper option.

They are also more convenient; guaranteed universal life policies that do not require a medical exam. In fact, it’s easy to get approved for life insurance, and it may only take a few days after applying for coverage to begin.

Life insurance after 60 years old

Maybe Due To A Marriage…

Above age 60, new marriages are not uncommon. A lot of people get remarried at this age, whether it be after divorcing their last partner, or possibly their spouse had passed away.

In the case of a new marriage, seniors over 75 often want to purchase life insurance to protect their husband/wife. After all, they don’t want to leave someone in that age range to pay for their final expenses. Ultimately, costs around $10,000.

It can be difficult for people over the age of 50 to get approved for life insurance, but it’s still very possible. Thanks to advancements in medicine, people are living a lot longer. Thus, means insurance agencies are more willing to insure older people. There are many options, products and services to help protect your family. You want to ensure that you shop around for the best life insurance rates.

At this age, you may not have small little ones dependent on you financially. However, you want to ensure that God forbids something happens to you, your family does not take on that financial burden at such a devastating time.

Your family will receive the death benefit to cover your funeral, pay off the mortgage, or even pay your credit card debt if any.

Your independent life insurance agent will be able to guide you in the right direction. Provide you with the top carrier choices, at the best rates.

Big question is, when do you no longer need life insurance? Depending on your financial situation, that will determine whether you need it. Most carriers will not offer you insurance over 85!

4 Reasons You may need life insurance when you retire (VIDEO)

How Can Someone Over The Age Of 60 Get The Cheapest Rates On Their Life Insurance?

Being over the age of 60, you’re most likely a high risk applicant by life insurance companies. There’s no reason to add to these high prices with other things that will raise your rates.

Below, we’ll go over some of the things you can do to get the cheapest life insurance prices possible:

Compare Rates, this is one of the best ways to save money on life insurance. Each life insurance company will have different underwritings. This means that your perceived level of risk will vary from company to company. Comparing life insurance companies is particularly important for people over the age of 60.

First, certain companies will be willing to offer you an affordable policy. Second, while other companies may straight up decline your application. Improve your general health, by proving yourself to be in good health at the medical exam; the outcome will be lower insurance rates.

Before you apply, get in the habit of exercising and eating healthy. You can also take measures to lower your blood pressure and lose excess weight.

Do You Need Life Insurance After You Retire?

Many clients ask this question, it’s kind of a tricky question. Many people give up their policies at retirement age. Children are grown and have their own families. You have no debt.

However, all things considered at this point it is best to have a final expense/burial insurance policy in place. Like we mentioned above, you don’t want to leave your grown children and your family financially burdened at such a devastating time.

The average burial here in the state of Florida is around $10,000. We usually recommend doubling that to have enough for all funeral expenses and maybe leave a little something extra for family.

Call your insurance agent today to ask him/her all about final expense insurance.

Related Articles

FAQs

What are the best affordable life insurance options for people over 60?

For those over 60, term life insurance can be a cost-effective choice, offering lower premiums for a specified period. Whole life insurance, while more expensive, provides lifelong coverage and builds cash value, which can be beneficial for estate planning or as a financial safety net.

Can I still get term life insurance if I’m over 60?

Yes, you can still obtain term life insurance after 60, though premiums may be higher compared to younger ages. It’s important to compare different policies to find one that balances affordability with adequate coverage.

How does whole life insurance benefit those over 60?

Whole life insurance offers permanent coverage with fixed premiums, making it a stable choice for those over 60. It also includes a savings component that accumulates cash value over time, which can be borrowed against if needed.

Are there any specific considerations for over 60s when choosing between term and whole life insurance?

When choosing between term and whole life insurance, individuals over 60 should consider their long-term financial goals, health status, and the need for cash value accumulation. Term life might be preferable for short-term, lower-cost coverage, while whole life offers lifetime coverage and can be part of a broader estate plan.

Conclusion

It’s never too late to buy life insurance. You may be surprised at how many people over the age of 60 are looking into life insurance policies, and you should take a look as well!

If you aren’t sure where to start or what kind of coverage would work for your needs, we can help.

Get started today by getting an online quote from us. We will find a policy that is perfect for your situation so don’t wait any longer – call us now!