Affordable Life Insurance For Over 40

If you are looking for an affordable life insurance for over 40, you came to the right place!

This blog post is for all of you who are over 40 and need a life insurance policy. If you’re not sure what your needs are, we’ll help answer any questions about how much coverage you may need.

We hope that this information helps to guide you in the right direction so that when it comes time to purchase a life insurance policy, there will be no surprises on your end.

Table of contents

Life Insurance in your 40’s

You’re 40? No life insurance? Your family is at Risk – Let’s Talk!

Time waits for nobody. Let’s begin.

Affordable life insurance quotes can still be accomplished when shopping for over 40’s life insurance. However, a 40 year term life insurance policy will start to creep up in rates as at this age mortality ages for women (81) and men (77) are within 40 years.

Furthermore, the least expensive life insurance policy will be a 10 year term. But it is important to realize that life insurance rates by age vary!

Let’s dig in and look into the best life insurance in your 40s.

So here you are, you are not 25 years old anymore. Age 50 is right around the corner. While you are still in good health and hopefully free of any medical condition, now is the time to be buying life insurance.

Especially since you put it off for so long. We are all guilty of it, but time waits for no one! The longer you wait to get life insurance, the higher the prices. It’s time to put a financial plan together to protect your family.

Should I Get Life Insurance In My 40s?

Affordable life insurance over 40 is still in reach, you don’t want to wait until your 50s to get coverage. Applying for cheap term life insurance right now and getting the best life insurance premiums is your best option.

Why? There are so many things that you may need to cover when you compare term life insurance in your 40s. In fact, the period of time is now to get affordable over 40 life insurance.

Consider the list below:

- A house mortgage

- Any debts that you don’t want your loved ones to inherit

- Special occasions you may want to fund, like weddings or graduations

- Children’s college tuition

- Final expenses (these can cost about $10,000)

- To replace your income

- lump sum to the beneficiary to pay off funeral expenses

Deciding how much life insurance to buy definitely requires a lot of calculations as it varies by age. However, one thing is for sure: without life insurance, your family is at risk.

In your 40s, cheap life insurance policies are still possible, and affordable! When you start getting up in age, let’s say 50 to 59, our health changes. We are now older.

Your 20-year term policy that would have cost you $30.00 a month, is now going to be higher as you age and your health changes. Call today, a PinnacleQuote agent will help you get the most affordable term life insurance.

Why You Need Life Insurance Over 40 Years Old?

Buying life insurance in your 40’s you usually have something to protect. In fact, at this age, you are not worrying about student loans. However, you usually have a family, a mortgage and you have many that rely on you financially.

In addition, to protect your family is still very affordable. For instance, life insurance premiums are still really low on the 30 year term. Getting term life insurance would be the most affordable life insurance. Overall, term life insurance rates will determine the length of the term and the amount of coverage.

For example, term life insurance rates for 45 year old male will be 25% cheaper of those at age 49. Also, you will need to take a medical exam if the death benefit is over $100,000 with most insurance companies.

With that said, if you are looking for life insurance coverage at age 45, you might only need a 20-year term. For instance, you will have coverage for 20 years and it will take you to age 65. Above all, at this age, you are probably an empty nester and you won’t need as much coverage.

Also, keep in mind, life insurance for 45 year old female will be cheaper than a 45 year old male. Because of the difference in mortality ages, life insurance quotes will be cheaper and different with every life insurance company.

Best Type of Life Insurance for a 40 Year Old

The most affordable options…

First, you’ll need to decide if you want a long term policy to consider a permanent life policy or a term life policy. A term life policy is more basic, simply providing death benefit coverage.

However, it is also the cheapest type of over 40’s life insurance. It will cover you with a temporary amount of time; usually, you choose from 5, 10, 15, 20, or 30 year term of coverage.

Some carriers will offer a 40 year term life insurance rates.

A permanent life policy will cover you for your entire life. On top of this, permanent life policies have options for cash value build-up.

However, these plans can be significantly more expensive than term life plans. There are many different kinds of life insurance policies to consider.

Life Insurance Over 40 No Medical Exam

Being age 40 in the middle of the road based on mortality statistics. If you take good care of yourself then you should not have a health problem.

However, most people do not. This is the decade when health impairments like diabetes may creep up on you.

Furthermore, this is also the last decade to get really good life insurance rates. In fact, no exam life insurance is still affordable, and underwriting is still lenient.

Here are some of our best no exam carriers:

- Sagicor (Up To $1 million)

- SBLI ($500k)

- Nassau RE [Formally Phoenix] ($500k)

- Foresters ($400k)

- Assurity ($350k)

- American National ($250k)

- Mutual of Omaha ($300k)

What Is The Average Life Insurance Cost Per Month?

Many clients ask us, how much does over 40 insurance cost monthly? That is hard to answer. Why? You have to look at it this way, rates will depend on the following factors:

- Age

- Health

- Lifestyle

- Family history

No one person is the same. Life insurance is NOT a “one size fits all.” For instance, a 40 year old will have a cheaper rate than say a 49 year old.

The best way to determine the price per month with the best A+ rated carrier is to be in touch with your independent agent. They will be able to guide you throughout the entire process.

Life Insurance Rates for Age 40-49

Below we will show the best rates available for each rate class for a $250,000, $500,000, $750,000 and a $1,000,000. In addtion, we will show this for both male and female.

40 Year Old Male

| Rate Class/Term | $250,000 | $500,000 | $750,000 | $1,000,000 |

|---|---|---|---|---|

| Preferred/10yr | $14.67 | $22.88 | $31.46 | $36.12 |

| Standard/10yr | $18.61 | $31.10 | $43.58 | $56.07 |

| Preferred/20yr | $21.27 | $33.81 | $47.69 | $60.86 |

| Standard/20yr | $30.65 | $55.17 | $79.70 | $104.22 |

| Preferred/30yr | $33.23 | $59.31 | $86.80 | $111.99 |

| Standard/30yr | $52.51 | $96.36 | $143.65 | $181.65 |

40 Year Old Female

| Rate Class/Term | $250,000 | $500,000 | $750,000 | $1,000,000 |

|---|---|---|---|---|

| Preferred/10yr | $13.18 | $19.78 | $28.13 | $30.10 |

| Standard/10yr | $16.97 | $27.81 | $38.33 | $53.54 |

| Preferred/20yr | $18.64 | $30.14 | $42.40 | $52.95 |

| Standard/20yr | $26.28 | $44.41 | $65.86 | $81.43 |

| Preferred/30yr | $27.48 | $47.46 | $69.44 | $88.87 |

| Standard/30yr | $41.11 | $74.18 | $110.00 | $140.80 |

41 Year Old Male

| Rate Class/Term | $250,000 | $500,000 | $750,000 | $1,000,000 |

|---|---|---|---|---|

| Preferred/10yr | $15.87 | $24.64 | $34.10 | $40.42 |

| Standard/10yr | $20.85 | $35.58 | $50.31 | $65.03 |

| Preferred/20yr | $23.03 | $36.76 | $52.11 | $66.66 |

| Standard/20yr | $33.12 | $60.11 | $87.10 | $114.09 |

| Preferred/30yr | $36.31 | $65.47 | $94.97 | $122.55 |

| Standard/30yr | $56.80 | $104.74 | $156.38 | $198.09 |

41 Year Old Female

| Rate Class/Term | $250,000 | $500,000 | $750,000 | $1,000,000 |

|---|---|---|---|---|

| Preferred/10yr | $14.07 | $22.44 | $30.11 | $36.52 |

| Standard/10yr | $18.82 | $31.52 | $43.84 | $56.42 |

| Preferred/20yr | $19.44 | $32.76 | $45.66 | $57.06 |

| Standard/20yr | $27.44 | $47.38 | $70.52 | $87.15 |

| Preferred/30yr | $29.26 | $51.55 | $74.74 | $95.77 |

| Standard/30yr | $43.49 | $78.73 | $116.91 | $149.67 |

Who Has The Best Life Insurance Rates Over 40?

Let’s talk carriers!

- Banner Life

- Prudential

- Protective (Great Customer Service)

- AIG

To name a few! Each carrier will look at you differently. There is no “one size fits all” in life insurance.

Your independent agent will be able to tell you each carriers unique characteristics and based on your lifestyle, age, medical history he/she will know which company will be the best fit financially!

Best Life Insurance For A 40 Year Old Women

The cost of life insurance for 40 year old female is cheaper than it is for males. The fact is, women live longer. Their life expectancy is greater. Could be that we are just stronger in general!

For a woman in good general health. At this age, now is the time to consider a policy as it will never be as cheap as it is right now. As you age, the rates will increase.

A whole life insurance policy for a 40 year old female is much more expensive. Below are the cheapest term life insurance rates and whole life comparisons:

Face amount $500,000: healthy non – smoker.

Term Life – $25.25 a month with Banner Life.

Whole Life – $543.99 a month with Foresters.

To summarize the question, What is a better term or whole life insurance? Definitely term life is better at this stage of life. Why? Whole life is geared towards seniors, for their final expense and burial policies.

Best Life Insurance For A 40 Year Old Men – Smoker

Quotes for life insurance for a 40 year old male will be slightly different than that of females. Smoker vs. Non-Smoker rates.

As you can see below there is a significant difference in rates. Banner Life is an excellent company to turn to for smokers as they are best in rates.

Always be honest when filling out your application. You will be taking a para-medical exam most likely. So it will show up in a blood/urine test.

How much is a $500,000 life insurance policy? See life insurance quotes below:

40 year old Non Smoker Rates

40 year old Male Smoker Rates

Guaranteed Acceptance Life Insurance Age 40

If you have been turned down or declined for health issues then guaranteed life insurance over 40 might be your only option.

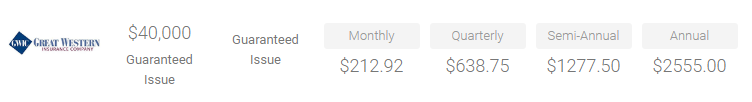

There are two companies that offer a guaranteed issue life insurance policy for 40-44 year old. The first company is Great Western Insurance Company (GWIC).

With this policy, a graded death benefits the beneficiaries will receive the first 2 years of which all premiums paid will be refunded plus 10%. After the waiting period, the company offers the full death benefit.

The second, Prosperity Life has their Prime Term 100 that has 3 questions, as long as you are not terminal of less than 24 months, confined to a nursing home or hospice and or diagnosis of any cancer the last 24 months, you are covered!

These require little to no health questions and the Great Western will cover the terminally ill.

Once you hit age 45, in some states AIG will offer you a guaranteed issue life insurance policy! Then Gerber finally at age 50. Most GI carriers offer it at 50 years of age and over.

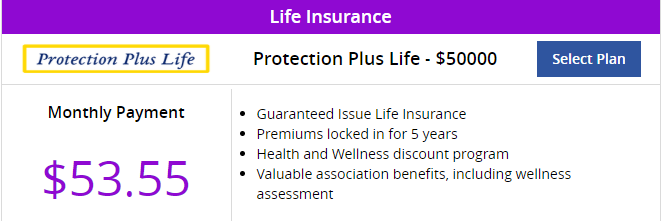

Since recently there was no guaranteed acceptance policy in your 30’s. Most would have to go with an accidental death policy which does not cover illness. We now have a 5-year renewable term that is guaranteed acceptance. The carrier is Protection Plus.

Here are some examples of a Guaranteed Acceptance Life Insurance age 45:

Age 35, Protection Plus Life, offers Guaranteed acceptance 5 yr renewable term.

Guaranteed Acceptance Life Insurance Under 40

When it comes to guaranteed acceptance life insurance under 40 the products available are very limited to a handful of carriers. I will talk about the ones I use. In this case, a graded benefits policy might have more of a broader range of availability.

With that said, I am not a fan that insurance carriers limit these products to under 40 even though it’s based off mortality risks.

Here are the carriers I look to for under 40 guaranteed acceptance:

- CFG

- Senior Life

- Pekin

- Nationwide

- United

- NGL

Protection plus Life has a product I consider my go-to under age 40.

- Anyone age 18-75

- $10,000-$50,000

- 5 Year Renewable

- Convertible

- Modified Death Benefit years 1-2

Cheap Term Life Insurance Quotes For People In Their 40s

Term Life Insurance is quite a popular choice

So, you purchased term life insurance, now what? Whether it be a 20 year term, 30 year, here is what you need to know. Term life insurance is a popular option for people in their 40s.

At this age, it’s still quite possible to find an affordable policy that offers solid financial protection for your family. Below, we’ll give a few tips on how to get the cheapest life insurance rates possible on your coverage:

- Compare rates — one of the best ways to save money on life insurance is to simply receive several quotes from the top life insurance companies. By doing this, you can compare prices, and potentially save a lot of money on your policy. You can find affordable life insurance!

- Hire an independent insurance agent — an agent can help connect you with the best life insurance companies that are more likely to offer you the lowest rates. Your agent will guide you with the amount of coverage you will need to purchase based on some health and lifestyle questions. In addition to your age, children’s ages, mortgage, income, etc. They’ll know which companies have more lenient underwriting, so you can get a lower quote, despite age or health conditions. As a person in their 40s, they can assist you in getting the lowest rates for your age.

- Quit tobacco products — cigarette smokers can expect to pay 2 to 3 times more for their life insurance than nonsmokers. Quitting just a year before applying can cut your rates in half.

- Take measures to improve your general health — unless you go with a more expensive no medical exam policy, you’ll need to get a physical so that the life insurance company can assess your level of risk. Obviously, you’ll want to make a good impression by being as healthy as possible for the medical exam. So, eat healthier, exercise more, take measures to lower your blood pressure, etc.

Rate Comparison Charts

Don’t put life insurance on the back-burner! The price will increase as you age.

Below are the price difference if you keep putting off getting life insurance.

Term life insurance 40 year old male

Cost of term life insurance at age 45

Life insurance for 49 year old male

As you can see above, there is a difference from age 40 to life insurance over 45 to age 49. The importance of putting an affordable life insurance policy in place NOW is important.

By putting life insurance off, because you think you have time, is a gamble on your family’s future. And it most certainly shows that as you age, the price increases! ACT NOW!

When shopping for a term life insurance rates for 45 year old male that has a goal of getting to the retirement age of 65, 20-year-term life insurance will be the most affordable to meet your goals.

Getting the best life insurance for 45 year old male/female will obviously be a little different in price. Whereas life insurance for 45 year old male will be more expensive.

What is the least expensive form of life insurance?

The answer to that is simple. Term life insurance would be the least expensive and most cost-effective at this stage of life. There is no cash value in term life.

This type of life insurance will expire technically before you would be expected to pass away. However, when it does expire, at that point, you could renew for another term policy.

Life Insurance Quotes Over 40

Now is the time to get over 40s life insurance. Premiums go up every year you age. Rates triple by the time you are in your 60’s! Where do you begin?

Often times our clients start out googling for quotes via State Farm life insurance. And although they are a wonderful company, they are most affordable for your auto and home insurance.

In fact, quite often, they try to bundle you a package deal. It will end up costing you even more.

I took it upon myself to get a quote from State Farm to compare quotes. See below….

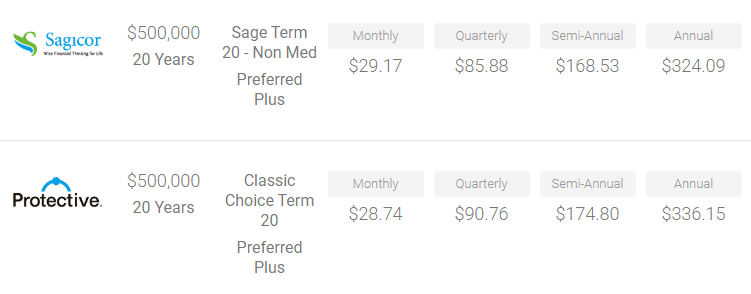

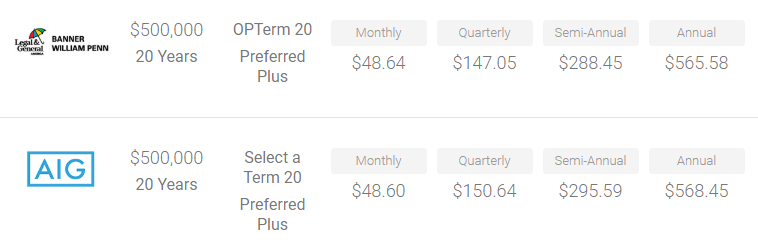

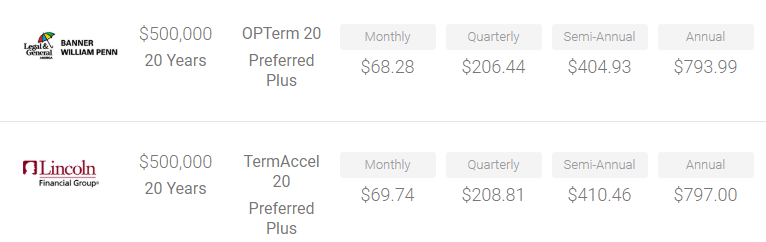

State Farm Insurance Vs. Protective and AIG examples

Now, there may not seem like a huge difference here. Based on my stats. 4’11, 111lbs at age 45. Non-Smoker Preferred at a face amount of $500,000. That is over a $90 dollar savings per year! In the world, we live today, life, families, groceries… That $93.00 is a HUGE saving!

What term length should I buy?

Good question.

For those 40 year old, we recommend a 30-year term policy, if possible. As long as you can afford it, it’s always better to pay for longer coverage. With modern medicine, people are living for much longer.

Life insurance for seniors over 75 is more attainable then recent years. You don’t want to buy term life insurance in your 50’s because it will be far more expensive.

In fact, you may even want to consider a whole life policy. You can read about term life vs. whole life policies and decide for yourself.

The most important thing, though, is that you do get life insurance coverage and that you get the best rates based on your age and health.

It’s never too late or too early to buy affordable life insurance. Don’t wait. Get it while it’s still cheap and hopefully before you are diagnosed with any health issues, like diabetes.

You’ll save a lot of money on your policy if you get it while your still young and still healthy.

It is not too late to purchase life insurance

In fact, now is the time.

I guess for many people the thought of death makes them avoid the subject of life insurance altogether. I get it. Who wants to talk about death?

The truth is, you are thinking of it all wrong. We are talking about the “living”. The family you leave behind. The family who depends on you financially.

Like we mentioned earlier, when you die, your paycheck dies with you. When this happens, your family has nothing to fall back on financially.

They look to “go fund me” to cover your funeral. That is fine and all. However, if they get the cost covered, what happens next.

What about the mortgage, college, food, living the life you envisioned for them? This is what life insurance covers! Even, helps pay off your outstanding student loans,

You must understand, it isn’t always just a question of what is the best life insurance to get. It is when is the right time to get it. That time is NOW!

Life insurance will not be as cheap as it is today. For the mere fact that as you age, rates increase. The longer you put purchasing life insurance off, the greater the risk of leaving your family financially crippled in the event of your death!

FAQs

Key factors include age, health status, medical history, lifestyle choices (like smoking), the amount of coverage, and the policy type.

Term life insurance is often more affordable and may be sufficient for specific needs, like covering a mortgage. Whole life insurance provides lifelong coverage and a cash value component but is more expensive.

Coverage should be based on financial obligations, including debts, living expenses for dependents, and future plans like retirement savings or children’s education.

Pre-existing health conditions can affect rates, but maintaining a healthy lifestyle can help mitigate some of these impacts.

Securing life insurance at this age can provide peace of mind, financial security for your family, and can be a component of your overall financial strategy.

Consider your financial goals, the needs of your dependents, potential future expenses, and the type of policy that best suits your situation.

Compare quotes from different providers, choose a term that aligns with your needs, and consider a policy with a lower benefit amount if it’s sufficient for your needs.

While there aren’t specific products only for over 40s, many policies are designed to be flexible to cater to the needs of individuals in this age group.

It’s never too late to get life insurance. While premiums may be higher than they would have been at a younger age, the benefits of having coverage can still be substantial.

Related Articles

Conclusion

You may be surprised to find out that the majority of people who are looking into life insurance policies are over the age of 40.

If you’ve been putting off buying a policy, it might be time to get one! Get an affordable quote today and see what kind of coverage is available for your budget. Contact us if you have any questions or need help getting started with your new plan.