Is 40 Year Term Life Insurance the Smartest Way to Protect Your Income Until Retirement?

If you are looking at 40 year term life insurance in 2026, you are probably asking a deeper question than, “What is the cheapest policy?” You are asking, “How do I protect my income, my family, and my mortgage for as long as I realistically need it?”

Maybe you are in your 20s or 30s with a 30-year mortgage, young kids, and plans to work well into your 60s. A 20-year term feels too short, and even a 30-year term might leave a gap in your late working years. At the same time, permanent life insurance quotes may have shocked you with how expensive they are.

You might be wondering:

- “Is 40 years of term coverage even available from reputable companies?”

- “How much more does it cost than a 30-year term?”

- “What happens if my needs change before the 40 years are up?”

In this 2026 guide, we will walk through how 40 year term life insurance works, which companies actually offer it, real sample rates by age, who it is best for, and when a shorter term or permanent policy may be smarter. By the end, you will be able to decide whether a 40-year term is the smartest way to lock in long-term protection—or if you would be better off structuring your coverage differently.

What Is 40 Year Term Life Insurance in 2026 and How Does It Work?

40 year term life insurance is a level term policy that keeps your premium and coverage amount fixed for a full 40-year period. If you die at any point during those 40 years while the policy is in force, your beneficiaries receive the tax-free death benefit. If you outlive the term, the coverage simply ends and no benefit is paid.

Most term policies on the market still last between 10 and 30 years, but a small number of insurers now offer 35- and 40-year term as the longest available level term lengths in 2026. This makes 40-year term a niche product aimed at people who want coverage that stretches right up to, or even slightly beyond, their expected retirement age.

40-Year Term Life Coverage Timeline

See how different term lengths stack across a 40-year window and when each is typically used.

How to read this timeline

Each row shows how long coverage lasts on a 40-year scale. Longer bars mean coverage stays in place deeper into your working and retirement years.

- 10-Year Term: Short-term debts, business loans, quick payoff goals.

- 20-Year Term: Typical mortgage, young children, income protection.

- 30-Year Term: Full working years, family security, long mortgage.

- 40-Year Term: Extended income protection into later life and early retirement.

Planning tip: Many families mix term lengths (layering) to match major milestones—like paying off a mortgage, raising children, and protecting income closer to retirement—without overpaying for coverage they no longer need.

Which Companies Offer 40 Year Term Life Insurance in 2026?

Not every insurer sells 40 year term life insurance. That alone is important to understand before you shop.

Only select carriers—like Legal & General America (Banner Life), Protective, and certain digital platforms that partner with these insurers—offer term coverage up to 40 years. Many other companies still cap terms at 30 years because that is where most consumer demand sits and where risk is easier to price.

Age is another key factor. Rate examples and carrier guidelines show that 40-year term is usually available only up to about age 40–45 for healthy applicants; in fact, some rate charts stop offering 40-year term at age 50 entirely.

This is why it is helpful to start with a term life insurance basics guide, then work with an independent broker who can see which companies still offer 35- and 40-year options at your age and health profile.

Compare Our 40-Year Term Life Powerhouses

Click a carrier logo to see how their 40-year term solution helps protect your family over the long haul.

Banner Life OPTerm – 10 to 40-Year Level Term

Includes 40-Year TermBanner Life’s OPTerm series offers flexible level term coverage with competitive pricing and strong conversion features backed by Legal & General America.

- Durations: 10, 15, 20, 25, 30, 35 and 40-year terms with premiums guaranteed to stay level during the term.

- Issue ages (40-year term): Typically available to healthy non-tobacco clients through mid-40s (tobacco classes slightly lower).

- Extras: Conversion option to permanent coverage, optional riders (children’s coverage, waiver of premium, term riders) and strong financial ratings.

Protective Classic Choice Term – Simple, Long-Term Protection

Includes 40-Year TermProtective’s Classic Choice Term is built for affordability and long-term income protection, with options all the way out to 40 years.

- Durations: 10, 15, 20, 25, 30, 35 and 40-year level term periods with guaranteed death benefit during the term.

- Issue ages (40-year term): Available for many applicants from age 18 up to mid-40s (with lower maximum ages for tobacco users).

- Highlights: Budget-friendly premiums, flexible underwriting classes, and a straightforward application and underwriting process.

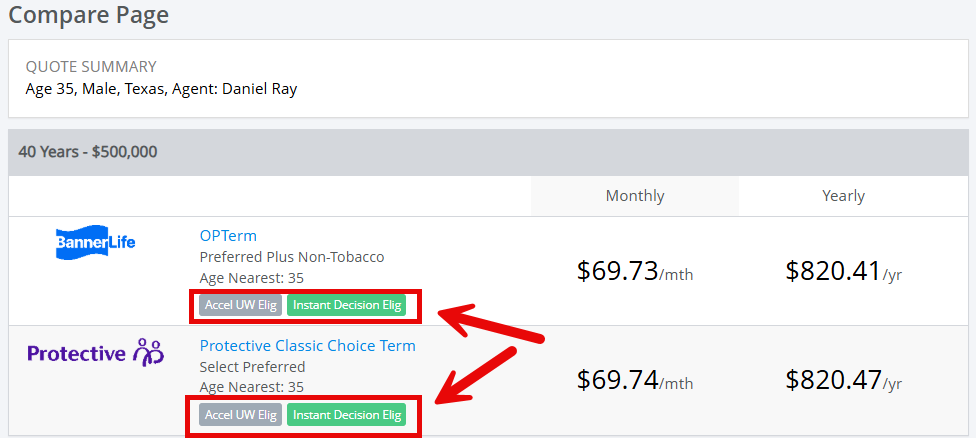

For qualified clients, top-rated carriers like Banner Life and Protective Life can offer accelerated underwriting with Instant Decision Eligible options. That means a healthy 35-year-old can often secure 40-year term life insurance with up to $2,000,000 of coverage in minutes instead of waiting weeks for traditional underwriting.

Who Is 40 Year Term Life Insurance Best For in 2026?

Not everyone needs a 40-year term. For many people, a 20- or 30-year policy is enough to cover major debts and the years when children depend on their income.

A 40-year term can make sense if you:

Before listing specific cases, it is useful to think in terms of “income timeline.” The question is: how many years do your loved ones truly rely on your paycheck? If that number stretches beyond 30 years, a longer term can match that risk more closely.

- Are in your 20s or early 30s and expect to work into your 60s or later.

- Just started a long mortgage (e.g., 30 years) and want coverage that outlasts it.

- Have young children now and plan to have more, extending your dependency timeline.

- Have a spouse who depends on your income well into your later working life.

- Care for a special-needs child or dependent who may need support long term.

For these scenarios, a 40-year policy can wrap around your working life, giving your family protection far beyond what a 20- or 30-year term would offer. This aligns well with content like life insurance for young families and life insurance for parents, where income replacement is the primary goal.

How Much Does 40 Year Term Life Insurance Cost in 2026?

Because the insurer is covering you for a longer period, 40 year term life insurance costs more than a comparable 20- or 30-year term—but still much less than permanent coverage.

Quote examples for healthy non-smokers show that for $250,000 – $1,000,000 of coverage, a 40-year term might look roughly like this:

- Age 20: around mid-$20s per month for males, low $20s for females.

- Age 30: around high-$20s to low-$30s for males, low-$20s for females.

- Age 40: around $60 per month for males, high-$40s for females.

- Age 50+: carriers no longer offer 40-year terms at this age.

40 year term life insurance calculator:

Before looking at specific numbers, remember that these are sample rates, not guarantees. Final pricing depends on your age, health, lifestyle, and underwriting class.

Comparing a 20yr, 30yr and 40yr Term Life Rates

Compared to a 20- or 30-year term with the same coverage amount, you will likely pay more each month—but you are also buying an additional decade of guaranteed protection. For many families, that extra decade lines up with college, late-career earnings, or paying off a mortgage.

Use this slider-based comparison tool to explore your options. Simply choose your age, coverage amount, and term length (20, 30, or 40 years) to see sample premiums side by side for males and females. This will help you quickly compare how prices change across different term lengths, while you review information about 20 year term life insurance, 30 year term life insurance, and 40 year term life insurance on the same page.

Pros and Cons of 40 Year Term Life Insurance vs 20–30 Year Term

Like any long-term financial tool, 40-year term has trade-offs you should understand before you commit.

First, think about what you are solving for. Are you trying to cover the absolute longest stretch of your working life, or are you trying to cover the years when your financial obligations are highest? Your answer shapes whether a 40-year term is the right fit or overkill.

Pros of 40 Year Term Life Insurance

- Longer protection: Coverage can follow you from early adulthood into your 60s, often through retirement age.

- Fewer renewals: You are less likely to face a sudden premium spike or new underwriting later because the term lasts so long.

- Predictable budgeting: Level premiums for four decades can be easier to plan around than buying new policies later, when you are older and possibly less healthy.

Cons of 40 Year Term Life Insurance

- Higher premiums than shorter terms: You pay more per month than a 20- or 30-year term of the same face amount.

- Limited availability: Fewer carriers offer 40-year terms, and age limits are stricter.

- Risk of overbuying: If your need for coverage drops sharply after 25–30 years, you may end up paying for years you no longer truly need.

To balance these pros and cons, some families combine a 40-year base policy with shorter “stacked” term layers or compare it to one million dollar term life designs to match current and future needs more precisely.

40 Year Term Life Insurance vs Whole Life (Which Is Better?)

You may also be comparing 40 year term life insurance to whole life or other permanent policies. The key difference is simple: term is designed to cover a period of risk, while whole life is designed to last for your entire lifetime and build cash value.

Before listing specific points, it helps to ask what problem you are solving. Are you primarily protecting income and debts, or are you trying to leave a guaranteed legacy or fund long-term estate goals?

- Cost: A 40-year term policy with a large death benefit is usually a fraction of the cost of a comparable whole-life policy.

- Duration: A 40-year term can cover your income-earning years, but will eventually end; whole life can cover you for life if premiums are maintained.

- Cash value: Term builds no cash value; whole life may build savings, but at much higher cost.

For most families primarily focused on income replacement and debt protection, a long term policy plus investing the savings separately is usually more efficient than buying a large permanent policy. This is a classic term life insurance vs whole life decision point.

Can You Convert a 40 Year Term Life Policy to Permanent Coverage?

Many term policies, including some 35- and 40-year options, allow you to convert some or all of the coverage into a permanent policy during a specific conversion period without a new medical exam.

Before looking at your carrier’s rules, think about why you might convert: maybe you want a smaller, lifelong policy for final expenses or estate planning, or perhaps your health has changed and you cannot qualify for new coverage.

General patterns you will see:

- Conversion is usually allowed only up to a certain age (for example, age 65 or a set number of years into the term).

- You can often convert part of the coverage, not just all of it.

- Premiums will increase because you are moving into a permanent policy.

If you choose a 40-year term, it is wise to read the conversion section carefully and consider content like how to convert term life to whole life so you know your long-term options before you need them.

Underwriting, Age Limits, and Eligibility for 40 Year Term Life Insurance

Qualifying for 40 year term life insurance is similar to applying for any other term policy, but insurers are more careful because they are committing to four decades of risk.

Most carriers that offer 40-year terms limit them to relatively younger applicants—often in their 20s, 30s, or early 40s—and they expect good or very good health. Rate examples show that at ages 50 and 60, 40-year term is often no longer available.

Underwriting may include:

Before listing methods, remember that each company has its own process. Some may move faster with digital tools; others rely more heavily on traditional exams.

- A full application with health questions and lifestyle disclosures.

- Prescription history and background checks.

- A paramedical exam (blood/urine) for larger face amounts.

Some companies offer accelerated or “no-exam” underwriting for certain age and coverage ranges, but this still involves data checks and is not guaranteed. This is where guides like no medical exam term life insurance can help you know what to expect and how to qualify.

How to Decide If 40 Year Term Life Insurance Is Right for You

Deciding on 40 year term life insurance is ultimately about matching coverage length to real life, not just picking a round number.

Start by asking: “When will my family truly stop relying on my income?” For some, that is when the house is paid off and the kids are on their own. For others, it is later—especially if a spouse depends on your income or you have long-term caregiving responsibilities.

A simple decision path:

- List Your Longest Financial Obligations

Include your mortgage payoff date, youngest child’s projected independence, and your target retirement age. - Compare Term Lengths (20, 30, 40 Years)

Ask whether a 20-year or 30-year policy realistically covers those obligations, or whether only a 40-year term lines up with your timeline. - Compare Premiums and Total Cost

Look at how much you will pay over the life of a 20-, 30-, and 40-year term. For some, 40-year term is worth the added cost; for others, a 30-year policy plus more aggressive saving is smarter. This is also where designs like one million dollar term life come into play. - Review Existing Coverage and Employer Plans

If you already have group coverage or another policy, you may not need 40 years at the full amount. Instead, you might layer a 40-year base policy with shorter supplemental coverage. - Work with an Independent Broker

An independent expert who is not tied to one carrier can compare 40-year options against more common terms and help you see the trade-offs clearly.

FAQs About 40 Year Term Life Insurance in 2026

Before answering specific questions, remember that search data shows people mainly want to know whether 40 years is available, affordable, and necessary for their situation. These answers should be short, direct, and easy to scan.

Usually not. Most carriers that offer 40 year term life insurance limit it to younger ages, often cutting off somewhere in the early 40s. By age 50, you may only see terms up to 20 or 30 years.

It depends on your goals. If your major obligations end in 20–30 years, a shorter term is usually enough. If your income will be needed well into your 60s or you have long-term dependents, 40 years of coverage can match that need more closely.

Yes. A 40-year policy costs more per month than a 30-year term with the same face amount because the insurer is on the hook for an extra decade of risk. But it is still far cheaper than a comparable whole life policy.

If you outlive the 40-year term, the coverage ends and no benefit is paid, just like any other term policy. At that point, you can decide whether you still need coverage or whether savings and retirement assets are enough.

Many insurers allow you to decrease the face amount in the future if your needs change, but you cannot increase it without new underwriting. Check your specific policy and consider resources like term life insurance basics for how changes work.

Related Articles

Final Thoughts

Is 40 Year Term Life Insurance the Best Long-Term Strategy for Your Family?

In the end, the question is not, “Is 40 year term life insurance good or bad?” The question is, “Does it match the real length of time your family needs your income?”

If you choose a shorter term and your coverage expires while you still have a mortgage, kids in college, or a spouse depending on your paycheck, you may be forced to buy new coverage later at older ages and higher rates—or go without. If you choose a 40-year term that stretches through your entire working life, you may pay more up front, but you remove the risk of losing coverage when you still need it most.

Ask yourself:

- “If my coverage ended 10 years before I retire, what would that mean for my family?”

- “Would I rather pay a little more now for 40 years of certainty, or bet on being able to buy coverage again later?”

Your answers will tell you whether 40 year term life insurance is the smartest move or whether a 20- or 30-year policy plus savings and other strategies can achieve the same protection at a lower cost.

More Life Insurance Resources