Is Mortgage Protection Life Insurance in 2026 Really the Smartest Way to Protect Your Home and Family?

When you start searching for mortgage protection life insurance, you are not just buying a policy—you are trying to answer a hard question: “If I die early, can my family keep this house without going broke?”

Banks, mailers, and online ads all promise “state-regulated” or “special” mortgage protection offers. They sound official and urgent. What most people never see clearly is who gets the money, how the benefit shrinks over time, and whether they are quietly overpaying compared to a straightforward term life policy that protects more than just the mortgage.

In this 2026 guide, we will walk through exactly how mortgage protection life insurance works, how it differs from regular term life, what a realistic quote looks like, and who it actually makes sense for. By the end, you will know when to say “yes,” when to say “no,” and how to keep control of the decision—not the lender or an aggressive mailer.

What Is Mortgage Protection Life Insurance in 2026?

Mortgage protection life insurance in 2026 is a type of term life policy designed to pay off your remaining mortgage balance if you die during the term. The death benefit usually decreases as you pay down the loan, and in many policies the payout goes directly to your lender rather than your family.

What Is Mortgage Protection Life Insurance and How Does It Work

Before you ever sign an application, you need a clear picture of what mortgage protection life insurance actually is—not the sales pitch, the reality.

Mortgage protection life insurance (often called mortgage protection insurance or mortgage life insurance) is a type of term life policy built for one job: pay off your mortgage if you die during the term.

The coverage amount is tied to your loan. As you pay down the mortgage, the death benefit usually declines over time, while your premium normally stays level.

In many designs, the payout goes directly to the lender, not your spouse or kids.

That means your family gets the house paid off, but they do not receive a check they can use for income, debts, or other needs.

It is very different from buying regular term life and using it as life insurance for mortgage protection, where your beneficiaries control the money and can decide how best to use it for the family.

Some mortgage protection policies are sold at the closing table or through mailers. Others are offered later by banks or credit unions. The product feels convenient and “connected to the mortgage,” which is exactly why many people say yes before comparing it to a standard term life option.

Mortgage Protection Life Insurance vs Traditional Term Life: What’s the Real Difference?

On the surface, both mortgage protection life insurance and term life promise the same thing—if you die, money is paid out. But under the hood, they behave very differently, and that is where most people either save money or waste it.

With mortgage protection life insurance, the benefit usually declines as your loan balance drops. The policy is tied specifically to that debt. In many cases, the lender is the primary or only beneficiary, and the money is used to pay off the mortgage. Your family gets the house, but not a flexible lump sum.

With traditional term life, you pick a coverage amount and a term—10, 20, 30 years—and the death benefit stays level the whole time. If you die during the term, your beneficiaries receive a tax-free lump sum they can use for anything: mortgage payments, living expenses, tuition, or clearing other debts. That is why many consumer sources say a standard term policy is usually cheaper and more flexible than MPI.

If you want to protect the home for decades, a 30 year term life insurance cost comparison often shows that you can cover the mortgage and still leave additional money behind for nearly the same, or even lower, premium. For higher-income families or big loans, comparing options side-by-side with a one million dollar term life insurance policy quote can be eye-opening. Term is usually doing more work for every dollar you spend.

Here is our comparison tool that will show you your savings. Above all, it’s always advised to talk to an expert before making your decision.

20-Year & 30-Year Level Term vs Mortgage Protection Insurance (MPI)

Comparison across $250k, $500k, $750k, and $1,000,000.

Enter your details

Click “Update Rates” to refresh the comparison.

Next step: request a full mortgage protection insurance quote.

Rate comparison

Headers now line up perfectly with the numbers.

| Coverage | 20yr-T | 30yr-T | MPI | Est. Savings |

|---|

Want real carrier options? Use the quote link.

How Much Does Mortgage Protection Life Insurance Cost

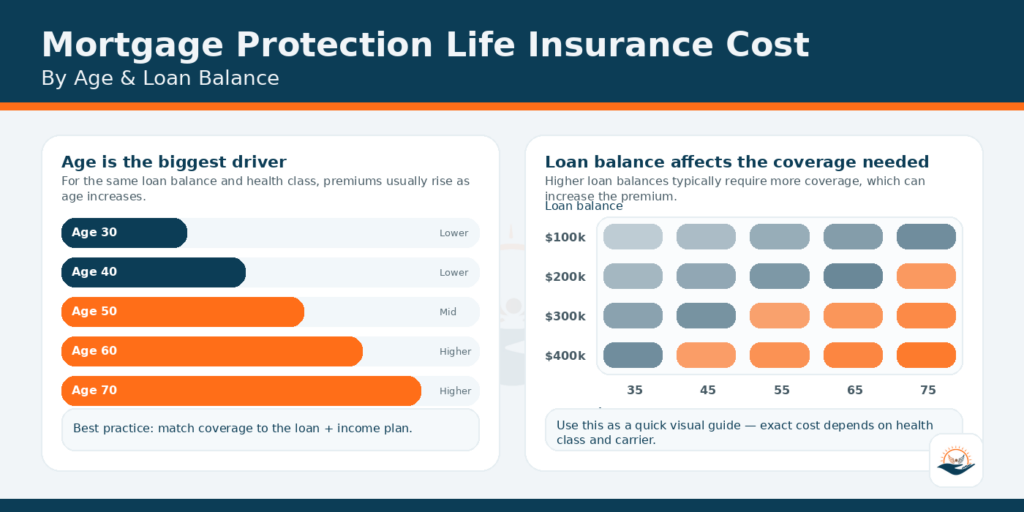

There is no single price for mortgage protection life insurance in 2026. The premium is built from a mix of your age, health, loan size, term length, and whether the policy is fully underwritten, simplified issue, or closer to guaranteed issue.

You can use a mortgage protection insurance quote as a rough benchmark, but understand what’s driving the number:

- Loan balance and term. Bigger loan and longer remaining term equals higher risk and a higher premium.

- Age and health. Younger, healthier non-smokers tend to see much lower rates than older applicants with medical issues.

- Policy type. Simplified or guaranteed-issue mortgage protection (no medical exam) usually costs more per dollar of coverage than fully underwritten term life.

Many real-world examples show mortgage protection premiums running from a few dozen dollars a month for smaller loans at younger ages to well over $100 per month for older homeowners or larger balances. At the same time, level term policies covering the same mortgage amount often come in noticeably cheaper—and they allow your family to decide how the money is used.

Who Actually Needs Mortgage Protection Life Insurance (and Who Probably Doesn’t)?

Not everyone shopping for mortgage protection life insurance should buy it. There are situations where it fits, and plenty where it does not.

Mortgage protection can make sense if your health is borderline for traditional underwriting, and a simplified-issue MPI policy is one of the few offers you can qualify for. In that case, making sure the mortgage is paid off if you die early may be better than leaving your family with a payment and no backup.

It can also be appealing if you are laser-focused on the house and you know you will sleep better having a policy dedicated to the mortgage. Some people like seeing “mortgage paid” as a single clear outcome, even if it is not the most efficient way to buy coverage.

On the other hand, if you are relatively healthy and can qualify for good term rates, traditional term life is usually the smarter move. It lets you protect income, debts, future goals, and the home in one policy. For many families, a properly structured term plan beats siloed mortgage protection life insurance in both cost and flexibility.

For bigger income or larger loans, this is where comparing MPI against a one million dollar term life insurance policy can make things very obvious very quickly.

How to Shop Mortgage Protection Life Insurance Without Getting Burned

You do not need a complicated strategy. You just need to slow down, get your numbers straight, and compare the right things side-by-side.

First, gather your mortgage details: current balance, interest rate, years remaining, and monthly payment. Every quote—MPI or term—will hinge on those numbers.

Second, decide how much total protection you really need. Some homeowners only want the mortgage covered. Others also want income replacement, debt payoff, or future college money built into the same plan. This is where running a simple term life needs analysis is more than a formality; it keeps you from under- or over-insuring.

Third, get quotes for both mortgage protection life insurance and regular term life with the same starting coverage. If you owe $250,000, compare $250,000 of MPI with $250,000 (or more) of level term, not mismatched numbers.

Finally, work with an independent broker instead of whoever mailed you a postcard or sat at the closing table. Independent agencies can weigh several carriers, health niches, and structures at once instead of just pushing one pre-packaged offer from a bank.

MPI vs Term Life Comparison Tool

Enter a few details to see an estimated monthly cost comparison. For a full quote, request a mortgage protection insurance quote.

Enter your details

Click “Update Comparison” to refresh results.

Your side-by-side estimate

Use the quote link for real carrier pricing.

$—

$—

How these estimates are calculated

This uses a simplified “rate per $1,000” approach that increases with age, term length, and tobacco use. MPI is modeled as typically priced higher than term for similar coverage. For comparison only.

Mortgage Protection Marketing Tricks to Watch Out for in 2026

The way mortgage protection life insurance is marketed in 2026 matters as much as the product itself. Some campaigns are honest. Others are not.

You will see mailers that look like official government notices or lender documents, using phrases like “state-regulated benefit,” “time-sensitive,” or “final chance to enroll.” In reality, these offers are typically just standard mortgage life insurance offers from private companies, not unique state programs.

Some envelopes are designed to look like they are coming directly from your lender or the county recorder’s office. Others imply that failing to respond could somehow put your mortgage at risk, when all they are really doing is trying to start a sales conversation.

If a marketing piece leans more on fear, urgency, and vague “state regulation” than on clear explanations of coverage, benefit, and cost, treat it as a red flag. A straightforward life insurance for mortgage protection conversation should not need smoke and mirrors.

People Also Ask

Mortgage protection life insurance can be worth considering if your health makes full underwriting difficult and you want a simple way to guarantee the mortgage is paid off. For most healthy homeowners in 2026, a properly shopped term policy usually offers more coverage and flexibility for less money.

If your existing life insurance is large enough to pay off the home and still cover your family’s other needs, you may not need a separate mortgage protection policy. Your beneficiaries can decide how much of that benefit to put toward the mortgage and how much to reserve for income, debts, or future goals.

No. Private mortgage insurance (PMI) protects the lender if you stop making payments; it does nothing for your family if you die. Mortgage protection life insurance is a personal life policy tied to your mortgage. It is intended to pay the loan off if you pass away during the term.

Related Articles

Final Checklist Before You Buy Mortgage Protection Life Insurance

Before you commit to mortgage protection life insurance in 2026, run through this checklist so you are making a clear decision, not reacting to a mailer or a script.

First, confirm who the beneficiary is. If the lender is the only beneficiary, your family will not receive a separate lump sum for income or other needs.

Second, check whether the benefit decreases while the premium stays level. If you are paying the same amount every month for a shrinking benefit, ask whether a level term policy could give you steadier protection and better overall value.

Third, compare the MPI quote to a term quote with the same initial coverage amount and term length. If term life clearly protects more than just the house for a similar or lower premium, that is hard to ignore.

Finally, make sure the premium fits comfortably in your long-term budget. The right policy is the one you can keep in force, not the one that looks impressive on paper and gets dropped in three years.

Ready to Compare Mortgage Protection vs Term Life?

Pick the option you prefer below. Each path helps you find the right protection for your home and your family.

Get a Quote

See side-by-side mortgage protection and term life numbers so you can pick the option that truly protects your home and your family’s bigger plan.

Call Now

Talk with an independent expert who will walk you through your mortgage, income, and health and tell you plainly whether mortgage protection life insurance or term life fits you better.

Schedule a Call

Choose a time that works for you to quietly review your options and build a plan that keeps your family in the home even if life takes a hard left turn.

More Life Insurance Resources