2024 American General/AIG Life Insurance Review

If you are in search of American General Life Insurance, you are in the right place!

That’s right, your favorite insurance company is back in the game. You might know them as American General or AIG Life Insurance (depending on where you live). They’re not a Fortune 500 company anymore but they are still here and ready to provide coverage for our generation.

Who knows? Maybe we’ll be able to retire again one day! Did I mention that my blog posts come with free life insurance? Just kidding… but seriously give me a call at (855)380-3300 if you want to get started!

Article Navigation

AIG Life Insurance Reviews

Overall the life insurance company AGL (American General Life Insurance Company) is a member of the American International Group. American International Group Inc AIG is a multinational finance and insurance corporation that operates in more than 80 countries.

Is AIG a good insurance company?

As we go over the AIG insurance reviews in this article I would hope you will be comfortable knowing that AIG is a powerhouse name. They operate under the following brands, United States Life Insurance ( Life Insurance company in the City of New York), AIG Direct, American General, and AIG.

I know, all these names are confusing, That is why it’s important to filter through the AIG life insurance reviews USA. In fact, American International is responsible for the financial obligations of AIG brands.

Who Is American General Life Insurance?

Is American General Life Insurance a good company? American General has been around for over a century and a half and has consistently provided top-notch life insurance services with an A rating for financial strength.

With millions of clients, American General proudly offers reasonably priced policies with terrific customer service. Furthermore, American General specializes in life insurance for all ages. For example, they have very competitive rates for life insurance in your 20’s and life insurance in your 30’s. Also, in your middle age for Life insurance in your 40’s, life insurance over 50, and even life insurance for seniors over 75.

Finally, AIG is among the top for high-risk life insurance such as multiple sclerosis, epilepsy/seizures, and life insurance with diabetes. Also, special risk life insurance after DUI. These are all a plus of having the ability of the issuing insurance company to take on these risks.

In addition, when a policy is issued by American General customer service is one call away if you have any issues or just want to make a payment change. With AIG being available in every state and product features in their flagship products, this gives them top AIG reviews in addition to AIG direct reviews.

AIG, Life Insurance for all Generations

However, it’s never a good idea to fall in love with the first insurance company you investigate. Make sure that you go over several options, compare rates and policies, in addition to the claims-paying ability, and then make your decision.

After all, there are plenty of excellent life insurance companies out there, such as

Life Insurance For PreExisting Medical Conditions

What about Life Insurance For Pre-Existing Medical Conditions. First, American General, AIG, has lenient underwriting guidelines for those looking for life insurance with treated blood pressure. Also, they are tolerant of rates in life insurance for treated cholesterol.

Furthermore, they are among the best rates for life insurance for smokers and cigar and smokeless tobacco.

Chronic Condition and Life Insurance

Last, if the levels are well above average in these impairments, then it may cause a declined life insurance policy. Also, life insurance for cancer patients pays a fee extra after treatment below five years. In some cases, a guaranteed acceptance life insurance policy would make sense.

How Reliable Is The American General Life Insurance Company

Since they’ve been around for so long, and have built up such a large clientele, American General is widely-known.

The company has gained a strong reputation for its ability to protect families’ financial security. In addition, they’re rated highly by most rating agencies, a good indication that they are, indeed, quite reliable. A.M. Best rating agency rates them An A excellent.

AIG/American General

In recent years, American General has joined AIG. They offer a wide variety of life insurance options, ranging from term life insurance to indexed universal life insurance coverage. Wondering how much life insurance costs?

What Does The American General Life Insurance Company Offer

- Term Life Insurance — Only offering death benefit protection, this necessary kind of life insurance is great if budgeting, or for those not wanting to commit to permanent life insurance coverage. You can choose up to a 30-year term policy. However, the most popular is the 20-year term life insurance policy

- Index Universal Life Insurance — With this insurance, multiple investment options exist. There’s an interest crediting method, for example. A popular choice for those looking to create some cash value builds up.

- Universal Life Insurance — A versatile option. With universal life insurance, you can choose how much protection you want, plus how much premium you would like to pay. One of the pluses of universal life insurance is that the premiums go directly into the cash-value account, which means you don’t need to pay taxes on them. Also, this is a good fit if you’re looking for a safety policy that will cover them for the rest of their lives.

- Whole Life Insurance — The most popular permanent life insurance policy. It’s pretty simple — all you need to do is keep paying your fixed premium, and your family receives it once you pass away. One of the pros to whole life insurance is that your premium won’t go up, even if your health declines.

- Variable Universal Life Insurance — Customizable premiums plus death benefits. There are also cash value investment opportunities.

- Guaranteed Issue Whole Life Insurance — coverage for people who have pre-existing conditions. Keep in mind, this policy is a two year graded death benefit. If you die within the first 24 months from natural causes, your premiums paid plus 10% will be paid to your beneficiary. However, if you die from an accident, the entire death benefit will be paid.

What Else Is There To Like About American General Life Insurance Company

Several of American General’s life insurance policies come equipped with living benefits, on top of death benefits. As the name suggests, this means that the money is accessible while the policyholder is still alive, if need be.

Furthermore, this is a massive selling point for some that worry about getting too much money tied up if severe injury or illness strikes.

What Does AIG Life Insurance Cover

Prioritize Activities vs. Life Insurance

As mentioned above, American General gives people the opportunity to build up cash value. Take a quick glance at the types of insurance policies that American General offers. See how it compares to other life insurance companies out there. It’s no wonder American General is rated one of the best insurance companies out there.

Here at PinnacleQuote, we can save you plenty of time and money on your life insurance policy. Furthermore, this is because once we learn about you, we’ll know exactly which insurance companies can give you the best rates and coverage.

Can I Borrow Money From My AIG Life Insurance Policy

Depending on the policy, you can borrow against the cash value. AIG offers living benefits where you can tap into the policy if you become terminally ill. It can help you pay for medical expenses.

AIG Insurance Quote

American General Life Insurance Quote/AIG Mobile Quote

Overall, AIG has some of the best term life insurance products in the industry. Not only are the AIG insurance reviews USA great, but the AIG term life insurance reviews are also even better.

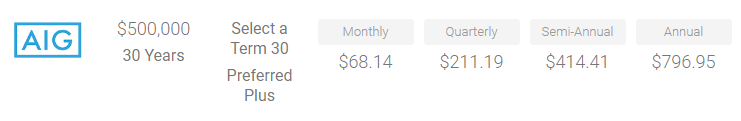

Example quotes for a 40-year-old healthy female with AIG:

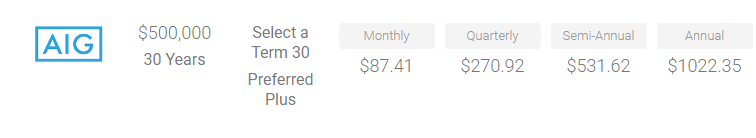

Example quotes for a 40-year-old healthy male with AIG:

AIG Life Insurance Underwriting Guidelines

Clients with high-risk pre-existing conditions or health impairments, AIG is top notch with their lenient underwriting. Conditions such as heart disease, diabetes, and some lifestyle choices such as marijuana.

How Do I Contact AIG Life Insurance?

AIG life insurance policy information and AIG claims phone numbers are below:

Address: PO Box 305355, Nashville, TN 37230-5355.

Phone: (800) 888-2452

American General Long Term Care Administration

If you have questions regarding your AIG life insurance payment or need to speak with a representative directly at the company, see below: PinnacleQuote is also here to help you with any questions or concerns.

Policies beginning with 582:

PO Box 64889, St. Paul, MN 55164-0889. Phone: (888) 565-3769

Policies beginning with 130:

PO Box 64036, St. Paul, MN 55164-4036. Phone: (800) 710-9876

FAQs

How does AIG’s term life insurance work?

AIG’s term life insurance provides coverage for a set period, typically ranging from 10 to 30 years, with fixed premiums and a guaranteed death benefit if the insured passes away during the term.

What is unique about AIG’s whole life insurance policies?

AIG’s whole life insurance policies offer lifelong coverage with fixed premiums, a death benefit, and a cash value component that grows over time.

Can I customize my AIG life insurance policy with riders?

Yes, AIG offers various policy riders, such as accidental death benefit, child rider, and chronic illness riders, allowing policyholders to tailor coverage to their specific needs.

Is AIG known for competitive pricing on their life insurance policies?

AIG is generally competitive in its pricing, particularly for term life insurance, but rates can vary based on individual circumstances like age, health, and lifestyle.

Does AIG offer life insurance for people with pre-existing conditions?

Yes, AIG provides options for individuals with pre-existing conditions, though the terms and premiums may vary based on the specific condition and overall health.

How is the customer service and claims process with AIG?

AIG is known for its customer service and efficient claims process, but experiences can vary. It’s advisable to check recent customer reviews and ratings for the most current feedback.

Are there any digital tools or apps offered by AIG for policy management?

AIG offers online account management, allowing policyholders to view policy details, make payments, and more. Availability of mobile apps or additional digital tools should be confirmed directly with the company.

How does AIG stand out among other life insurance providers in 2024?

AIG is known for its wide range of products, competitive pricing, and options for high-risk individuals. They also have a strong financial stability rating, which is crucial for life insurance companies.

Related Articles

Conclusion

If you need some help with life insurance, AIG is a good place to start. Their customer service is pretty great and they are in over 80 countries, so it’s probably easy for them to get their hands on any documents or information that may be required of your situation.

Get a quote from them today!