2024 Guide To Buying Life Insurance For Your Parents

If you are wondering how to buy life insurance for your parents, you came to the right place.

It’s never easy to think about the future and what it may hold. When you’re a parent, your children are always at the top of your mind. What will happen if something happens to you? Will they be taken care of?

It can be hard to think about these things, let alone talk about them with our parents; but as we get older, we need to start thinking more seriously about how we want things handled in case anything ever does happen. If you don’t have life insurance for your parents and they’re not ready for retirement yet, this blog post is for you!

Life Insurance For Your Parents: Should You Buy It?

Article Navigation

- Why Parents Need Life Insurance

- How Much Life Insurance Do Parents Need

- What Types Of Life Insurance Is Best For A Parent?

- Do Stay-at-Home Parents Need Life Insurance?

- Life Insurance For Parents ‘No Medical Exam ‘

- Why New Parents Need Life Insurance

- How To Buy Life Insurance For Your Parents

- FAQs

- Conclusion

Why Parents Need Life Insurance

Above all, parents need life insurance!

If you have kids you need life insurance, PERIOD. I am a father, and it is completely irresponsible if you are the primary breadwinner and don’t have at least 10 times your income.

Especially if you have children under the age of 10! Furthermore, if you have children under the age of 5, you need at least 15 times your income.

Let’s face it, someone just like you and me dies yesterday! If you don’t believe me just check your local obituaries.

Yep, just like you and me. In fact, they had kids, probably young kids. What will your kids and your spouse do in the event of your death? This is why parents need life insurance.

After seeing this video, just stop procrastinating! You are not going to live forever. In fact, death is the only thing guaranteed in life except, the death benefit that is paid to your loved ones.

Remember, it will never be as cheap as it is now!

How Much Life Insurance Do Parents Need

Above all, the parents’ financial responsibility when raising children is enormous.

Furthermore, life insurance coverage is a great way to protect a family’s financial burden if the breadwinner passes away. In fact, if you are a stay-at-home spouse what are you going to do in the event of the breadwinner dying?

You will probably have to go out and get a job to cover childcare. If you have older children you may have to cover student loans! So, How much on average does it cost to raise a child?

Stay at home parents need to be protected financially from these burdens.

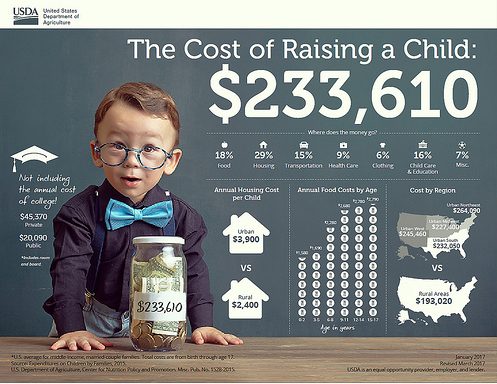

Buying life insurance may be the single best way to do this. For instance, a USDA study from 2015 projects families spend about $233,610 up until the child is 18. That is about $13,000 a year!

These will cover:

- Housing

- Food

- Child Care

- Education

So the types of life insurance that are needed will depend on your personal finances.

What Types Of Life Insurance Is Best For A Parent?

As a parent, purchasing a quality policy will depend on the life insurance company and the product you purchase. For instance, out of the 3 dozen or so variations of life insurance, it really breaks down to two, permanent life insurance and term life insurance.

Types of permanent life insurance, in my opinion, are not the best products for a family just starting out. The cost is about 3-4 times more expensive than term. Also depending on what your strategy is, a financial advisor can give you more insight into this.

Types of permanent life insurance:

- Whole Life

- UL/IUL/GUL

- VUL

Some of these policies take time and grows slowly. Also, these policies aren’t used for just insurance only. Many times they can be used for tax-deferred situations.

Do Stay-at-Home Parents Need Life Insurance?

Why would you need life insurance as a stay at home parent? As a stay at home parent, you are the glue that holds the home and the family together. Should you die, what would your family do?

Think about the day to day cost of living raising a family today in 2019. You have your mortgage, rent, utilities, auto payments, monthly credit card debt, food, school and clothing supplies, the list goes on and on.

If the breadwinner were to die today, the stay at home parent would need to get a job outside of the home. Now add childcare, and the above list we already mentioned.

So, how much is a stay at home parent worth? Today in 2019, over $162,000 annually! Not surprised, you are in fact the taxi, chef, doctor, teacher, and parent. You wear many hats!

Life Insurance For Parents ‘No Medical Exam‘

Above all, purchasing life insurance for a parent or as a parent can be one of the most important choices to make. Whether you are young or seniors over 80, getting a solid life insurance plan will financially protect your loved ones.

Getting insurance without a medical exam can be very convenient. In fact, if you have minor health issues, answering medical questions and health questions is a lot better than giving blood and urine.

For instance, applying for a simplified issue life insurance can result in coverage within a few days to cover burial expenses and/or final expenses.

However, if you are trying to get life insurance for seniors over 75, then you might have to get medical exam life insurance if you need a larger death benefit to say cover estate taxes.

Otherwise, a burial insurance policy might just be the best route to go.

Here are some of the best No Exam life insurance carriers that offer this product:

- SBLI (Up to $500,000)

- Sagicor (Great For Seniors) also up to $1,000,000

- Assurity Up to $500,000

- Nassau RE

How Much Life Insurance Should I Buy as a Parent?

Is buying life insurance a worthy investment? Well if you care about the well being of your kids then yes. When is the right time to take a term insurance plan? There is no better time than today!

In general, to reiterate from above, you want to have at least 10 times your income. That is the rule of thumb. I always advocate that if you have young children, under 5, then 15-20 times income is adequate.

For example, if you make $100,000 a year and have a 4-year-old and expecting another, then a 2 million dollar policy would be sufficient.

A stay at home parent should have at least 50% of what the primary breadwinner has.

3 Critical Reasons Single Parents Need Life Insurance

If you are a single parent you are taking the burden of two. To point out, I grew up with a single parent. I don’t think I have seen my mother sleep from age 5-15. A single parent is sacred!

Here are 3 reasons why single parents need coverage:

- Financial Security

- Caregiver

- College

Why New Parents Need Life Insurance

Obviously starting a family is the most adoring feeling anyone can have. Notably, having your very first child changes everything.

Most young adults usually have the responsibility light bulb go off. I know I did. Life just changes in that moment of time.

To demonstrate, I always tell my clients when you are starting out try to take care of your family as soon as possible.

Overall, life insurance will never be as cheap as it is when you are young. Purchasing a 30yr term at a multiple of 15 times your income will solidify your loved ones financial security.

As the primary breadwinner, god forbid if that day comes, you want to make sure that your kids are taken care of until they are throwing a cap and gown in the air at graduation.

How To Buy Life Insurance For Your Parents

If you have parents who are seniors or over the age of 75 then if they passed away it may cause a financial burden on you. First off, there must be an insurable interest. However, if it is for funeral expenses then you can take out a policy as long as your parents are aware and agree.

Some policies have living benefits which are great for long term care if there is a critical or a chronic illness. In these cases, you will need to have the policy active before any illness is made aware of.

Barbara Marquand, the writer for Nerdwallet, has a great article on affordable long term care insurance.

How To Get Life Insurance For Your Parents Online

Getting online life insurance is the most convenient way to purchase a policy. In fact, most sites provide an insurance calculator that requires the coverage amount and some do not require a medical exam.

PinnacleQuote Life Insurance Specialists have the capabilities of shopping consumers to dozens of A+ carriers to secure the best rate. We have the fastest process in the industry.

Can I Buy Life Insurance For My Elderly Mother?

Yes. You can purchase life insurance on parents. As long as there is insurable interest and you have your parents consent.

Buying life insurance for your parents is quite simple. Give us a call today we will shop you to multiple A+ rated carriers.

Many with voice signature or email signature application. Once qualified, your parents can have a policy within a 30 minute period!

We specialize in all things life insurance. Best Price, Best Carrier, PEACE OF MIND!

For a more personable touch, reach out to me, 855-380-3300. You will get the most affordable life insurance quotes for parents!

FAQs

Why should I consider buying life insurance for my parents?

Purchasing life insurance for your parents can provide financial security in the event of their passing. It can help cover funeral expenses, outstanding debts, and provide a financial cushion for the remaining family members.

What types of life insurance are suitable for parents?

Term life insurance and whole life insurance are common options. Term life provides coverage for a specific period, while whole life offers lifelong coverage with a cash value component.

Can I buy life insurance for my parents without their knowledge?

No, it’s generally not possible to purchase life insurance for someone without their consent. The insured individual usually needs to participate in the application process, including medical exams and providing relevant information.

How much coverage do my parents need?

The ideal coverage depends on factors like their age, health, financial obligations, and funeral costs. It’s advisable to assess their current and future needs to determine an appropriate coverage amount.

Is it more expensive to insure older parents?

Yes, generally, the older the insured, the higher the premiums. Age is a significant factor influencing life insurance rates. However, the cost can vary based on health, coverage type, and other factors.

Can I be the beneficiary of my parents’ life insurance policy?

Yes, you can designate yourself as the beneficiary of your parents’ life insurance policy. This ensures that you receive the death benefit to help cover expenses and provide financial support.

Can my parents get life insurance if they have pre-existing health conditions?

It depends on the specific health condition. Some insurers offer coverage for individuals with pre-existing conditions, but the premiums may be higher. It’s essential to shop around and discuss health details with potential insurers.

What happens if my parents outlive the term of their life insurance policy?

If your parents have a term life insurance policy and outlive the coverage period, the policy expires, and there is no death benefit paid. However, they can consider renewing the policy or converting it to a permanent life insurance policy if available.

Can I use my parents’ life insurance payout for any purpose?

Generally, yes. Once the life insurance payout is received, it can be used for various purposes, such as funeral expenses, outstanding debts, mortgage payments, or any other financial needs.

What factors should I consider when choosing an insurance provider for my parents?

Consider the company’s reputation, financial stability, customer reviews, available policy options, and the ease of the application process. Obtaining quotes from multiple insurers can help in making an informed decision.

Related Articles

Conclusion

So, should you buy life insurance for your parents? If they are the primary breadwinner and have a family to support with their income, then yes. It is irresponsible not to protect yourself from what might happen if something were to go wrong tomorrow. You can get quotes online in just a few minutes that will give you peace of mind knowing your loved ones would be provided for financially. Just click on this link or call us at (855) 380-3300 today!