Are Life Insurance Height & Weight Chart Guidelines Really the Key to Getting Approved in 2026?

When you first hear life insurance height & weight chart guidelines, the real question in your head is usually, “Am I too heavy for approval—or will they use this to jack up my rate?”

Every carrier uses its own build chart. Two companies can look at the same height and weight and put you in completely different rate classes—one might offer Preferred, the other might rate you or even decline. Charts for fully underwritten term life tend to be stricter, while final expense and simplified issue products often allow higher weights but charge more to offset the risk.

In this 2026 guide, we’ll walk through how build charts really work, why term and final expense guidelines are different, and how to use life insurance height & weight chart guidelines to your advantage instead of letting them scare you away from coverage.

What are life insurance height & weight chart guidelines in 2026?

In 2026, life insurance height & weight chart guidelines are build tables each company uses to assign your health class. For every height, they list a maximum and minimum weight for Preferred, Standard, or rated classes. Being above the limit usually means a higher rate class or a decline, but limits vary a lot by insurer and by product type.

What Do Life Insurance Height & Weight Chart Guidelines Actually Decide?

Before you get lost in numbers, you need to know what life insurance height & weight chart guidelines really do—and what they don’t.

Every company maintains a “build chart.” For each height, they list a weight range for their best classes (Preferred Plus/Elite), mid-range classes (Standard), and then higher-risk “table” ratings. If you fall inside the range, they can consider that class. If you’re over the maximum weight, they drop you to a lower class or postpone/decline.

What these charts don’t tell you is the full story of your health. Underwriters also weigh blood pressure, labs, sleep apnea, diabetes, cardiac history, and more. Two people at the same height and weight can land in different classes because the build chart is only one piece of the puzzle.

Treat the chart as a *class guide* (Preferred/Standard), not a pass/fail rule. Two people at the same weight can land in different classes based on health + labs.

What really determines your outcome:

- Build + waist: some carriers care more about build distribution than BMI alone.

- Blood pressure + labs: A1C, cholesterol, liver enzymes can move the class.

- Meds + history: sleep apnea, diabetes, cardiac history, etc. matter.

- Carrier rules differ: one company may be strict, another may be flexible.

How Build Charts Work for Fully Underwritten Term Life vs Final Expense

For most people, the confusion comes from mixing term life rules with final expense rules. They are not the same.

Why term life build charts are stricter

Fully underwritten term life is priced to be as efficient as possible. Carriers do blood work, exams, and detailed records because they are offering big face amounts—often $250,000, $500,000, or $1,000,000+—for relatively low premiums. To protect that pricing, they use tighter height and weight limits.

For example, some carriers cap Preferred at a BMI in the mid-20s and Standard in the low-30s. If your build is outside the Standard range, they move you to table ratings, where the premium can jump 25–100% above Standard, or they may pass entirely for very high weights.

This is where an agent who understands life insurance for overweight can pair you with a carrier that’s more forgiving for your build instead of forcing you into the strictest chart available.

Why final expense and simplified issue allow higher weights

Final expense and simplified issue policies work differently. The face amounts are smaller—often $5,000 to $40,000—and the premiums are higher. In exchange, many of these products allow higher BMIs and less-than-perfect builds, sometimes with no medical exam.

Their build charts still have limits, but an applicant who is too heavy for fully underwritten term may qualify comfortably for a level-benefit final expense plan or even guaranteed issue coverage, depending on health history.

When we’re helping someone who’s concerned about their build, we usually compare both paths: strict term life with more underwriting and better pricing versus more relaxed final expense charts that trade convenience for higher cost per dollar of coverage.

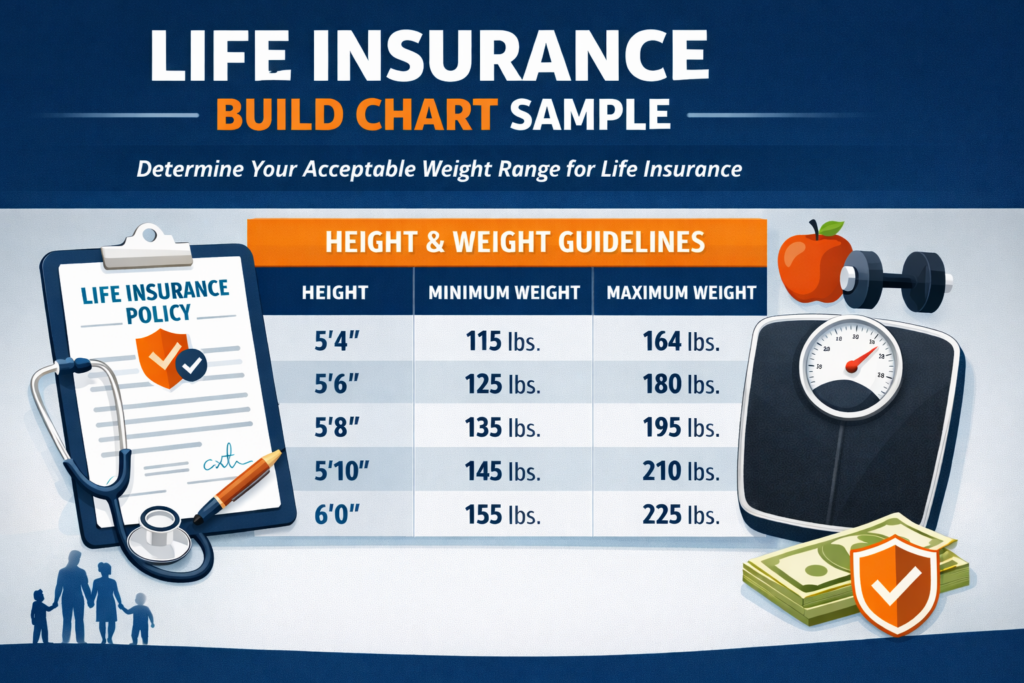

Sample Life Insurance Height & Weight Chart Guidelines by Rate Class

Before numbers, one quick reminder: what you’re about to see are examples, not promises. Each carrier tweaks its build chart, and many now separate charts by age band and gender.

Example term life build ranges (Preferred vs Standard vs Table)

Here’s a simplified way to think about fully underwritten term life build ranges (using approximate BMI ranges and typical carrier patterns):

For an adult around 5’10”:

- Preferred / Preferred Plus: often capped near a BMI ~27–28

- Standard: often allowed up to BMI ~31–33

- Table ratings: above Standard up to a carrier-specific cut-off (some go into BMI high-30s or low-40s before declining)

Interpreting this:

If you’re 5’10” and 190 lbs, you may fit a Preferred build chart with the right company. At 225 lbs, you’re more likely Standard. At 260+ lbs, many term carriers start rating or declining, while some niche carriers still consider at table ratings.

Carrier Results Ranked (Build-Only)

Example final expense build ranges for seniors

Final expense whole life charts lean more forgiving, especially for seniors in their 60s, 70s, and early 80s. Typical patterns:

- A 5’5″ client in their late 60s might still qualify for level-benefit coverage with weights that would be “Table” or “Decline” on strict term life charts.

- Many burial carriers have separate senior build charts that stretch the maximum acceptable weight because face amounts are smaller and pricing is higher.

Where term might say “Standard or Table 2 only,” a final expense carrier might offer its best non-smoker class as long as other conditions are controlled.

This is exactly why pairing life insurance height & weight chart guidelines with the right product (term vs burial insurance for seniors over 85 or younger seniors) is more important than staring at one chart in isolation.

Sample Final Expense Build Chart

Each company builds its chart around its own claims data and risk appetite. That is why “overweight” at one carrier can still be Preferred at another.

What you learn:

- Strict carriers may cap Preferred earlier (lower max weight).

- Flexible carriers may allow higher build for Standard or even Preferred.

- Age matters: build tolerance can change as age increases.

- Exam vs. no-exam: simplified products often price build differently.

People Also Ask

These are PAA-style questions that show up around life insurance height & weight chart guidelines and life insurance build chart.

Yes. Many people who are medically overweight or obese still qualify for life insurance. You may not get the top Preferred class, but Standard or table-rated coverage is often available, especially if your other risk factors—blood pressure, cholesterol, diabetes control—look decent.

No. Every company uses its own build chart. Some are strict on BMI; others are more lenient and allow higher weights at better rate classes. That’s why a 5’8″, 240 lb applicant might be declined by one carrier and approved Standard by another.

BMI is a quick way for insurers to estimate risk. Very high or very low BMI can signal higher mortality. But BMI is only one factor; underwriters also look at waist measurements, build, family history, and labs. Some muscular people have “overweight” BMIs but still qualify for top classes after underwriters see the full picture.

When a company offers $1 million or more in term life, a claim hits their books much harder than a $15,000 burial policy. To keep those big-face premiums low, they want tighter control of risk factors, including build. That’s why they draw harder lines on their term life build charts.

In extreme cases, yes. If your weight puts you above the company’s maximum build limit for any class, they can decline until weight is reduced or stabilized. But a decline with one company doesn’t mean all carriers will say no; many niche carriers design their life insurance height and weight chart to be more accommodating for larger builds.

Other Factors That Can Help or Hurt You Beyond Height and Weight

The build chart is just one column in a much bigger underwriting spreadsheet.

Carriers also look closely at:

- Blood pressure and treatment

- Cholesterol and ratios

- Diabetes control and A1C

- Cardiac history (MI, stents, bypass)

- Sleep apnea and CPAP compliance

- Smoking, vaping, or other nicotine use

You can be slightly outside a preferred build range but still land a solid class if everything else looks strong. Similarly, a “perfect” build won’t rescue poor labs or multiple serious conditions.

This is where an honest conversation matters. If we know your real height, weight, meds, and diagnoses, we can match you to a carrier whose build chart and overall guidelines line up with your profile instead of forcing you through a company that never had room for you in the first place.

How Overweight Applicants Can Still Get Approved (Term and Final Expense)

If you’re worried about the scale, the goal isn’t perfection—it’s fit.

For term life, we often start by:

- Checking build charts for carriers known to be more forgiving at higher BMIs. Like Prudential and Banner Life

- Right-sizing the face amount and term so you’re not pushing beyond what your financials support.

- Using term life insurance rates by age side by side with build limits to see what’s realistic today versus what might be possible after weight loss.

For final expense and burial coverage, we:

- Target level-benefit plans first if your build and health allow it.

- Use guaranteed-issue only when truly needed, because the cost per dollar of coverage is high and there’s usually a graded benefit.

- Compare build rules across several top final expense carriers instead of assuming one “no” is the final answer.

The key is this: Life insurance height & weight chart guidelines are not there to shame you; they’re just risk maps. With the right carrier and product mix, most people can still put real protection in place—even if the scale isn’t where they want it yet.

Related Articles

FAQs About Life Insurance Height & Weight Chart Guidelines in 2026

These FAQs focus on higher-intent “what do I do next?” questions and are separate from the PAA set above.

If your doctor already has a plan in motion and you’re expecting stable weight loss, waiting a few months could help your class. But if you’re uncovered today and your family depends on your income, waiting too long can be riskier than applying now and improving later. Some carriers will reconsider your rate class after documented weight loss.

Once your policy is issued, your rate class and premium are locked in, as long as you keep paying. Later weight gain does not cause your premium to increase or your existing coverage to be cancelled, although it could affect new coverage you try to buy in the future.

Some carriers use unisex build charts; others use separate charts for men and women, especially at older ages. In practice, it still comes down to maximum weight at each height for each class, but gender can shift those lines slightly depending on the company.

Most carriers update underwriting manuals—including build charts—every few years or when new mortality data or product designs roll out. That means a chart you saw five years ago may not match 2026 guidelines, which is another reason to work off current data, not old blog posts.

Some companies have “credit” or “fit” programs that can offset one negative factor (like build) with positive ones (strong labs, excellent exercise history, clean cardiac workups). In those cases, underwriters may stretch the build chart and offer a better class than your BMI alone would suggest.

If you are close to a better class, small changes *before labs* can matter. The goal is not “perfect”—it is “best class available for your profile.”

Simple, practical moves (non-medical):

- Timing: apply when weight is stable (avoid big fluctuations).

- Sleep + hydration: can impact blood pressure readings.

- Docs: keep recent checkups, A1C, and BP notes ready (if favorable).

- Shop smart: if one carrier is tight on build, use a carrier with higher build tolerance.

Final Thoughts: Using Life Insurance Height & Weight Chart Guidelines to Your Advantage

At the end of the day, life insurance height & weight chart guidelines are tools—not verdicts.

The real question isn’t, “Do I fit this chart perfectly?” It’s, “Which carrier and product line has a chart that fits me well enough to get the right coverage at a fair price?”

If your build is clean and your health is strong, the goal is to lock in the best possible class now, while you have leverage. If your weight is higher than you’d like, the goal is to stop assuming “no” and instead find the company whose build rules match your reality—whether that’s fully underwritten term, a blended strategy, or a final expense plan designed for seniors with real-world health and build.

You don’t need scare tactics or sugar-coated promises. You need clear rules, honest expectations, and someone who knows how to read the build charts across multiple carriers so your family gets protected without guesswork.

More Life Insurance Resources