2024 Guide on Life Insurance for Colon Cancer Survivors

If you’re searching for life insurance for colon cancer survivors, you’ve come to the right place!

A colon cancer survivor is someone who has been diagnosed with the disease and had their tumor removed. After surgery, chemotherapy, and radiation treatments, many survivors are left wondering what to do next.

They may be concerned about how they will pay for future medical care or if they’ll need long-term nursing home care down the line. This blog post talks about life insurance for colon cancer survivors – one of our top 5 most popular topics!

We discuss eligibility requirements, exclusions, and other details that you should know before making a decision on which policy might work best for your situation.

Article Navigation

Can I get Life Insurance With Colon Cancer?

Above all, colon cancer is the 2nd deadliest cancer to be diagnosed with behind lung cancer and just in front of breast cancer. Furthermore, early detection is the key to any cancer patient.

If you are ever diagnosed with colon cancer (colorectal cancer), depending on the stage, grade and treatment will determine if and when you can buy a life insurance policy.

Life insurance underwriters will take into consideration all things related to this NOW pre-existing condition.

But overall, life insurance is available and is very possible to achieve after a diagnosis of colon cancer.

Colon Cancer Life Insurance

After a diagnosis of colorectal cancer, you will have to wait at least one year before a life insurance carrier will consider coverage. In most cases, they will wait 1-3 years again depending on the treatment as this is a high-risk health impairment.

The best-case scenario is usually standard if treatment more than 10 years ago with no reoccurrences. However, some insurance companies will consider it better than standard after 10 years.

For instance, even with stages 0-1, you will be charged a flat extra until year 5. Again, the underwriters are aware of the extensive treatment involved and these are some of the ways colon cancer is detected.

- Colonoscopy

- Biopsy

- Molecular testing of the tumor

- Blood tests

- CT or CAT scan (Computed tomography)

- MRI (Magnetic resonance imaging)

- Ultrasound

- Chest x-ray

- PET-CT scan (Positron emission tomography)

Usually, you will have a team of doctors that will review all of the results with you to determine the treatment. This can be a combination of targeted therapies with the main goal of shrinking the tumor for possible surgery for removal.

These are the information the insurance companies underwriter will want to know and see.

Life Insurance After Colon Cancer Treatment

As stated above, the successful purchase of life insurance will depend on the diagnosis of colorectal cancer, stage, grade, and if it has the cancer cells spread.

Above all, the treatment will speak volumes on how aggressive the cancer was. The more aggressive the cancer is the lower the chance you will get covered.

Among these factors, there are many treatment options that oncologists will prefer with the main goal to eradicate colon cancer.

Here are some of the treatments cancer patients will be subject to:

Surgery

- Laparoscopic surgery – Viewing scopes are passed into the abdomen. The incisions are small with shorter recoveries.

- Colostomy for rectal cancer – Surgical opening where the colon is connected to the surface area of the abdomen where waste is collected through a pouch.

- Radiofrequency ablation (RFA) – In the event that cancer spreads to the liver or any other organ, RFA is used to heat the tumors or freeze them (Cryoablation).

Even after surgery, you may have to retrain your bowel. These procedures are very common in stage 3 and more advanced stages. These stages are more challenging in getting a traditional life insurance policy.

Radiation therapy

- External-beam radiation therapy – When a machine is used to deliver x-rays to beam the cancer area.

- Stereotactic radiation therapy – This is commonly used when cancer has spread to the liver or lungs.

- Intraoperative radiation therapy – Single dose of high radiation given during surgery

- Brachytherapy – Radioactive seeds that are placed inside the body. In most cases, its injected in the liver to treat the colon cancer that spread and surgery is not an option.

Medication Therapies

- Chemotherapy – Are drugs used to destroy cancer cells by ending the cancers cells capabilities to grow.

- Targeted Therapy – Treatment that targets specific genes, tissue and proteins that allow cancer to grow.

- Immunotherapy – Boost the body’s natural defenses to fight the cancer

Here are the treatment options by stage, these are the biggest focus life insurance companies have when determining the risk of coverage.

Stage 0 Colorectal Cancer and Life Insurance

Treatment is usually a polypectomy or removal of the polyp during a colonoscopy. This is when the underwriter will be more favorable.

Stage I Colorectal Cancer and Life insurance

The removal of the cancerous tumor and lymph nodes is the most common treatment.

Stage II Colorectal Cancer and Life insurance

Surgery is usually first, then chemotherapy almost always follows. This is called adjuvant chemotherapy and is focused on killing any remaining cancer cells.

Stage III Colorectal Cancer and Life Insurance

Surgery and followed up with aggressive chemotherapy. Sometimes it is in combination with radiation therapy.

Stage IV Colorectal Cancer (Metastatic) and Life Insurance

This is when cancer has spread to other parts of the body, otherwise known as metastatic cancer. For instance, distant organs as the liver, lungs, and other tissues such as ovaries in women.

Treatment plans include a combination of surgery, chemotherapy, immunotherapy, radiation. Obviously, patients with this stage have a lower chance of survival rate as the cancer is aggressive.

Options For Individuals With Stage 4 Colon Cancer

When people with stage IV colon cancer are diagnosed it is an uphill battle, to say the least. The 5-year survival rate is 14%. When all other treatments have been taken into consideration, even clinical trials alternatives, then the focus will be on the quality of life.

When you are deemed to have a terminal illness, palliative care will help manage pain and reduce a person’s symptoms.

In this case, a guaranteed issue life insurance policy will be the only available life insurance. Although the face amounts are limited to a maximum of $25,000, there will be a two-year waiting period.

This is very hard to bear as someone terminal may not have two years left. If the cancer patient passes inside the two years then all premiums will be refunded +10%.

Term Life Insurance For Colon Cancer Survivors

Acquiring a term life insurance policy after being diagnosed with colon cancer will depend on when the treatment ended. The application process will be extensive as the underwriters will request all medical records via APS (Attending Physicians Statement) and pathology reports.

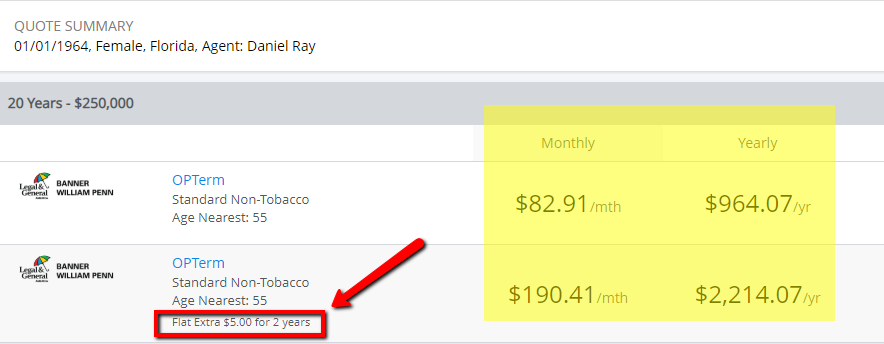

At best you will possibly be eligible for a standard rate after 5 years with early-stage colon cancer, but a flat extra will most likely be assessed.

Life Insurance With A Flat Extra

A flat extra is a fee that insurance companies charge when they deem you to be a higher risk. In this case, the carrier will slap a flat extra per 1000 of $5-$10.

Here is an example of a standard rate versus a flat extra for a 55-year-old female with stage 0 colon cancer that she had treatment over 2 years ago.

Standard Vs. Flat Extra $5/1000 for 2 years,

Life Insurance Underwriting For Colon Cancer

Colorectal cancer is the top 3 most common cancer in the world. Your risks of being diagnosed with colon cancer start to increase after age 40. In fact, it rises sharply at ages 50-55.

Here are the factors that will affect the decision of the underwriter:

- Date of diagnosis

- Stage and grade of the tumor

- Family history of other types of cancer

- Treatment

- Date treatment was completed

- Ongoing Follow-ups

- Any recurrence

- Any complication of treatment

When applying for life insurance with a colon cancer history you can have smoother processing of your application by supplying the life insurance company with an APS.

However, here are some of the little extra you can do:

- Pathology report

- Details and dates of treatment

- Hospital reports

- Detailed follow-ups including colonoscopy and detailed tumor markers

Once the underwriter has all the information from diagnosis to last treatment and follow-ups, then they can make a final decision.

On higher stage and grade tumors, they may consider over 8-10 years past treatment. Some carriers will offer possible preferred (John Hancock) if the case meets the criteria of standard for at least 10 years.

Standard plus is possible if history qualifies for a standard rate for the past 5 years.

Best Case: Stage 0 – Standard or better.

Typical Case: Stage 1 tumor, 2 full years after treatment – $5/1000 for 2 years.

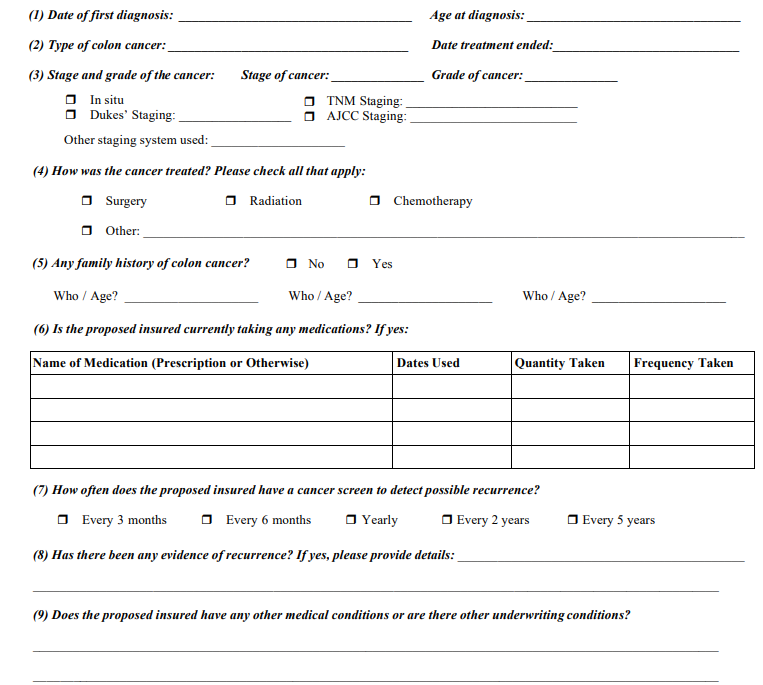

Colorectal Cancer Questionnaire For Life Insurance

When applying for life insurance after colon cancer treatment the insurance company will ask you to fill out a Colorectal Cancer Questionnaire. It looks something like this:

Colorectal Cancer Questionnaire

This will also assist the underwriter in making a decision.

Can You Get Life Insurance On Someone Who Is Dying

The answer is yes. But the traditional life insurance like term life, Participating Whole Life, Universal life will not be possible. When a patient is terminal, the only option for coverage is a guaranteed issue life insurance policy.

FAQs

Yes, colon cancer survivors can qualify for life insurance, but the terms and rates will depend on factors like the stage of cancer, treatment history, and duration of remission.

Insurance premiums may be higher for colon cancer survivors due to the increased health risks associated with a history of cancer. The specific rates depend on the individual’s health situation and the insurer’s policies.

The choice between term and whole life insurance depends on the survivor’s current health, financial goals, and how long it has been since they were declared cancer-free. Consulting with a financial advisor or insurance specialist can help determine the best option.

Typically, a medical exam is required to assess the current health status and to determine the level of risk for the insurance provider.

The waiting period to apply for life insurance after cancer treatment can vary. Most insurers require a period of remission, often ranging from 2 to 5 years, before considering an application.

Related Articles

Conclusion

Colon cancer survivors have an increased risk of developing colorectal or bowel cancers. Life insurance for colon cancer survivors is a necessity to ensure that your family receives the financial security they need in case you are diagnosed with another form of this disease. We can help you find life insurance quotes and talk about how much coverage you might want depending on your income, as well as what events may trigger a payout from your policy – such as death by natural causes, suicide, accidental injury or illness. Let us know if we can answer any additional questions!