How To Buy Life Insurance After Thyroid Cancer in 2024

If you are in search of life insurance with Thyroid Cancer, you’ve come to the right place! Life Insurance is an important step to take, and there are a few things you should know before you get started.

I had a recent scare when my doctor found out I have thyroid cancer (Yikes!) but now that I’m on the mend, it’s time to think about protecting myself with some good old-fashioned life insurance! This blog will outline what steps to take and how much life insurance coverage you can buy if this has happened to you too.

Article Navigation

Life Insurance After Thyroid Cancer

When you are a cancer survivor in some cases you have been through a battle. You have gone through treatment, possible surgeries, and the end result is you are hopefully cancer-free.

However, when you have a pre-existing condition such as a thyroid cancer diagnosis how will this affect the ability to secure a life insurance policy?

We will talk much about this topic in this article.

Can You Get Life Insurance After Thyroid Cancer

Is life insurance available after thyroid cancer? Will life insurance be available after thyroid cancer treatment?

The answer to both these questions is yes! For instance, the rate that you are approved for will come down with what types of thyroid cancer you were diagnosed with and treatment.

Again, when you are diagnosed with cancer of this type, it will come down to your treatment plan when applying for life insurance.

Although life insurance companies will have different guidelines when it comes to thyroid cancer, the types of life insurance that’s available will come down to if you are undergoing treatment.

What Type Of Life Insurance Is Available After Thyroid Cancer

The most common type and most affordable life insurance is term life insurance. However, after a diagnosis of thyroid cancer, the underwriting will be extensive.

The underwriting for thyroid cancer is not much different than lung cancer, breast cancer, prostate cancer, or colon cancer. There will be a paramedical exam and medical records will be ordered. Above all, the underwriter will want to see the pathology report. This will all determine what the life insurance rate will be.

Here are the types of life insurance that will be available after treatment is completed.

- Term life insurance

- Whole life insurance

- Final Expense/Affordable burial insurance

Again, medical histories will also have an effect on which policy you can get. If you have had multiple types of cancer, then a guaranteed issue life insurance policy may be the last resort.

What Will Life Insurance Cost Me After Thyroid Cancer

There are three very important things that will determine what the cost will be after thyroid cancer.

- Working with an independent agent that knows the guidelines of the carriers that specialize in thyroid cancer underwriting.

- Picking the right carrier for your coverage. Sometimes it has more to do with being successful in getting coverage than rolling the dice and hoping for getting coverage.

- Making sure whatever route you pick, it has to be affordable. Why get life insurance if down the road you can’t afford it.

Above all, a standard rate can be considered after the first follow-up after surgery if favorable. This is usually for those over 45 years of age with stages I or II low-grade cancer.

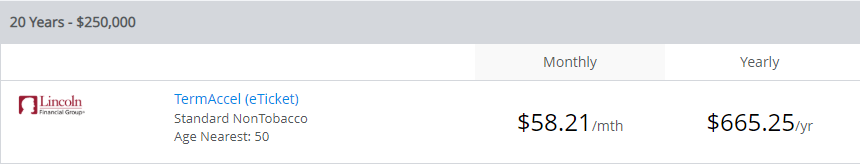

Here is the rate for a 50-year-old female with the best-case scenario:

Overall, if you are able to get a standard rate you will want to go out as far as possible just in case cancer ever comes back. When getting life insurance after a cancer diagnosis, you want to make sure you have a guaranteed death benefit for peace of mind!

Where Can I Buy Life Insurance After Thyroid Cancer

Again, where you go to is just as important as who you go to. Make sure you have an independent agent that can shop you to the right carriers.

We deal with carriers that specialize in thyroid cancer. Above all, Lincoln Financial Group has given a preferred rate with favorable treatment history with no waiting periods. We also like John Hancock as well.

How To Find Affordable Life Insurance After Thyroid Cancer

How To Buy Life Insurance After Being Diagnosed With Cancer! Again, the path you choose will depend on stage, grade, treatment, and age. These all have to do with survival rates!

If you are in the early stages then we can find you a term policy with Lincoln Financial group or John Hancock.

If you are a senior say over the age of 75, then you may only need a final expense policy. In this case, our goto final expense carrier is Royal Neighbors of America. Above all, RNA is very lenient with cancer history including thyroid cancer and they have an awesome voice application. In some cases, you will be approved within 30 minutes.

Then if you were in later stages and are in a waiting period, then the best option would be a guaranteed acceptance policy. Our goto carriers are AIG, Gerber, and Great Western. Each will approve you with no questions asked! But there will be a 2-3 year graded period.

About Thyroid Tumors

When a mass forms in the thyroid it is usually from healthy cells growing out of control. This will result in two types of cells:

- Follicular cells – These produce the thyroid hormone. This hormone is needed to live, PERIOD! It controls the bodies metabolism and how calories are burned.

- C Cells – These special cells produce calcitonin which assists in calcium metabolism.

Types Of Thyroid Cancer

When you are diagnosed with thyroid cancer it is usually one of these five:

- Papillary Thyroid Cancer – Slow growing and the most common.

- Follicular Thyroid Cancer – Slow growing and less common than papillary thyroid cancer.

- Hurthle Cell Carcinoma – Derived from the follicular cells and much more likely to spread to lymph nodes.

- Medullary Thyroid Cancer – MTC can be treated before it spreads. This is a very rare thyroid cancer as it is in less than 3% of cases.

- Anaplastic Thyroid Cancer – The rarest form, accounting for less than 1% of the cases. Extremely fast growing and difficult to treat.

Thyroid Cancer Statistics

Over 50,000 adults in the United States are diagnosed with thyroid cancer annually. In fact, these are about 75% of these cases are women. Just over 2,000 deaths a year are from thyroid cancer.

The 5-year survival rate is about 98%. However, these are based on many factors. These include type, stage and if it has spread.

Living as a Thyroid Cancer Survivor

You can live a normal life as a thyroid cancer survivor. Although thyroid cancer is a critical illness, you can take medications to substitute the hormones that the body needs.

FAQs

Yes, individuals who have had thyroid cancer can often obtain life insurance, but the policy terms and premiums may vary based on the cancer’s severity and treatment success.

Premiums may be higher, particularly if the cancer was more advanced or recent. However, lower rates may be available for those with early-stage cancer and a longer history of remission.

Insurers typically need details about the type and stage of your thyroid cancer, treatment methods, current health status, and the length of time since treatment or remission.

It’s generally advisable to apply after a period of stable health following treatment completion, often ranging from one to several years, depending on individual circumstances and the insurer’s guidelines.

Related Articles

Conclusion

The question of life insurance after thyroid cancer is a tough one to answer. But thankfully, we’re here for you! We’ll help you get the information you need in order to make an informed decision and understand your options when it comes to getting life insurance coverage with or without having been diagnosed with thyroid cancer. Let’s start by understanding who needs life insurance? That’s right – everyone does. It doesn’t matter how old they are, what their family situation looks like, or whether they have any assets – if someone dies unexpectedly, there will be some expenses that must be covered…and these costs can quickly add up.