Breast Cancer Diagnosis and Life Insurance – How To Qualify 2024

If you are searching for life insurance following a breast cancer diagnosis, you’ve come to the right place! We will discuss how you can qualify.

You may have heard about the newest breast cancer breakthrough that was published this week. The researchers discovered a new gene mutation that seems to prevent breast cancer cells from spreading and causing more damage in other parts of the body.

If you are not sure what this means for your life insurance, I am here to help! Don’t worry about updating your policy just yet because there is still plenty of research that needs to be done before we know if it will work for everyone or not.

In the meantime, make sure you keep up with annual mammograms and any other screenings recommended by your doctor so you can stay healthy and happy while waiting for these exciting discoveries! For now, all women should continue with their yearly mammograms as well as take care of any other needs.

Article Navigation

Can I Get Life Insurance After Breast Cancer?

Above all, being diagnosed with breast cancer is a very scary situation to all involved, friends, family, and the patient! In fact, acquiring life insurance after a breast cancer diagnosis can be challenging.

The anxiety of how to face it, what are the treatments, how is life going to be? These are all the things that flash through your mind when the oncologist confirms the diagnosis and you become a cancer patient.

With this in mind, depending on the stage, grade, and history of the consumer will determine what type of life insurance will be available. With a pre-existing condition like breast cancer, there will be a period of time where you will not be able to apply as you go through treatment.

Other than skin cancer, women are diagnosed with breast cancer than any other cancer. With this n mind, traditional life insurance may be the only path after first being diagnosed.

Life Insurance After Breast Cancer Treatment

Once you have a history of breast cancer the best-case scenario when it comes to the rate is a standard rate. In fact, breast cancer treatment is just as significant in regard to if and when you are able to apply for life insurance.

We will go over the different type of treatment and how it will affect the rating class which will determine the price. When it comes to cancer treatment, there are different areas such as surgery, radiation, and chemotherapy.

In fact, because of the biology of breast cancer, whereas some tumors are small and grow fast as others are large and grow small, this will have a major impact on what treatment path is taken.

These are based on:

- Stage (I-IV)

- Breast cancer genes (BRCA1 or BRCA2)

- Patients overall health and age

- Hormone Receptor Status

In reality, the treatment will determine if traditional life insurance is possible.

Types of treatment:

Surgery

- Lumpectomy – Removal of the tumor and a small area of cancer-free tissue around the tumor.

- Mastectomy – Entire breast removal.

Lymph Node Removal

- Sentinel – Surgeon removes a small number of lymph nodes

- Axillary – Multiple lymph nodes removed from under the arm

Radiation Therapy

- External Radiation Therapy – Most common

- Intra Operative Radiation Therapy – Used in an operating room setting

- Brachytherapy – Placing Radioactive sources in the tumor

Radiation therapy is usually given after a lumpectomy and mastectomy for a number of weeks, usually 3-6 weeks.

Medication Therapies

- Immunotherapy

- Hormonal Therapy

- Chemotherapy

These treatments if successful with early-stage cancer, (stage 0 -Stage 2), you may be able to have a possible standard rate after 5 years.

Breast Cancer And How It Affects Life Insurance

Obviously how breast cancer affects life insurance all depends on the stage and the treatment as we have discussed. With many types of cancer, it is a high-risk situation.

The way underwriters look at is determined of the survival rate statistics and what type of breast cancer. There will be over 250000 that will be diagnosed with breast cancer this year. Out of that number, less than 65000 will be diagnosed with in situ breast cancer (Stage 0).

This will result in almost 45000 deaths.

The 5-year survival rate with invasive breast cancer is 90% with the 10-year survival rate at just over 80%.

If cancer spreads to other parts of the body, then the 5-year survival rate is under 30%.

This is what the insurance company’s underwriters weigh when determining the rate and/or eligibility.

Getting Life Insurance After Breast Cancer

Trying to secure a life insurance policy after a breast cancer diagnosis can be challenging. You want to make sure you are dealing with an independent life insurance agent that knows the cancer guidelines to multiple life insurance companies.

The agent needs to know which carriers have a lenient approach and an open mind when submitting on behalf of life insurance applicants.

How To Get Term Life Insurance With Breast Cancer

Getting affordable term life insurance quotes after a breast cancer diagnosis will depend on stage, treatment and if the cancer spread.

The rule of thumb when it comes to purchasing a term life insurance policy after cancer treatment is a possible standard rate after 5 years and in some cases after 10 years if more than a stage 3 diagnosis.

If the insurance underwriter feels you are more of a risk they will charge you a Flat Extra per 1000 of coverage. This is usually in effect for multiple years or until after you have passed the 5-year survival rate.

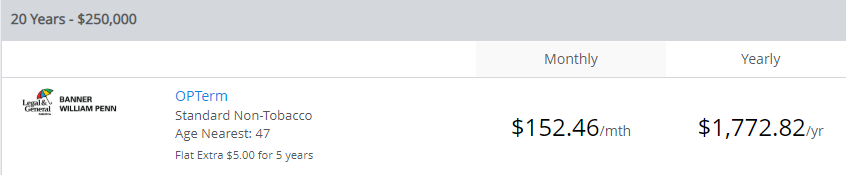

Here are examples of a standard rate versus and $5.00 flat extra per 1000 for 5 years.

Standard

Flat Extra For 5 years

Breast Cancer Life Insurance Underwriting

Life insurance underwriting will vary for breast cancer survivors and it will be looked at on a case by case basis. In most cases, the insurance company will give a tentative offer with no guarantees of coverage. they will want to see a pathology report and do a full underwriting before giving you a legitimate offer.

Some non-medical companies like Nassau RE or Sagicor will give Standard, if treatment completed over 5 years ago (excluding tamoxifen), and no evidence of recurrence.

Otherwise, Decline. Or, 6 years or more since surgery, diagnosis, or last treatment; no recurrence or additional occurrence – Rated.

Again, this will be on a case by case basis.

Life Insurance After Stage 3 Breast Cancer

Stage 3 breast cancer is when a tumor is larger than 50mm. This makes it very challenging for coverage to take place in the early years. Some carriers will postpone until after 10 years since treatment.

Here are the stages of stage 3 breast cancer.

- Stage IIIA – Spread to 4-9 lymph nodes and the tumor is over 50mm

- Stage IIIB – Spread to the chest wall and causing swelling. Spread up to 9 lymph nodes but has not spread to other parts of the body.

- Stage IIIC – Any size tumor that spread to more than 10 lymph nodes. Has not spread to other parts of the body.

The 5-year survival rate for stage 3 breast cancer is about 75%.

If you are in the early years of diagnosis, then a guaranteed issue life insurance policy would be the best option. Usually, the maximum coverage is $40,000, and it has a 2-year waiting period or graded period.

FAQs

Can I get life insurance after a cancer diagnosis?

Yes, it will depend on stage, treatment and overall health.

Can you get life insurance with a terminal illness?

Yes, we have Guaranteed Issue Life Insurance that will cover any health impairment!

Is cancer considered accidental death?

No, death caused by cancer is a natural occurrence and will be treated as such

Do life insurance policies pay out for cancer?

Yes, if you purchased a life insurance policy before diagnosis then the policy will pay out in full.

Related Articles

Conclusion

Although coverage is available for consumers with a breast cancer history. Its always better to have a life insurance policy in place when you don’t need it rather than trying to get a policy when you do need it.

Being proactive early in life will put you at ease and relieve the anxiety of “What’s my family going to do”.

So get life insurance early, when you are healthy. If you have cancer history in the family, then get a critical illness policy or a policy with living benefits built in. PROTECT YOUR FAMILY!