Cheap Term Life Insurance For Women 2024 Guide

Many are not aware that they can get cheap life insurance for women, which is great peace of mind. The process of getting the coverage was very easy and hassle-free.

I am so glad I did this because it’s one less thing to worry about in my retirement years!

Article Navigation

- Term Life Insurance Quotes For Women

- Affordable Term Life Insurance For Women

- Great Life Insurance Companies For Women

- Affordable Life Insurance Quotes For Women

- One Million Term Life Insurance For Women

- Life Insurance For Women ‘No Medical Exam ‘

- Life Insurance For Pregnant Women

- Stay At Home Mom Life Insurance

- Low-Cost Life Insurance For Women

- FAQs

- Conclusion

Term Life Insurance Quotes For Women

Women – The Glue that Holds the Family Together

Getting Cheap Life Insurance for Women is a must! Many people believe the misconception that life insurance is only essential for men.

However, life insurance is important for every adult with dependents. Even stay-at-home mothers are advised to get cheap term life insurance.

If any of your loved ones would suffer financially if you passed away, then you should think about getting life insurance. There is nothing more rewarding than protecting your family.

Which is a better term or whole life insurance?

- Term Life Insurance ~ provide your beneficiary/beneficiaries a death benefit if you die during a specified term

- Whole Life Insurance ~ builds cash value that you can use at a later point in life if you choose to. It also will add to the death benefit pay-out to beneficiary/beneficiaries.

Although more expensive than a traditional term policy, some people choose a return of premium policy. If you end up not needing your policy, you will get a refund of your premiums. Ask your independent life insurance agent if this should be an option to consider for you and your family.

Before deciding on a policy, you need to know the details and differences between term life insurance vs. whole life insurance. Below, we’ll debunk the notion that stay-at-home moms do not need life insurance.

Affordable Term Life Insurance For Women

Low-cost Life Insurance for Women For Stay at Home Moms/Homemakers

Life insurance is not only just for the primary breadwinners. Here’s why!

People assume that those that do not bring in an income do not need life insurance.

However, this is simply not true. The estimation is that the average amount of work that a stay-at-home mother/homemaker puts in is worth over $100,000 annually. This includes

- housekeeping

- cooking

- psychological support

- teaching

- driving the children

- caring for the children

As you can see, stay-at-home mothers are extremely valuable to a home. Replacing these duties is very costly, especially when considering the children. Life insurance is a great investment — it’s the best way to protect your family in the event that you pass away.

Do Men or Women Pay More For Life Insurance

How does affordable life insurance for women compare to life insurance for men?

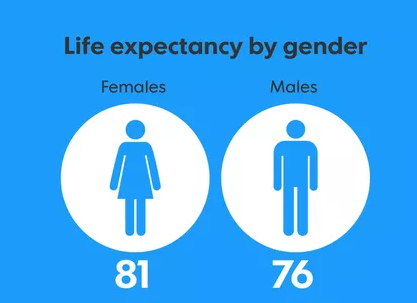

Did you know? Women have a longer life expectancy than men.

Life insurance is actually cheaper for women. This is because mortality tables show that women tend to live longer than men (by an average of about 5 years).

They also tend to develop serious health conditions, such as heart disease, significantly later in life. Add it all up, and it means cheaper life insurance rates for women.

Great Life Insurance Companies For Women

A few of the cheapest term life insurance companies.

Many clients ask, who has the cheapest life insurance? Below are just a few of the Top Rated A+ carriers that we would recommend who do offer affordable life insurance plans. With that being said, it is always best and advisable to speak with an independent life insurance agent. Why?

Because every client is different. From Health impairments, age, family, lifestyle, etc. Every carrier will look at you differently. At PinnacleQuote, we will tailor-make you a policy that fits you and your family’s needs. We work for you, not the insurance company. Our goal is to help you make the best choice!

- Banner (Especially for Smokers)

- Protective

- AIG

Affordable Life Insurance Quotes For Women

How much life insurance do I really need?

Life Insurance will not get any cheaper than it is RIGHT NOW. Here is why.

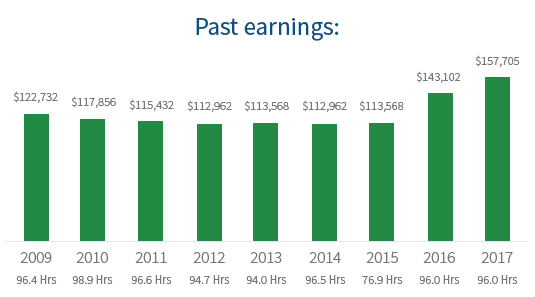

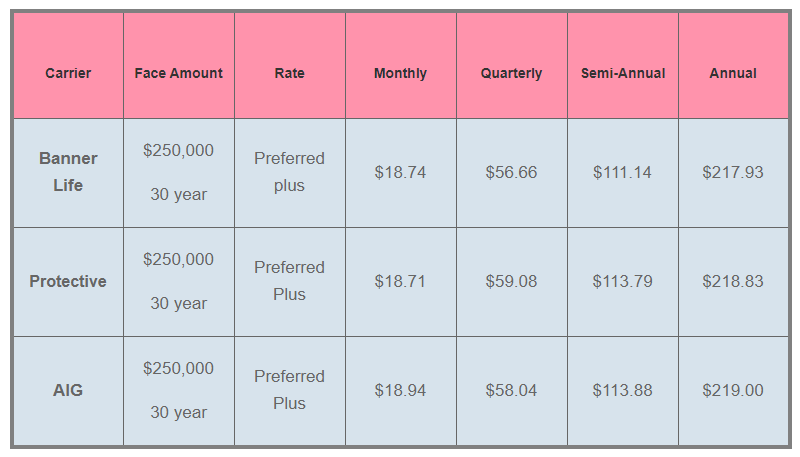

For a healthy 34-year-old woman, as you can see below, finding cheap term life insurance for women is quite easy and affordable. Remember, what you put off today, will cost you tomorrow in one way or another. By that I mean, we as humans tend to put things on the back burner. I get it, life is busy!

However, by you doing this, each year that goes by, and your age, your life insurance rates will go up! Don’t fall into the way of thinking, “you have time”. Because honestly, you do not.

Life insurance is for your children, Not you. You die, your spouse dies, YOUR PAYCHECKS DIE WITH YOU.

Put a life insurance policy in place NOW, while you are young and know that your children’s future is secure in the event of your death. When you have affordable life insurance rates such as below.

To have that peace of mind, knowing that your children’s future will be OK. That feeling is PRICELESS.

Term life insurance rates for a 34-year-old healthy female/homemaker:

One Million Term Life Insurance For Women

You need one million dollar policy for women and young families

Here’s why…

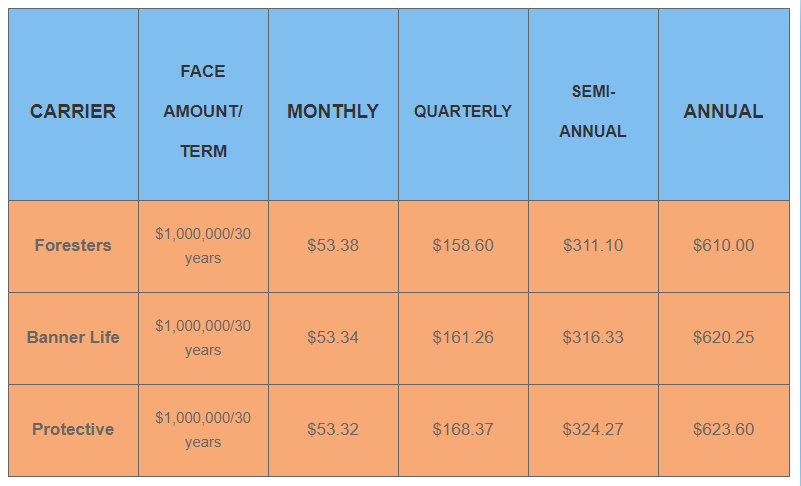

I bet you are thinking that a one million dollar life insurance policy is outrageous… But is it? Let me tell you something, in today’s world, it is not. Here are the results of a woman/homemaker/mom applying for a one million dollar policy:

A one million dollar policy is quite achievable. Now is the time as rates will increase as you age. Don’t put this on the back burner because you think you have time.

Truth is, No one knows how much time they have and life could end in a split second!

Life Insurance For Women ‘No Medical Exam‘

Yes, you can. You will be asked some medical questions. But keep in mind, your premiums will be higher. See rates to follow and compare with the above rate chart.

Mutual of Omaha: $250,000 /30 years, the monthly premium is $63.00. That is a difference of over $44 dollars.

Many people consider State Farm Insurance company for life insurance. They are awesome for home and auto. If you end up bundling a package, you will end up paying more out of pocket over a period of time.

Here is an example of the same age, face amount with State Farm. As you will see their monthly premiums are slightly higher than then AIG, Protective, etc…

State Farm: $250,000/30 years, the monthly premium is $25.23. Annually is $290.00.

Life Insurance For Pregnant Women

What if I am pregnant?

When to apply for Life Insurance could make a difference. Here’s why…

Pregnancy alone should not raise the prices of your life insurance rates, so long as it is a healthy pregnancy.

However, if there are complications from your pregnancy, it’s advised that you wait until after you have the baby before you apply for life insurance.

This gives you a chance to lose excess weight, and get back into solid health before applying, which will keep your premiums on the cheaper side.

*Life gets busy especially with a newborn at home. Keep in mind.

With all this being said, the sooner you apply the better! Waiting is extremely risky — you never know what could happen tomorrow. Also, the younger you are when you apply for life insurance, the cheaper the rates will be.

What Sort Of Things May Affect How Much I Pay In Premiums

Getting a cheap term life insurance for women is achievable. The younger you are, the better it is to start shopping around. Here is why…

- Age — As mentioned above, the younger you are when you apply, the cheaper your rates will be. *With age comes age-related health conditions that may cause life insurance companies to consider you a high-risk applicant.

- Your Physical Health — The more physically fit you are when you apply, the better. If you have any life-threatening health conditions, you will need to pay more for life insurance because of the risk that the insurance company is taking by covering you.

- Your Mental Health — People with serious depression or mood conditions, such as Bipolar disorder, may need to pay more for their premiums. It’s important to properly treat your mental health issues before applying for life insurance.

- A High-Risk Lifestyle — People with dangerous hobbies, like extreme sports, may have to pay for it with a higher monthly premium.

- Tobacco Use — This is a big one. Cigarette smokers can expect to pay around 2-3 times more for their life insurance than nonsmokers. Even the top life insurance companies will have high premiums for smokers.

Depending on the carrier some may have stringent guidelines to acquire life insurance in the third trimester, especially if there were any complications.

However, existing coverage will give you protection 100%

Stay At Home Mom Life Insurance

Can A Stay-At-Home Mom Get Cheap Life Insurance?

STOP SMOKING

It is very possible for stay-at-home moms to get cheap term life insurance protection, especially if you make an effort. For example, quitting cigarettes 6 months before you apply for life insurance can cut your rates in half.

Low-Cost Life Insurance For Women

Implementing a healthy diet for the long term and exercising regularly can also help you save money on life insurance.

The better your overall health is when you apply, the lower your rates will be.

Lastly, when looking for affordable life insurance, we suggest working with an independent insurance agent.

An independent agent can help you compare several quotes at one time so that you know you are getting the most affordable coverage. Furthermore, they’ll be able to answer any of your questions.

As a Mom of 4 children myself… I Get it! Life Gets Busy! But Remember This…

To compare cheap life insurance on your own via the internet is achievable, However, it is very time-consuming narrowing down life insurance quotes online and finding that one low-cost life insurance policy.

I personally know as a Mom of four children, time is not always on our side, between work, life, kids, etc. To set aside hours of your time to shop for life insurance cannot just be time-consuming but an extremely frustrating task!

When we get to that point, we just don’t do it, it goes on the back burner and time passes and now you are a year older, or God Forbid, worse ~ You Die unexpectedly. Now, What do your children do?

This is why life insurance is so extremely important. It isn’t something you can get easily when something goes wrong. You need to have it in place for WHEN THAT SOMETHING GOES WRONG!!!

FAQs

Q: Why is term life insurance a good choice for women seeking affordable coverage?

A: Term life insurance is often more affordable than other types of life insurance. It provides coverage for a specified term, making it a cost-effective option, especially for women seeking financial protection during specific life stages.

Q: What factors influence the cost of term life insurance for women?

A: Factors such as age, health, coverage amount, and term length impact the cost of term life insurance. Generally, younger, healthier individuals can secure lower premiums.

Q: Can women find cheaper term life insurance rates in 2024 compared to previous years?

A: Insurance rates can fluctuate based on industry trends, but securing affordable term life insurance often involves comparing quotes from different providers. It’s advisable to shop around for the best rates.

Q: How can women ensure they get the best rates on term life insurance in 2024?

A: To secure the best rates, women should maintain good health, avoid tobacco use, and compare quotes from multiple insurance providers. Working with an independent insurance agent can also help in finding the most cost-effective options.

Q: What term length is recommended for women seeking cheap life insurance?

A: The ideal term length depends on individual circumstances, such as financial obligations and life stages. Women may consider terms that align with major life events, such as mortgage payoff or children’s education.

Q: Are there any discounts or incentives for women when purchasing term life insurance?

A: Some insurance providers offer discounts for factors like good health, non-smoking status, or bundling insurance policies. It’s important to inquire about available discounts during the application process.

Q: Can women convert a term life insurance policy to permanent coverage later on?

A: Many term life insurance policies offer conversion options, allowing women to convert to permanent coverage without a medical exam. This can be beneficial if long-term coverage becomes a priority.

Q: Are there specific considerations for women in different age groups when buying term life insurance?

A: Yes, the age of the insured is a significant factor in determining premiums. Younger women typically enjoy lower rates. It’s crucial to secure coverage that aligns with future needs while considering budget constraints.

Q: How can women assess the appropriate coverage amount for their term life insurance policy?

A: Calculating the coverage amount involves considering financial responsibilities, such as mortgage, debts, and future needs like children’s education. Online calculators and consultations with insurance professionals can help determine the right amount.

Q: Is there a specific process for applying for cheap term life insurance in 2024?

A: The application process involves providing health information, lifestyle details, and selecting coverage options. Working with an insurance agent can streamline the process and help women find affordable coverage tailored to their needs.

Related Articles

Conclusion

It’s not always easy to know if you need life insurance, but it is a good idea. If you’re wondering whether or not cheap term life insurance for women would be enough coverage, the answer is yes! The best way to make sure that your dependents are taken care of in case anything happens to you is by getting covered with affordable and reliable life insurance policies. Get started today by requesting a quote from us! We’ll give you all the information about what type of policy will work best for your situation so that there’s no confusion when it comes time to sign up.