The Truth about Life Insurance with Multiple Sclerosis

Life insurance with Multiple Sclerosis doesn’t have to be confusing. If you’re living with MS, you might wonder about your options and how to get coverage that fits your life.

We’re here to explain the different types of plans, what to expect when you apply, and tips for saving money on your policy.

Whether you need full coverage or a simple policy, we’ll help you understand what’s available so you can make the best choice.

Table of contents

- Navigating Life Insurance When You Have Multiple Sclerosis

- Exploring Coverage Options for MS Patients

- Understanding the Underwriting Process for MS and Life Insurance

- Securing Favorable Life Insurance Estimates with MS

- Securing Life Insurance with MS

- Life Insurance Claim Settlements for MS Patients

- Navigating Life Insurance Ratings with MS

- Conclusion

- FAQ

Navigating Life Insurance When You Have Multiple Sclerosis

Is life insurance available to those with Multiple Sclerosis (MS)?

Absolutely. While MS, an intricate immune system condition, can present challenges in acquiring life insurance, it’s certainly achievable.

Being considered a high-risk applicant may affect the rates and types of policies available to you. Factors such as the severity of your MS, overall health, and the duration you’ve been living with MS will all play a role.

This article delves into the specifics of securing life insurance for MS patients, covering term life insurance options, underwriting processes, symptom considerations, and resources for finding the best policy for your situation.

Ready to explore your options? Let’s dive into life insurance for MS

Exploring Coverage Options for MS Patients

“Does having multiple sclerosis affect your life insurance coverage?”

It’s a common question among those diagnosed with this pre-existing condition. The answer varies, depending on whether your diagnosis is classified as “Suspected MS” or “Confirmed MS.”

Most individuals with MS can obtain life insurance coverage; however, the extent of coverage and the premiums may differ, especially if there are significant complications or atypical symptoms associated with your condition.

Understanding the Underwriting Process for MS and Life Insurance

When applying for life insurance with MS, expect a detailed underwriting process.

It’s essential to be well-prepared to answer questions regarding your condition and treatment. Here are some typical inquiries you might encounter:

- What medications are you currently taking for MS?

- Have you undergone any treatments for MS?

- Do you have a history of smoking?

- Has there been any progression or improvement in your MS?

- When did you experience your last MS flare-up?

- How frequent have seizures been, if any?

Accuracy and transparency in your responses are crucial. Insufficient information can lead to challenges in securing a policy or higher premiums.

| Condition | Time Since Event | Underwriting Table |

|---|---|---|

| Suspected MS, not confirmed | < 2 years | Table 4 |

| 3-4 years | Table 3 | |

| 4+ years | Standard (preferred possible) | |

| Definite MS | < 2 years | Table 6 |

| 3-5 years | Table 4 | |

| 6-10 years | Table 3 | |

| After 10 years | Table 2 | |

| Severe Abnormalities, immobility | Decline | |

Securing Favorable Life Insurance Estimates with MS

Securing competitive life insurance estimates as an individual with MS depends largely on the expertise of your chosen agent.

An experienced independent agent can connect you with insurance carriers that are more accommodating to MS clients.

Those with a preliminary MS diagnosis may still qualify for standard rates, and in some cases, even preferred. On the other hand, a confirmed MS diagnosis often leads to a higher rate classification.

The duration since your diagnosis plays a crucial role, as it helps insurers gauge the progression of the condition.

Securing Life Insurance with MS

Acquiring life insurance for those with Multiple Sclerosis, classified as high-risk, is achievable with full transparency about your medical history.

The stage and severity of your MS play significant roles in determining your premiums. Postponing the acquisition of a policy could lead to higher costs and difficulties, particularly if your condition progresses.

Whether your MS is mild or advancing, it’s crucial to consult with an independent agent promptly to secure the coverage you need. Now is the time to act for your peace of mind and security.

Life Insurance Claim Settlements for MS Patients

Life insurance for individuals with MS functions similarly to policies for other health conditions in terms of claims. The type of policy you hold—whether it’s a term or whole life—determines the payout process.

For standard policies, benefits are typically dispersed soon after death. However, for those with severe MS who opt for guaranteed issue policies, there may be a waiting period, often two years, before the full benefits are payable.

Graded or modified policies usually distribute a portion of the death benefit incrementally over two to four years, depending on the policy terms and insurance provider.

It’s important to note that for most policies, if the death occurs under certain circumstances such as suicide within the initial two years, the claim may be contested by the insurance company.

Related Articles

Does Multiple Sclerosis Shorten Your Lifespan

This is a question that not only I get asked often, but also a question the underwriters ask themselves. For instance, they will consider mortality when making a decision.

With that said, even know there have been major breakthroughs the last quarter-century, MS life expectancy is about 7 years fewer than someone that does not have the disease.

WHAT IS Multiple Sclerosis ( MS)

MS is a central nervous system disease which affects the brain and spinal cord. It destroys the protective coating on nerves. This slows the flow of directions from the brain into the body, which makes motor works difficult.

MS is seldom completely debilitating or fatal. Some individuals with MS will experience moderate symptoms for several years of their lives but not become incapacitated because of it.

But, others may experience rapid development of symptoms and also quickly be not able to care for themselves.

Many people ask, Is MS hereditary? It isn’t. According to the National MS Society, if you have a close family member with MS, this increases your chances.

There is a 0.1% chance of you developing Multiple Sclerosis. However, this number increases to 2.5- 5% if you have a sibling or parents with the disease.

Can Critical Illness Cover MS Sufferers

Yes, as long as you lasted 14 days after diagnosis, then MS will be covered. TO place a claim there must be a definite diagnosis of MS and evidence of symptoms caused by MS.

Remember, here is what an underwriter will ask themselves.

“WHAT IS THE LIFE EXPECTANCY OF SOMEONE WITH MS“

Although not a fatal disease, MS can shorten a person’s life expectancy by at least 7 years. It is extremely important at the early signs/stages of this disease you seek medical treatment.

A healthy diet and a positive outlook on this disease will help you through any challenges you may face going forward!

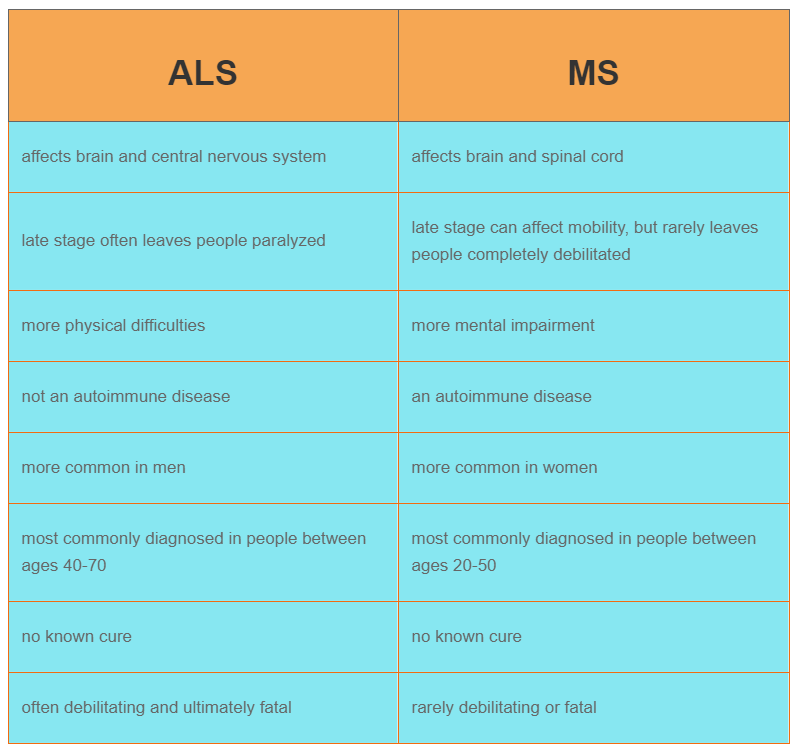

WHAT IS Amyotrophic Lateral Sclerosis ( ALS)

Lou Gehrig’s disease (ALS) is progressive and fatal. In fact, Lou Gehrig’s greatly impacts the brain and central nervous system.

In a healthy body, motor nerves in the brain send signals throughout the entire body, telling the body and muscles systems the way to work. ALS slowly destroys those neurons, preventing them from working correctly.

Finally, ALS destroys the neurons entirely. At these times, the brain can no longer give commands to the body, and people with late-stage ALS become paralyzed.

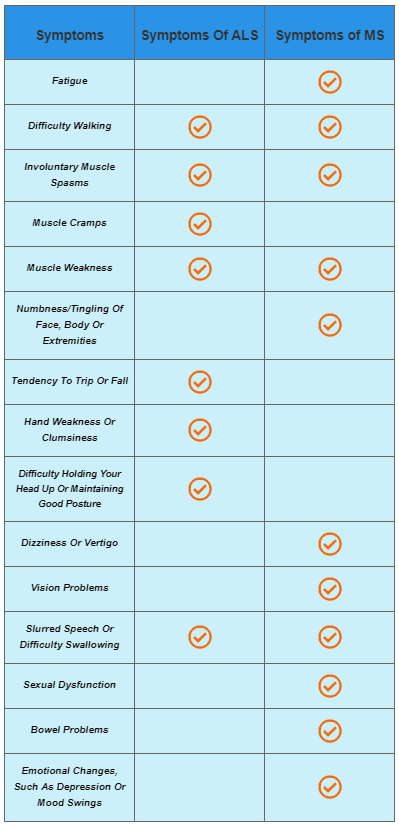

What Are The Early Signs Of MS And ALS

ALS vs MS

Both disorders attack and destroy the body, affecting nerve and muscle function. Because of this, they discuss lots of the very same symptoms, particularly in the early stages.

First symptoms include:

- Muscle stiffness and fatigue

- Loss of muscle control and coordination

- The difficulty with moving limbs

Multiple Sclerosis vs ALS (The Conclusion)

However, the symptoms afterward become quite different. People with MS often experience greater psychological impairment than people with ALS. Individuals with ALS typically develop greater physical difficulties.

WHAT ARE THE SYMPTOMS OF SEVERE MS

Some of the most severe symptoms of this awful disease include:

- Pain in the muscles, nerves and your joints

- Tremors

- Sensory Disruption/changes

- Bowel and bladder incontinence. UTI’s and even constipation.

- Mobility disruptions and weakness in the upper and lower extremities

IMPAIRED RISK AND MULTIPLE SCLEROSIS

It’s also important to note that with MS, you are in the Impaired Risk Category by life insurance companies. Otherwise known as high-risk life insurance or special risk life insurance. This also makes getting life insurance for seniors over 75 more difficult.

Also, if you have MS and are looking for life insurance for smokers, smoking may speed the progression of MS. A.M. Best will provide the financial stability ratings for the carrier you choose.

Also, the 20-year term life insurance policy is the most popular when getting life insurance.

MULTIPLE SCLEROSIS CAN BE BROKEN DOWN INTO 4 PHASES:

- Clinically Isolated Syndrome — these are the first symptoms, caused by swelling in the CNS.

- Relapsing-Remitting Multiple Sclerosis — this course is the most common. CNS symptoms may worsen, more attacks follow.

- Secondary Progressive Multiple Sclerosis — this phase usually follows relapsing-remitting Multiple Sclerosis. At this point, one’s MS may be labeled active or inactive.

- Primary Progressive Multiple Sclerosis — the most intense course, damage to the spinal cord affects everyday life.

Which MS phase you are in. More importantly, how active your MS is, will likely affect your life insurance policy. Life insurance companies are all different, and, certainly, their MS underwriting guidelines will also be different.

Consequently, it can save you a significant amount of money if you hire one of our agents at PinnacleQuote to help you find the best, cheapest life insurance rates available.

Navigating Life Insurance Ratings with MS

When you apply for life insurance, insurers will assess the severity of your MS to determine your rating category. A standard rating is achievable for those with MS, although preferred rates are less likely.

Individuals with additional health concerns or who use tobacco may face higher rates. Recent diagnoses, particularly within the last year, can lead to policy declines.

Additionally, there’s evidence suggesting that managed high blood pressure might slow MS disability progression, contrasting with the adverse effects high cholesterol may have on MS, such as increasing brain lesion development.

LATE STAGE MULTIPLE SCLEROSIS

MS AND LIFE INSURANCE

Remember, if declined, guaranteed issue life insurance is always there as a backup. With guaranteed issue life insurance, acceptance is fast after you apply. In fact, you won’t need to go through a medical exam.

However, these policies are more expensive. Also note, alcohol has a number of short-term effects that can exacerbate many of the symptoms of MS. So a history of DUI will also make it harder to get the best rate with MS.

At PinnacleQuote, we can answer any and all of your questions regarding life insurance with MS, and make sure that you get connected to the right life insurance companies.

Working with us can potentially save you a large amount of time and money, since we do all the research for you, and have the resources and connections to get you the best quotes on your life insurance.

The Interrelation Between MS and Other Health Complications

Recent studies indicate that women with MS may face a higher risk of cardiovascular complications, including stroke, heart attacks, and heart disease.

MS can lead to weakened muscles and nerve damage in the spinal area, which may result in pain, fatigue, inflammation, and respiratory difficulties.

SLEEP APNEA CONNECTION WITH MS

Obstructive Sleep Apnea may compound weariness seriousness in MS. This treatable issue of rest and breathing is a known reason for exhaustion and related indications all in all populace studies.

This also constitutes a critical hazard factor for cardiovascular malady, metabolic disorder, engine vehicle mishaps, diminished profitability, psychological brokenness, and low quality of life.

Yet, in spite of its effect on the overall public, the degree to which OSA adds to weariness in people with MS is inadequately comprehended, and the pervasiveness of OSA in MS stays vague.

Though some fight that the commonness of OSA is higher in MS patients than in the all-inclusive community, heterogeneity in subjects considered, example sizes and result measures have prompted very factor estimates.

Furthermore, no institutionalized approach has been produced to distinguish clinical highlights that may flag OSA chance in people with MS.

Research on recognizing highlights of OSA versus other rest related indicators of exhaustion in MS could enable clinicians to distinguish patients well on the way to profit by rest assessments and upgrade weariness administration.

The reason for this investigation was to survey the recurrence of analyzed OSA and raised OSA hazard among MS patients in a tertiary MS focus.

Also, to evaluate connections between exhaustion seriousness, OSA, OSA hazard, and rest quality among people with MS in the outpatient setting.

MEDICAL MARIJUANA TREATMENT FOR MS

Medical Marijuana and MS

If you have had Multiple sclerosis for some time now and attempted a cluster of things to facilitate your torment or control those muscle fits.

However, you’re simply not getting the alleviation you require. Is it time, you ponder, to focus on all the discussion about medicinal marijuana? Would it be able to be a possibility for you?

It’s conceivable.

Some have been given relief from medical marijuana treatment. In some cases, it helped the tingling sensation in hands and feet subside.

Some people with MS have experienced sensations as tasting root beer on the roof of the mouth and/or smelling ammonia. So Marijuana has been known to help MS patients with there symptoms.

If your being treated with marijuana for your multiple sclerosis, life insurance carriers will rate you for the underlining condition and not the treatment itself.

INDICATIONS OR SYMPTOMS OF MS

MS-related sensory system harm

Multiple Sclerosis signs and side effects may vary enormously from individual to individual and through the span of the sickness relying upon the area of influenced nerve filaments. They may include:

- Deadness or shortcoming in at least one appendages that ordinarily happens on one side of your body at any given moment, or the legs and trunk

- Fractional or finish loss of vision, typically in one eye at any given moment, regularly with torment amid eye development

- Drawn out two-fold vision

- Shivering or agony in parts of your body

- Electric-stun vibes that happen with certain neck developments, particularly bowing the neck forward (Lhermitte sign)

- Tremor, the absence of coordination or insecure stride

- Slurred discourse

- Exhaustion

- Wooziness

- Issues with Entrail and bladder work

(At the point when to see a specialist.)

See a specialist in the event that you encounter any of the above indications for obscure reasons.

MULTIPLE SCLEROSIS VS ALS (LOU GEHRIG’S DISEASE)

As you can imagine, when life insurance underwriters are considering approving coverage for MS, that the similarities between ALS and MS could cloud their judgment.

In various ways, both of these diseases are similar. However, key differences decide the difference between the therapy and prognosis. ALS is always a decline.

ALS also called Lou Gehrig’s disease, is progressive and fatal. In fact, it greatly impacts the brain and central nervous system.

In a wholesome body, motor nerves in the brain send signals through the entire body, telling the body and muscles systems the way to do the job.

ALS gradually destroys those neurons, preventing them from functioning properly.

Finally, ALS destroys the nerves entirely. At these times, the brain can’t provide orders to your system, and people who have late-stage ALS become paralyzed.

MS Society Life Insurance

As per the National MS Society, A study estimates nearly 1 million people in the United States are living with MS.

In addition, it is also estimated that 2.3 million people live with MS globally. In fact, 200 new cases are diagnosed each week in the United States.

Multiple Sclerosis life expectancy? Statistics show for people with MS is around 5 to 10 years lower than the average

INSPIRATIONAL QUOTES

How to stay positive with MS? Support groups can be very helpful when you going through all the emotions of having this disease. When you can share your thoughts, fears, stories with people who are going through the very same thing as you, can be a very impact on your mind and body. CLICK HERE for more information.

Multiple Sclerosis Inspiration and Life Insurance

When faced with a chronic illness, there can be many challenges besides finding the best life insurance policy/carrier. Sometimes just getting through the day is the challenge.

We tend to get frustrated and sad. Changing the way we look at things and our perspectives make things easier. Also, it makes us stronger.

PinnacleQuote is very knowledgeable with all health impairments. We support our clients. In fact, we are here to not only make the process of purchasing life insurance simple but to be a big support to you as well.

Any questions you may have, do not hesitate to ask!

National Multiple Sclerosis Society

Resource

If you suffer from Multiple Sclerosis and have questions. Here is a great resource for you. The National Multiple Sclerosis Society phone number is (800) 344-4867.

You can also call the Multiple Sclerosis Association of America by dialing (800) 532-7667 ext. 154.

Here at PinnacleQuote, Danny Ray the Owner and Agent specialize in ALL health impairments.

If you have any questions, don’t hesitate to give us a call! You can also set up a phone appointment to speak to Danny at a time specific to your needs and convenience.

Call me, (Lisamarie) at (855) 380-3300. This is my direct phone number, I can also be reached via email, Lisamarie@PinnacleQuote.com.

ALS Foundation for Life

Resource

For more information and resources regarding ALS, here is their phone number (508) 655-4381.

Here at PinnacleQuote, Danny Ray, the Owner, and Independent Agent specialize in ALL health impairments.

If you have any questions, don’t hesitate to give us a call! You can also set up a phone appointment to speak to Danny at a time specific to your needs and convenience.

Call me, (Lisamarie) at (855) 380-3300. This is my direct phone number, I can also be reached via email, Lisamarie@PinnacleQuote.com.

Here are some great references for MS:

Multiple Sclerosis Discovery Forum

National Multiple Sclerosis Society

Best APPS of 2019 for Multiple Sclerosis on your I-Phone

With today’s world and modern technology, we mostly find ourselves on our cell phones. Minicomputers!

Here are a few suggestions of the best APPS of 2018 for MS. You can utilize these apps for multiple sclerosis diagnosis and management of the disease.

- MS Clinical Resources ~ Free APP

- MS Self ~ Free APP

- My MS Diary ~ Free APP

- MS Focus Radio ~ Free APP

Conclusion

Life insurance is something that many people take for granted until they need it. So, what happens if you have Multiple Sclerosis and want to get life insurance?

It’s still possible! We can help you find a policy that works with your diagnosis in order to protect your family from financial hardship after death.

To learn more about the types of policies available, call us today at 855-380-3300 or fill out our quick online form. There are so many options we can provide life coverage no matter how complicated your medical condition may be. Get a quote now!

FAQ

Can I get life insurance if I have Multiple Sclerosis?

Yes, individuals with MS can obtain life insurance, though it may be categorized under high-risk life insurance options.

Does the severity of MS affect life insurance premiums?

The severity and type of MS can influence premiums, with more severe forms potentially leading to higher rates.

Are there life insurance policies that cater to MS patients?

There are specific policies like guaranteed issue life insurance and simplified issue policies designed for MS patients.

How does MS underwriting work for life insurance?

Underwriting for MS involves assessing the progression of the disease, treatments received, and overall health to determine eligibility and rates.

Will MS cause my life insurance to payout differently?

Life insurance for MS typically pays out like any other policy, but certain policies may have specific terms for payout timelines.

What if my MS is newly diagnosed?

A recent MS diagnosis, especially within the past year, may affect life insurance options and rates.

Can MS lead to other health issues that affect my life insurance?

MS can increase the risk of cardiovascular problems, which may be considered during the life insurance underwriting process.

Does smoking affect my life insurance if I have MS?

Smoking can lead to a substandard rating on life insurance for those with MS, impacting premiums and coverage options.

2 Comments

chiropracteur paris 19

whoah this weblog is fantastic i really like reading your articles.

Keep up the good work! You know, a lot of individuals

are looking around for this information, you can aid

them greatly.

Danny Ray

Thank you, knowledge is power, and If we can make it easier for one person than we have succeeded!!

Thank you!!