How To Get Life Insurance After Skin Cancer in 2024

You can get life insurance after skin cancer! I will go over everything you will need to know and more!

In my line of work, I see a lot of people struggling with major health issues.

Skin cancer is the most common type, and bouncing back after a diagnosis challenges many people.

One way you can help yourself recover from skin cancer is by getting life insurance so your family will have financial security in case you die from this or any other ailment.

It may seem like an unusual idea, but it’s actually perfectly normal to get coverage if you’re at risk of dying prematurely.

If nothing else, take some time out today to think about how much you love your loved ones, and then contact us for more information on how we can provide life insurance coverage for people who are living with skin cancer!

Table of Contents

- Life Insurance After Skin Cancer

- Skin Cancer Life Insurance Rate Class

- Life Insurance After Melanoma

- Melanoma In Situ Life Insurance

- Melanoma Life Insurance Underwriting

- Term Life Insurance with a History of Skin Cancer

- Basal Cell Skin Cancer Life Insurance

- Term Life Insurance And Skin Cancer Basal Cell

- Skin Cancer Life Insurance Squamous Cell Carcinoma

- FAQ’s

- Conclusion

Life Insurance After Skin Cancer

Can I get life insurance if I have skin cancer? That will depend! Once you have a history of skin cancer you now have a pre-existing medical condition.

When getting life insurance after a skin cancer diagnosis you may be surprised that you are able to purchase any kind of coverage.

Above all, it will depend on the type of skin cancer that you have.

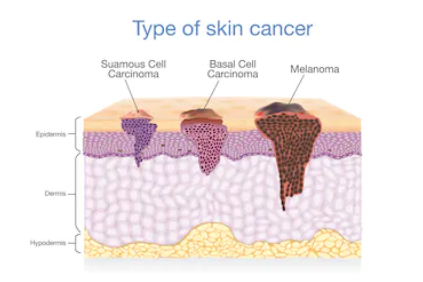

There are three types of skin cancer that can have an impact on rates. We will look at every one.

- Melanoma

- Basal Cell Carcinoma

- Squamous Cell Carcinoma

Melanoma is the most serious type of skin cancer.

This year just under 100,000 adults in the United States will be diagnosed with melanoma.

Skin Cancer Life Insurance Rate Class

Now that you know you can get life insurance under certain conditions, let’s talk about how it will affect your rate for skin cancer patients.

Life insurance companies will follow their own guidelines when determining what rating class they will offer.

In most cases, the standard is the best rate you will be able to get.

This usually has to do with a diagnosis of Basal Cell or Squamous Cell as these are the most common forms of skin cancer.

Now Melanoma, that’s a different story.

The rating class that insurance carriers will offer based on Melanoma will determine the stage, treatments, and any reoccurrences.

Melanoma rating is usually substandard rates and with a recurrence, it’s normally a decline.

Life Insurance After Melanoma

After being diagnosed with melanoma it can be pretty scary, to say the least.

Being able to acquire life insurance will depend on treatment. Let’s face it, melanoma is serious cancer.

However, just like most cancers such as lung, colon, or breast cancer, if caught very early you may be surprised to be able to get them near the top rates.

Again, it will depend on how early and what type of treatment.

Melanoma In Situ Life Insurance

If you have a history of malignant melanoma in-situ then preferred is possible with some carriers.

But it will still be a slim shot.

Everything must line up right for the insurance carrier to look at it as low risk.

Here are the main things the underwriter will look at when determining the risk when you are acquiring life insurance with melanoma in-situ.

- Date of diagnosis

- Depth and thickness of the tumor

- Type of treatment

The farther you are away from the date of diagnosis and treatment ending the better your rate will be.

The depths of the skin will have a major factor as well.

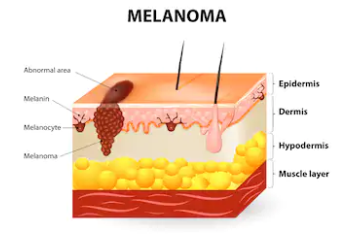

There are three layers of the skin that is important when having melanoma.

- Epidermis

- Dermis

- Hypodermis (Subcutaneous Tissue)

Again, the deeper the tumor goes (Hypodermis) the more chances the melanoma will spread.

If caught early, (Epidermis) then it usually will be a fast surgery with no additional treatment.

In this case, better rates will be available.

Again, malignant melanoma in-situ has a possible preferred rate with John Hancock.

Melanoma Life Insurance Underwriting

Ok, this is when we can get down to the nitty-gritty.

Understanding the reasons why insurance quotes are what they are will determine what type of insurance coverage you will get.

First thing, you will have to take a medical exam.

Keep in mind, with a history of melanoma you will be considered higher risk.

Life insurance underwriters will also want to know how you were diagnosed.

So they will be ordering an APS to see the start of this unfortunate journey.

Here are a few things a dermatologist will look at:

- New growth on the skin

- Suspicious change in an existing mole

- Sore that does not heal for a few weeks

The other piece of the puzzle the underwriters will want to look at when determining if the carrier wants to take the risk is the pathology report.

This report will have the results of the biopsy which will determine the stage and treatment goals.

This is what the pathology report will determine:

- The thickness of the melanoma

- Presence or absence of ulceration

- If cells are dividing, including type/subtype of melanoma

- Immune cells are present (Lymphocytes)

- Margin status, how deep is the melanoma cells

This will determine which stage or type of melanoma the patient has.

The thickness of the tumor will determine the degree of the chances of recurrence.

For instance, more than 4mm thick means a higher chance of recurrence.

This also may mean cancer has metastasized to other parts of the body.

If this has happened then a biopsy from the lymph nodes will be done.

Ok, so let’s focus on the stages of melanoma and how it will determine life insurance quotes or rates.

Melanoma Cancer Quotes

Melanoma Stages that life insurance underwriters will look at:

Stage 0 – This is referred to as melanoma in-situ where the cells are found in the outer skin (Epidermis)

Stage I – Still in the thin skin, this stage is in 2 subgroups IA or IB, this will depend on the thickness.

Then we have, Stage II – Thinker than stage I as it is extended through the epidermis to the dermis which is the inner layer of the skin. There are three groups, A, B, or C, depending on the thickness.

Stage III – This is when the melanoma spread locally or through the lymph nodes. This stage is divided into 4 subgroups, A, B, C, or D depending on the size and lymph nodes involved.

StageIV- This is when the melanoma spread through the bloodstream to other parts of the body. The most common organs its spreads to are the lung, liver, brain, bone or gastrointestinal tract.

This is further evaluated on the distance by the following:

- M1a – Spread to distant skin or soft tissues

- M1b – Spread to the lung

- M1c – Spread to any other location but not the central nervous system

- M1d – Spread to the central nervous system, brain, spinal cord

Obviously, the higher the stage the more at risk the underwriters will conclude.

Here is the other information that will be with the APS:

- Regular follow-up

- Hospital treatment reports

Term Life Insurance with a History of Skin Cancer

Above all, term life insurance and skin cancer basal cell will not affect your rate class unless you have multiple occurrences.

However, even with multiple occurrences, you may have a standard rate with some carriers.

Overall, the skin cancer you need to be concerned with is melanoma.

For instance, term life insurance after melanoma will adversely affect your rate for years to come.

However, term life insurance with a history of melanoma and rate class will be determined on the treatments and stages.

Here are the likely underwriting decisions:

- In-Situ, possible preferred

- Stage 1 and 2, $5-$7/1000 flat extra for a minimal of 3 years

- Stage 3-4, declined for 2-5 years following treatment.

Term Life Insurance with Standard Plus rates is possible after 10 years after qualifying for standard rates.

Life Insurance For Melanoma Survivor

If you were a melanoma survivor then you are already blessed.

It’s nice to know that you are able to get among the best rates if caught early.

However, even if you beat the higher stages and are not able to get traditional coverage for up to 5 years, you can still get a guaranteed acceptance policy.

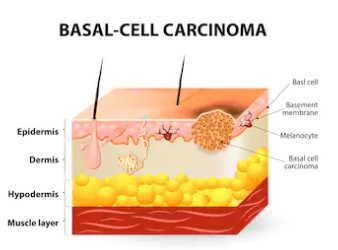

Basal Cell Skin Cancer Life Insurance

Can I acquire life insurance with basal cell skin cancer?

If you get skin cancer basal cell is the one you want.

This is the type of cancer that rarely spreads.

Even the APS is not required if it was determined to be basal cell carcinoma.

Consumers diagnosed with basal cell will be able to get standard or better immediately upon removal, Preferred is very possible as well.

Term Life Insurance And Skin Cancer Basal Cell

After a diagnosis of basal cell, underwriting will be the same as if you were not diagnosed.

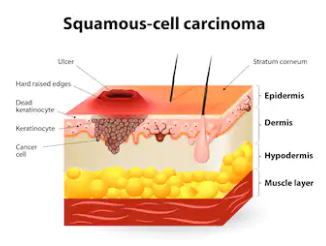

Skin Cancer Life Insurance Squamous Cell Carcinoma

If you received a diagnosis of squamous cell carcinoma and underwent successful removal, you’re eligible for rates from preferred to standard.

90% of all diagnosed skin cancers come from basal cell and squamous cell carcinoma.

Again, if you get skin cancer these are the two you want.

For more information, click here for the skin cancer foundation.

FAQ’s

1. Why is it harder to get life insurance after being diagnosed with skin cancer?

Well, let’s put it this way. Insurance companies like to play it safe. When they hear “skin cancer”, they think “risk”. It’s like when you’re playing a game, and there’s a tougher level—you’re just a bit more careful, right? Skin cancer can sometimes hint at possible health issues down the road. So, insurance companies might charge higher rates or be a tad pickier.

2. Are there types of skin cancer that affect life insurance rates more than others?

Absolutely! Think of skin cancers like different storms. Some are like light rain, while others are like big thunderstorms. For example, Basal cell carcinoma is the light rain—common and usually not too serious. On the other hand, Melanoma is the thunderstorm—it can be more dangerous. Insurance companies often take these differences into account.

3. Can I get life insurance if I had skin cancer a long time ago and am now cancer-free?

Good news here! Time is on your side. Just like when you spill milk and clean it up right away, it’s easier to forget about. If many years have passed since your diagnosis and you’ve been cancer-free, insurance companies tend to relax a bit. So yes, you can definitely get life insurance. The longer the gap, the better your chances.

4. What can I do to boost my chances of getting a good life insurance rate after a skin cancer diagnosis?

Great question! First, always follow your doctor’s advice and keep regular check-ups. It’s like doing your homework before a big test; it prepares you. Secondly, gather all medical records related to your skin cancer. It’s like showing your report card with all the good grades. Lastly, work with an insurance agent who knows the ropes. They can guide you to the best options, kind of like a coach helping you play your best game.

Related Articles

Conclusion

The moral of this story is that it’s important to be aware of your skin cancer history and what the implications are when you get life insurance.

For example, if you have a type of skin cancer that will not reappear in your lifetime then most companies will offer coverage for up to $1 million (some even more).

On top of just knowing the facts about whether or not someone with a specific condition can purchase life insurance protection, it also pays to know how much they would need to pay for their premiums.

So before applying for any kind of policy, make sure you understand all these factors – especially since there may be some surprises out there!

More Life Insurance Resources